Orderbooks for the first Croatian retail bond have opened yesterday at 8.00 CET and by 15.00 CET about 4.600 private individuals have placed orders in total size of 155mm EUR. Not bad for a maiden voyage. So what’s going to be left to institutional clients in March and what do we make of this initial piece of data? Well, You’ll have to open up the article and read it.

But first as an appetizer, some macro information nuggets in order to understand what the yield curves are telling us about market expectations. Minutes of the Federal Open Market Committee (FOMC) session that ended on February 01st reveals essentially nothing new. FOMC members are still hawkish and recent hard data such as US PMIs might have firmed their stance even further. It’s not just that US core inflation remains stubbornly elevated despite energy prices coming off their recent highs, but it’s the fact that the US labour market remains resilient and tailwinds to US consumer spending such as slowing headline inflation, last year’s pay rises, cost of living adjustments for retirees and state taxes might have set up the perfect framework for a soft landing to take place (i.e. inflation back under control without a recession). Torsten Slok (ex-Deutsche Bank macro wunderkind, currently working as a portfolio manager in Apollo) correctly pointed out what has been brewing under the hood of recent +517k growth in US non-farm payrolls. My mid-year 2022 US recorded net immigration in size of 1 million people and this flow could be directed into blue-collar job openings, putting a lid on wage-induced inflation from gaining even more momentum. Slok thinks the same forces could be at play in Europe and he doesn’t mention it directly, but it’s primarily because of the influx of skilled immigrants from Ukraine. Time will tell, although while sitting in Zagreb it’s difficult not to argue that such an influx caused rents and housing prices to skyrocket, pushing inflation higher in the process.

One thing almost everybody agrees on is that thanks to lagging the first half of 2022 and now having to catch up for the missed time, ECB has been reborn as the most hawkish central bank in the developed world. If you work with cash bonds/IRSs/FX swaps, then this is no Aha! moment for you – you have figured it out on your own by now. BBG WIRP function demonstrates how €STR expectations rose all the way to 3.65% in September 2023, implying about +125bps of hikes to unfold in the Euroland. In our view, it’s quite likely ECB will get there by the end of July, setting the place for more monetary policy coordination at the Jackson Hole meeting in August, which would also be attended by BoJs Ueda Kazuo. Goldman Sachs, Berenberg and Barclays all expect that the ECB would walk the walk and get to 3.50% by September, while Deutsche Bank sets the bar even higher at 3.75%.

We’re missing the big question here and that’s how come that in times as this ECB looks like the most hawkish of the three DM central banks? Part of the answer lies in the fact that the ECB took off (too) late with rate hikes, but a substantial part of the answer could be found in the unionization of the workforce in Europe. At a time when US immigration flows into blue-collar jobs and poster child white-collar companies such as Microsoft, Amazon, and even McKinsey are forecasting layoffs, European trade unions such as Verdi (Germany) are demanding a 10% wage rise this year for 2.5mm people working in public services. Exactly one month ago, Robert Holzmann (ÖNB – Österreichische Nationalbank) explained that faster hikes are actually an antidote to trade union demands, but in order to curb these demands the central bank has to convince households and corporations that they will bring consumer inflation under control within one year. This is possible – but the unions aren’t buying it.

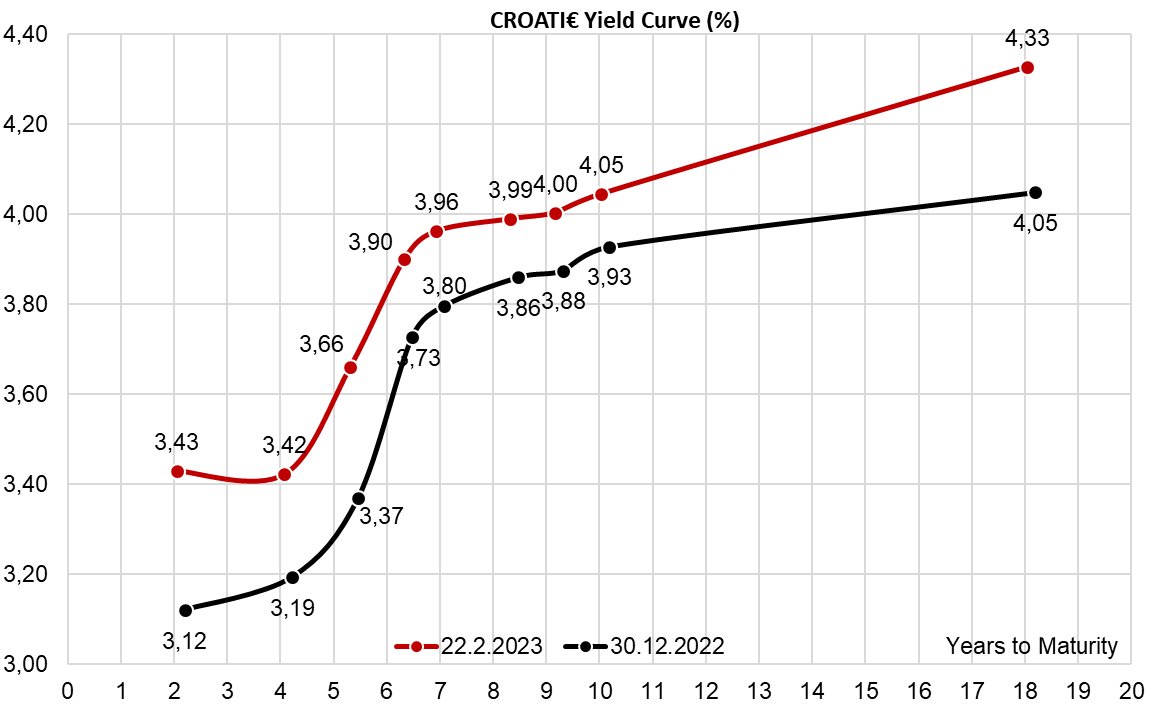

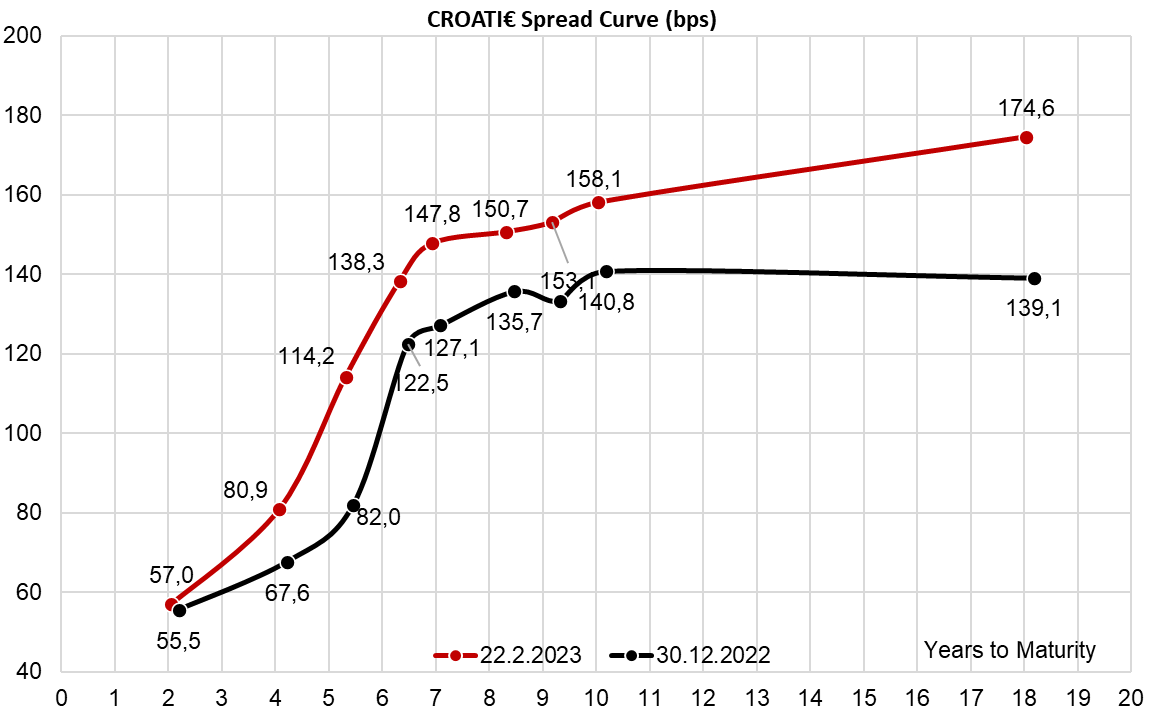

How is the Croatian bond market holding up? Yields have stabilized, albeit buyers are reluctant to add on more positions, excluding the front part of the curve. Last week we have seen trading in CROATE 5.75 07/10/2024€ at 3.20% YTM in modest sizes of 2mm EUR. The Croatian Ministry of Finance kicked off the first retail bond placement, starting the process yesterday morning. By 15.00 CET about 4.600 people gave orders in aggregate size of 155mm EUR to get a minimum yield of 3.25% on 2Y maturity. Although the average lot is 33.7k EUR, we argue that the medium order is closer to 100k EUR, at least according to our estimates. The prospects of institutional investors being able to take on their balance sheet the residual size up to 1bn EUR has dented demand on CROATI 3 03/11/2025€ (international bond with exactly the same maturity), which is currently traded at high 3.30% yields, but in sizes that are modest, albeit not scraps. And this is probably the highest value to our readers – if you are a cash bond portfolio manager, then you can easily see that the new bond is exactly on the yield curve and even if the retail leaves merely scraps for institutional investors, there are other instruments with similar characteristics being offered.

In 2022, ZABA recorded a net interest income growth of 8.2% YoY, net fee and commission growth of 13.9%, an operating income increase of 11.7%, and a net profit of EUR 248.4m, an increase of 24.7% YoY.

Before we start, it should be noted that all numbers were converted into euros, using the EUR/HRK exchange rates for 2022/2021, provided by the Croatian National Bank. Because of this reason, the numbers, especially relative changes might differ somewhat from the reported changes by ZABA itself.

Starting off with the net interest income, it amounted to EUR 405.5m in 2022, an increase of 8.2% YoY. Even though ZABA does not specify the exact reason for this increase, it can most certainly be attributed to the larger volume of loans issued, as well as an increase in interest rates on those loans, albeit to a lesser degree. Net fee and commission income amounted to EUR 207.5m, representing an increase of 13.9% YoY, which can also be tied to both a larger consumer base (due to the aforementioned higher loan volume) but also a wider array of services offered by the Bank, both to existing and new customers. Next up, the net trading and other income and expenses amounted to EUR 85.9m, an increase of 24.5% YoY, mainly due to higher trading result and other income. In total, this would mean that the net banking income (operating income) amounted to EUR 698.9m, an increase of 11.7% YoY.

Moving on to operating expenses, they amounted to EUR 321.3m, an increase of 8.6% YoY, or EUR 25.5m in absolute terms. Breaking the OPEX down further, administrative expenses increased by 9.9% YoY, or EUR 24.3m, and amounted to EUR 269.8m. Cash contributions to resolutions boards and deposit guarantee schemes more than doubled, growing by 139.4% YoY (or EUR 30m) to EUR 51.5m. A reversal of provisions was also recorded, amounting to EUR 59.8m in 2022, an increase of 187%, or EUR 39m YoY. On the other hand, financial assets not measured at fair value through P&L decreased by 83.8%, or EUR 35.5m, and amounted to EUR 6.8m, while depreciation decreased by 69.2%, or EUR 34.9m, and amounted to EUR 15.6m. ZABA notes that the inflationary pressures on costs were well managed during this year. Furthermore, as we can see in the increase in cash contributions to resolutions boards and deposit guarantee schemes, ZABA reserved a fair amount of money this year for any potentially averse situation. All of this would also mean that the cost-to-income ratio (CIR) amounted to 45.97%, a decrease of 1.3 p.p. YoY, meaning that ZABA managed to outgrow its cost growth with its revenue increase.

Finally, the profit amounted to EUR 248.4m, an increase of 24.7% YoY, due to the aforementioned revenue and cost developments.

ZABA key financials (2022 vs. 2021, EURm)

Source: ZABA, InterCapital Research

Moving on to the balance sheet, the total assets of the Group amounted to EUR 23.67bn, an increase of 12.4% YoY, or EUR 2.6bn in absolute terms. This was driven by an increase in cash, cash balances at central banks, and other demand deposits, as well as financial assets at amortised cost. However, the first category can be quite deceptive. Even though it increased by 39.1% YoY (or EUR 2bn) and amounted to EUR 7.15bn in 2022, there is another position in the balance sheet, the obligatory reserve with the CNB (Croatian National Bank), which amounted to EUR 814m in 2021, and stood at 0 in 2022. This would mean that a large proportion of the increase, albeit not the majority, also came from this source. If we exclude this effect, then the main driver of the growth in assets was the financial assets at amortised cost. In this category, loans, and advances to customers increased by 8.8% YoY (or EUR 951.7m), and amounted to EUR 11.81bn, followed by debt securities, which increased by 157% YoY (or EUR 729.4m) and amounted to EUR 1.19bn, and finally, loans and advances to credit institutions, which increased by 25.5% (or EUR 344.6m) and amounted to EUR 1.69bn. This further supports the viewpoint described above, that the loan volume growth was the key driver in the higher net interest income.

Moving on to liabilities, in total they amounted to EUR 20.98bn, an increase of 15.1% (or EUR 2.75bn) YoY. This was driven by the increase in financial liabilities measured at amortised cost, which by itself was mostly driven by higher deposits from customers. In fact, they amounted to EUR 19.1bn in 2022, an increase of 12.6% YoY (or EUR 2.13bn). This would mean that Zagrebačka banka (the largest bank in Croatia by assets) continually received a large number of deposits, both due to the fact that Croatians hold the vast majority of their financial assets as deposits, but also due to the switch to euro because of which we experienced an increase in deposit growth, especially in the latter part of 2022. On the other hand, this growth in the sheer amount of deposits could further support the aforementioned increase in loan issuances, despite the macroeconomic situation, inflation, and rising interest rates in Europe.

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 14 | 26.2.2023 | SNN | Nuclearelectrica General Assembly Meeting | Romania |

| 15 | 27.2.2023 | TTS | Transport Trade Services 2022 dividend proposal | Romania |

| 16 | 27.2.2023 | TTS | Transport Trade Services Preliminary Results for 2022 | Romania |

| 17 | 27.2.2023 | TEL | Transelectrica Preliminary Results for 2022 | Romania |

| 18 | 27.2.2023 | AQ | Aquila Preliminary Results for 2022 | Romania |

| 19 | 27.2.2023 | ALR | ALRO Preliminary Results for 2022 | Romania |

| 20 | 27.2.2023 | COTE | Conpet Preliminary Results for 2022 | Romania |

| 21 | 27.2.2023 | ATPL | Atlantska Plovidba Supervisory Board Meeting | Croatia |

| 22 | 27.2.2023 | ARNT | Arena Hospitality Group Supervisory Board Meeting | Croatia |

| 23 | 28.2.2023 | TGN | Transgaz Preliminary Results for 2022 | Romania |

| 24 | 28.2.2023 | DIGI | Digi Preliminary Results for 2022, Conference Call | Romania |

| 25 | 28.2.2023 | AQ | Aquila Preliminary Results for 2022 Conference Call | Romania |

| 26 | 28.2.2023 | ATGR | Atlantic Grupa Q4 2022 results, unaudited Financial Report for 2022 | Croatia |

| 27 | 28.2.2023 | ONE | One United Properties Preliminary 2022 Results | Romania |

| 28 | 28.2.2023 | WINE | Purcari Preliminary Results for 2022 | Romania |

| 29 | 28.2.2023 | SNG | Romgaz Preliminary Results for 2022 | Romania |

| 30 | 28.2.2023 | FP | Fondul Proprietatea Preliminary Results for 2022, Conference Call | Romania |

| 31 | 28.2.2023 | KOEI | Končar Q4 2022 Results, Unaudited Financial Report for 2022 | Croatia |

| 32 | 28.2.2023 | RIVP | Valamar Riviera Q4 2022 Results, 2022 Audited Annual Report | Croatia |

| 33 | 28.2.2023 | PODR | Podravka Unaudited Financial Statements for 2022 | Croatia |

| 34 | 28.2.2023 | ATPL | Atlantska Plovidba Management Board Meeting, Unaudited 2022 Annual Report | Croatia |

| 35 | 28.2.2023 | ARNT | Arena Hospitality Group Q4 2022 Results | Croatia |

| 36 | 28.2.2023 | ARNT | Arena Hospitality Group 2022 Annual Report | Croatia |

| 37 | 28.2.2023. | SPAN | SPAN Q4 2022 Results | Croatia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).