For our last blog before the summer break, we decided to write a short brief of what was happening on rates since the beginning of 2021 and what we expect to see in the rest of the year.

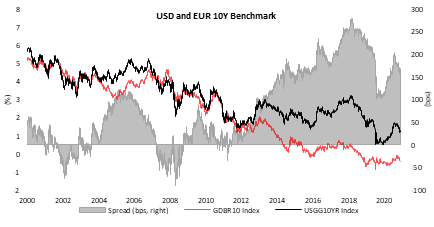

Since Georgia elections in January 2021 in which Democrats won the Senate, markets have started to price larger than previously expected fiscal stimulus that passed through the complex US legislation system quite easily. Mr Biden announced USD 2 trillion infrastructure plan even before USD 1.400 checks from the previous fiscal package were sent in full so US fiscal policy was viewed as the first driver of the reflation puzzle. Successful vaccination process in US, enormous savings that Americans are still hoarding, and pent-up demand should also be considered when looking at the first part of the year in respect of inflation and rates. Unemployment is still way above pre-crisis level but that is mostly due to lagging recovery in the service sector that should materialize once all the covid measures are out of the picture. At the same time, central banks were ensuring investors that increased inflation will show only transitory and that it will come back below targets already next year meaning that all the easing programs should be with us for longer. Above mentioned factors coupled with increasing growth perspectives as corona subsided and scare of investors that central banks could fall behind the curve created perfect storm for investors being long bonds. Yield curves around the globe steepened rapidly and US 10Y paper reached 1.80%, reflecting rise of 80bps since the beginning of the year. At the same time, EUR benchmark followed but due to ECB’s commitment to leave financing low for longer, bund yields rose only mildly compared to USTs, ‘only’ towards -10bps in mid-May. Back then, think-tanks across the globe were competing which forecast will be more bearish on rates as inflation kept rising and which one will forecast higher GDP growth.

However, every trend has its end. In April, May and June US inflation did overjump market expectations but reactions became less volatile with every release as investors started to realize that bonds were priced into perfection meaning that expectations on growth and inflation skyrocketed. In May and June, some lead indicators such as ISM showed growth peaking while central banks still did not move an inch in terms of thinking about tightening their policies. Reflation trade eased and yields once again went on a downward path and this week we saw the 10Y UST paper at 1.12%, only 4 months after we saw it close to 1.80%. Here, one should not forgive that CPI in US is still rising each month and that in terms of year over year, last CPI stood at 5.4%. In the last 30 years, we saw only few months in 1990 and July 2008 when CPI was above that level. Eurozone has the same story, but European economic growth prospective is significantly smaller while eurozone is not expected to have any issues with suppressing inflation pressures.

So, what do we take from the move in rates this year? With inflation prints being above every expectation and growth perspectives (financed by large deficits) being very optimistic it looked justified that yields should rise in the beginning of the year. However, investors witnessed an era of low inflation rates and most of them were not born in the 1970s when inflation was the public enemy number one meaning that most of the investors actually believe that inflation will once again fall below 2.0% and that the Japan scenario waits all of the developed markets eventually. In any case it is reasonable to fear higher inflation as the corona crisis did shake some of the economic theories while central banks provided more liquidity than ever before and looks like they will not stop providing more in the foreseeable future. However, the sharp move in March and the rhetoric on the markets looked a bit stretched which eased lately.

In any case, we expect inflation to decrease in the following quarters as supply issues in both goods and services are solved although we expect inflation to stay higher than before the corona crisis kicked in at least until mid-2022. That scenario should push central bankers to react a bit faster than it is currently expected and to start slowing down their purchases. However, if you have listened to Ms Lagarde yesterday and you believe her words, you better buy more bonds before ECB buys them all.

Source: Bloomberg, InterCapital

In H1, sales increased by 25%, EBITDA increase by 38.8%, while net profit increased by 56.7%.

Končar D&ST, the largest company of Končar Group, published their H1 results showing a very solid first half of 2021. To be specific, in the H1, Končar D&ST noted a sales increase of as much as 24.9% YoY, reaching HRK 696.8m. Such results indicate that Končar’s transformer segment is showing very strong results on both foreign and domestic market and should definitely boost to the overall Group result, which is in line with our expectations.

On the operating expenses side, one can note an increase of 20.4%, to HRK 692.4m, Of that the largest increase was noted on the material costs (+21.8%) of HRK 602.3m. We note that the company might be affected by the increased prices of raw materials which the company uses to in the production of transformers. To be specific, the company is exposed to the price changes of copper, aluminium, transformer metal sheet, transformer oil, insulation, steel etc. However, Končar D&ST hedges the risk of such fluctuations with forward contracts in case of copper (which is up by +23% YTD), while for steel, transformer sheet and other important supplies parts the company attempts to mitigate the risk with semi-annual and annual contracts.

In H1, EBITDA reached HRK 30.1m, representing an increase of 38.8% YoY. This translates into EBITDA margin of 8.2% (+1 p.p.). Going further down the P&L, operating profit reached HRK 45.1m, representing an increase by 55.4%.

Going further down the P&L, the company reported a net profit of HRK 36.8m, representing an increase of 56.7% YoY. Meanwhile, profit margin increased by 1.1 p.p. reaching 5%.

Looking at CAPEX, one can note a relatively low CAPEX of HRK 3.8m, compared to HRK 25.9m. As a reminder, back in 2019, company invested HRK 94.7m, which represents their highest CAPEX since 2012.