Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 2 | 26.1.2023 | PETG | Petrol Supervisory Board Meeting: Discussion of business plan and key targets for 2023 | Slovenia |

| 3 | 26.1.2023 | KRKG | Krka Preliminary Results for 2022, Press Conference | Slovenia |

| 4 | 27.1.2023 | PETG | Petrol Business Plan and key targets for 2023 | Slovenia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).

Recent Croatian cash bond flows were dominated by buyers and with the market dry of supply, some of the flow was funneled into local paper-based to an already known feng shui of the domestic market. What can we expect regarding monetary policy, geopolitical tensions, and Croatian bond placements in the nearest future? Read the article to find out.

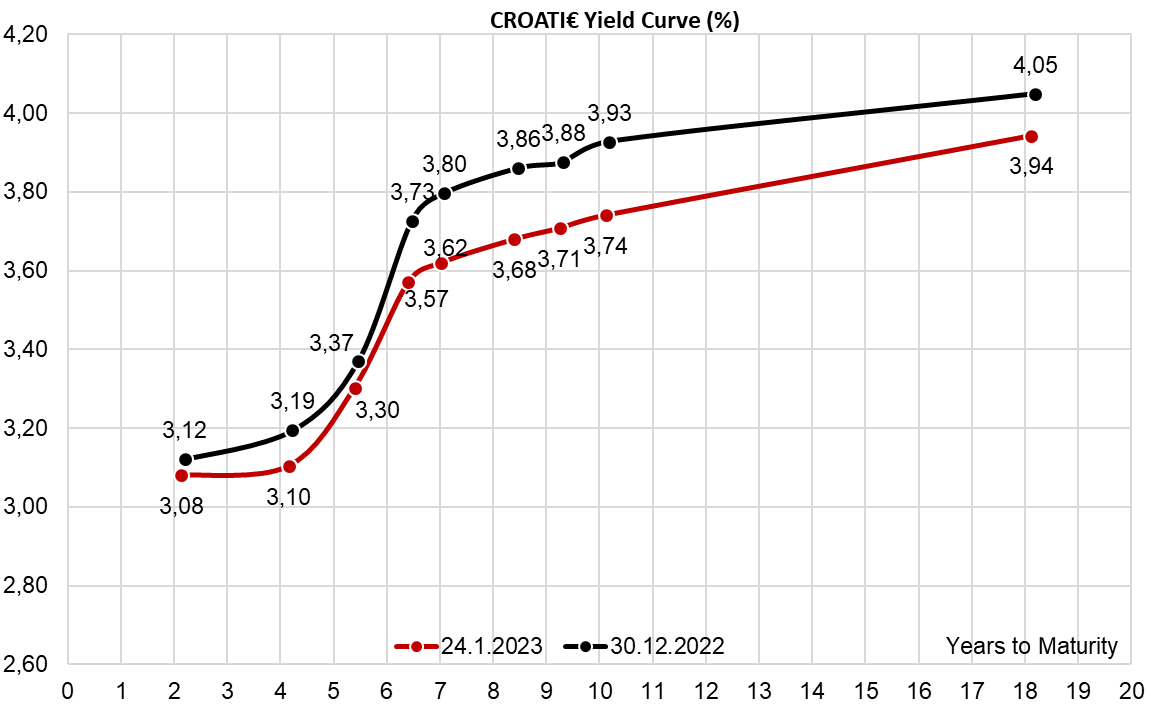

In recent trading sessions, our clients noticed two interesting market features. First of all, it was increasingly difficult to get a hold of a decent offer in CROATI€, especially for a longer duration. After a short-lived sell-off in mid-January, ignited possibly by an increase in CEE primary placements, the market was as dry as it could get. An increasing number of Street dealers indicated that they are short CROATI€, implying that they are better buyers than sellers. Based on this remark, the second feature of the recent trading sessions is the fact that whoever wanted to cut short their CROATI€ position managed to get the price close to BVAL mid, or even higher. But what were asset managers doing with the proceeds of the cash received from trimming their CROATI€ positions?

There were two scenarios. Some of them flocked into short-term EGBs at 2.50%-2.75% YTM since Croatian T bills offer 2.50% on 1Y duration and asset managers estimated that the EA credit risk is much smaller. This scenario also includes buyers of CROATE 1.75 11/27/2023€ at 2.70%-2.95% YTM. The second scenario was buying belly-of-the-curve CROATEs, such as CROATE 1.25 02/04/2030€ which was traded around 3.60% YTM. Notice that this yield implies no liquidity premium to CROATI€ curve, indicating that the market is tight and that CROATE€ sellers are getting slightly a better deal. This scenario was very popular among asset managers that had to target duration and couldn’t be invested into shorter paper all in.

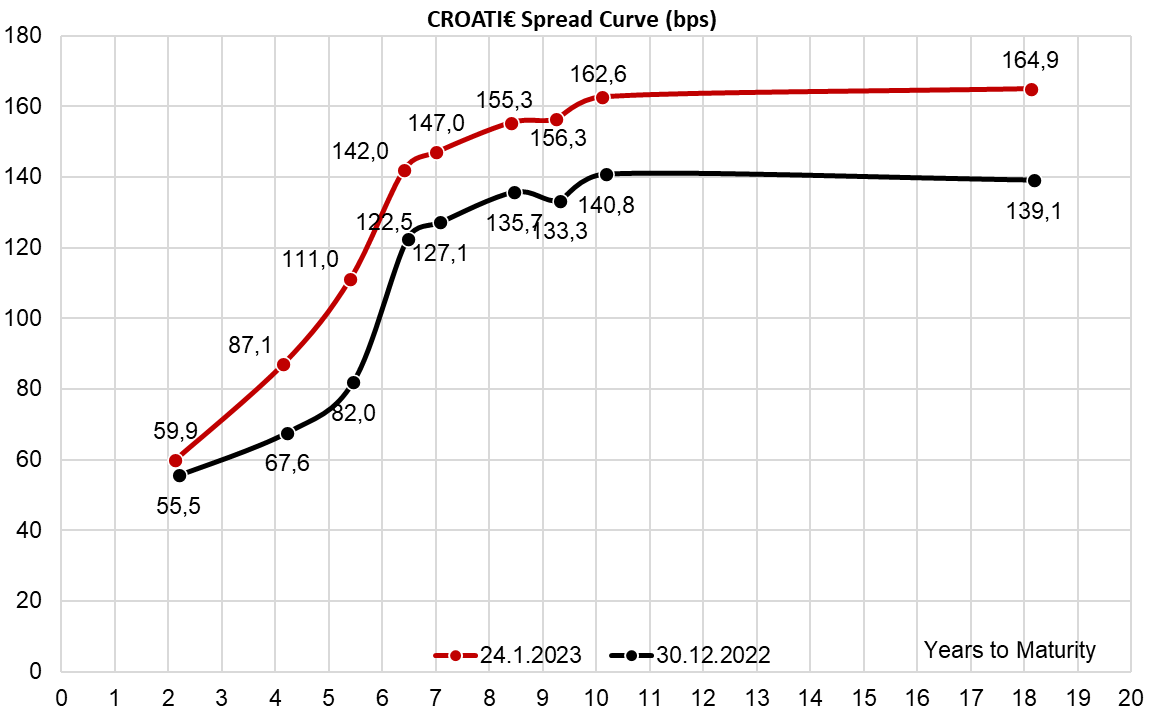

Naturally, there was more switching into shorter EGBs, than into razor-thin CROATE€. We were informed by some of the asset managers that a handful of them expect yields to go higher and spreads to widen even further based on ECB staying on the course of rate hikes and the geopolitical developments in the broader neighborhood. Speaking about the former, it’s worth bearing in mind that the latest addition to ECB’s GC, Croatian CNB head Boris Vujcic, favours a 50bps rate hike at next week’s meeting (February 2nd). This doesn’t mean that the new hawk has been hatched, Mr. Vujcic has been hawkish all along, but rather that the flock of hawks in Frankfurt got a new member of the club. In an environment of core inflation remaining elevated, inflation remains the war that has to be won to maintain monetary policy credibility.

But you all know this by now, so let’s focus on the latter – why do some Croatian asset managers expect CROATI€ spreads to widen compared to where they are now, and pray to the gods of geopolitical developments to make their wishes come true? The hopes are not unfunded by reality because of the recent reluctance of German Chancellor Olaf Scholz to supply Ukraine forces with modern tanks. On Sunday on a trip to Paris Scholz was asked if Germany would approve the supply of armour to Ukraine and his initial statement was affirmative. Nevertheless, when EU ministers met in Ramstein to confirm the deal of tank supply to Ukraine, Sholz’s statement was reserved and he looked as if he was holding back. We were also informed that in high politics every statement that is not a direct, unequivocal “Yes” effectively means “No”. To put the matters in context, Timothy Garter-Ash coined the phrase “Scholzing” – “communicating good intentions, only to use/find/invent any reason imaginable to delay these, or prevent from happening”.

Why is Scholz “Scholzing”? It’s evident that regarding Ukraine, all Western sides want peace, but the ways of reaching peace diverge. It seems that the United States views peace as Ukraine reaching arms parity with Russia on the ground and hence fending off Russian ambitions of crushing the country, leading to peace. Arms parity effectively means that more arms supplies to Ukraine increase the prospects of reaching peace. Poland is a strong subscriber to this point of view. Germany is not. From the German point of view, wars determine not who is right, but who is left and the German historic experience of wars was very much different from that of America. In other words, Germany favours a diplomatic solution to an open military conflict. But don’t worry – Germans will likely hop along on this arms supply issue, albeit not easily, not unequivocally, and not immediately.

This leads us to a final question – why does Ukraine need modern tanks such as Leopard 2, US Abrams, or French Leclerc? Because it’s quite possible that Russia will launch another offensive in late February and assault weapons would then be used to fend off an attack. This scenario would likely cause CEE spreads to widen and some of the asset managers hold this scenario as likely, hence keeping some cash on the sidelines to quickly scoop some of the CROATI€ sell-off. This also means that if the scenario does materialize and some CROATI€ comes to the market – well, you got to be quick to grab it.

What about Croatian bond placement? We think the next bond placement is going to be a local bond used to fund the maturing CROATI 5.5 04/04/2023$. Note that the USD international bond was swapped into EUR back when EUR was quite strong compared to the greenback, meaning that after the swap the net liability amounts to 1.0-1.1bn EUR. This means that the outstanding size may not exceed 1.25bn EUR and that the Ministry of Finance can wait until early March before putting things in motion. The domestic investor base may be resilient to the geopolitical scenario we have just outlined, but only time will tell.

Yesterday, Petrol published a report from its latest GSM, including information regarding Geoplin, the business scenario for 2023, as well as the activities taken to receive compensation for the damage from the regulated energy prices of 2022.

Starting off with Geoplin, in 2022 the Company was faced with a supply of natural gas cut off under the long-term contract with the Russian company Gazprom, resulting in a realized damage of EUR 140.3m. They note that in order to prevent further damage, Geoplin terminated the unsustainable contract with Gazprom at the end of 2022 and reduced the negative effect of the damage by offsetting the claims to Gazprom.

According to the preliminary and unaudited estimate, Geoplin’s sales revenue amounted to EUR 1.4bn in 2022, an increase of 80% YoY. Even with this growth, however, due to the aforementioned reasons, it recorded a gross loss of EUR 118.9m and a net loss of EUR 28m. Geoplin plans to generate positive results in 2023. According to the current estimate, Geoplin’s sales revenue will amount to EUR 1.1bn, gross profit to EUR 33.8m, while the net profit will amount to EUR 14.9m in 2023.

Moving on the Petrol’s business scenario for 2023, they note that the estimated effect of price regulation in Slovenia and Croatia on the Group’s EBITDA has been prepared by taking into account the current situation. Based on the currently effective Decrees and regulations, the negative effect of regulated prices on the Group’s EBITDA would amount to EUR 82.4m, of which the majority, EUR 62.5m, on the account of motor fuel price regulation in Croatia. The Management Board (MB) also informed the shareholders about the comparison of average motor fuel margins between Slovenia and other EU member countries in the period between 2020 and 2022, where Slovenia is at the bottom end among the EU countries and strongly behind the EU average in terms of both diesel and petrol margins. A key challenge presented by such low margins is that they do not enable making investments in green transformation.

Between 2018 and 2022, Petrol invested a total of EUR 276.2m in the energy transition. In 2022, the originally planned investments in the amount of EUR 100m were reduced to the most urgent ones in line with the available funds, that is, to EUR 60m, of which only EUR 24.4m for the energy transition. For 2023, the originally planned investments of EUR 135m were reduced to EUR 70m, of which only 30% of the total is planned for the energy transition.

At the Meeting, the MB provided a detailed presentation of the structure of retail price of regulated fuels in Slovenia and Croatia. Margin per litre of petrol or diesel accounts for much less than a tenth of the price on both markets, whereby it needs to be emphasised that such margin does not enable covering the increased labour costs, the cost of energy commodities, the costs of transport and warehousing and the financial costs of procurement. Based on the Group’s role in Slovenian and Croatian economic and social environments, Petrol emphasized that an unsuitable regulatory framework, if it stays in effect for a longer period of time, may have extensive economic and social consequences. The excise duties, taxes and contributions paid by Petrol d.d. contributed EUR 1.1bn to the budget of Slovenia, and in Croatia, the charges paid by Petrol d.o.o. (including Crodux derivati dva d.o.o.) contributed EUR 533m to the budget of Croatia.

According to the MB, Petrol d.d. was the largest company in terms of annual turnover in Slovenia in 2022. The Petrol Group has 3,320 employees in Slovenia and a broad network of more than 3.7k suppliers. In Croatia, Petrol Group has 2,211 employees and cooperates with more than 1.5k Croatian suppliers. For 2021, dividends paid by Petrol d.d. amounted to EUR 61.7m, of which EUR 20.2m was paid to state entities. They estimate that EUR 3.4m was deducted from domestic natural persons’ income tax based on the paid dividends. Because of this, the consequences of too low margins will affect all stakeholders of the Petrol Group.

Finally, Petrol commented on the actions taken to receive compensation for the damage resulting from the regulated energy prices in 2022. They note that certain concrete steps were already taken for this in Croatia and Slovenia, as the regulated energy prices had a strong negative effect on the business result presented in the preliminary unaudited estimate of Petrol Group for 2022 (click here to read more about this). Petrol emphasized that in Slovenia and Croatia, proposals for amicable dispute resolution have already been submitted to the State Attorney’s Offices, In Slovenia in the amount of EUR 106m and in Croatia in the amount of EUR 56m. A notification on the effect of price regulation on operations and market competitiveness in the Republic of Croatia has been sent to the European Commission, and initiatives to put an end to the petroleum product price regulation have been sent to the governments of both countries.

The main findings from a study on the petroleum product price regulation in Slovenia conducted by the School of Economics and Business of the University of Ljubljana were presented at the Meeting. The findings show that the regulation in Slovenia does not deliver any social benefits; moreover, margins in Slovenia are among the lowest in the EU, which is reducing market competitiveness, and the regulation does not support the ambitious goals in the field of renewable energy use for transport. It also suggests that the reasonableness of the motor fuel market regulation should be reconsidered.