On its yesterday’s monetary policy meeting, Fed decided to increase its reference rate by 75bps as expected while its projections for rates increased significantly since their last release in June. Is this the moment we can finally say that we have seen the peak of hawkishness? We are trying to find the answer in this brief article.

We always start with the facts after the events like this one but this time I wanted to present you market reaction to see how much Mr Jerome Powell and his company were hawkish or dovish. Well, both short- and long-term rates went up to decade highs right after the decision and projections were released while EURUSD came close to the 0.98 level. However, after the algorithmic trade was done and analysts digested the projections coupled with Mr Powell’s speech long-term treasury market went to flat for the day while UST 2y overjumped 4.0% and was up by a ‘modest’ 7bps. This could mean that Mr Powell delivered the exact amount of hawkishness that was being already calculated into the markets and that we will have to see Fed stepping up their game even more to see rates continue creeping higher.

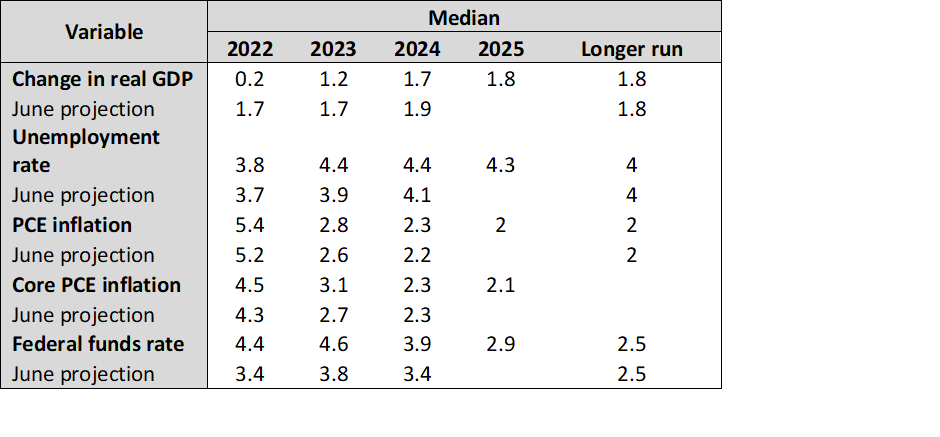

Back to the decision, as expected, Fed raised its rates to 3.0%-3.25%, resulting in rates being 3.0% higher compared to the start of the year (25bps, 50bps, 75bps, 75bps, 75bps) and their projections showed that there is still a lot of hikes in front of us. Namely, median Federal funds rate projection went to 4.4% for 2022, 4.6% in 2023, 3.9% in 2024, 2.9% in 2025 and 2.5% in the longer run vs June’s projections of 3.4%, 3.8%, 3.4%, and 2.5% respectively. This shows that Fed’s officials believe there will be more rate hikes needed while they see Fed’s pivot only in 2024. This year we could see another 75bps hike followed by a smaller one of 50bps, at least that is what is calculated right now. GDP projections were lowered as expected, and the unemployment rate projection was lifted to 4.4% in both 2023 and 2024 from today’s 3.7% which should imply a significant deceleration of economic growth and according to Governor Powell should ensure fall of inflation rates. Looking at the core PCE inflation projection, the median was set to 2.1% for 2025 meaning that the median Fed’s official does not see core PCE falling below 2.0% for the next three years.

Summary of Economic Projections, September 21st, 2022

Source: Fed – FOMC September 2022 Projections, InterCapital

Listening to Q&A session, we did not hear much news as the Governor said that inflation rates and especially core inflation is way too high and that they will have to increase rates into restrictive territory until something ‘breaks’. Mr Powell mentioned commodities that according to him have seen their highs while supply chains seem to improve which should drive inflation lower but said that Fed does not know when we will see the point to stop lifting rates or at least pause tightening for a while. Fed projections are showing cutting rates in 2024 while the market thinks that the peak of rates will be in H1 2023. All in all, Fed’s officials are still strongly determined to stop inflation with their tools and the market currently believes them. Until the next mini cycle in which the market mantra will be recession once again. With Mr. Putin in full mobilization, the mantra could be just around the corner and then we will once again read and listen that we have seen the peak of the yields in this cycle. In any case, with each day we are closer to the mentioned peak.

As of August 2022, Fondul’s NAV reached RON 16.18bn, which would translate into a NAV per share of RON 2.8190, an increase of 50.8% YoY.

According to the latest Fondul Proprietatea’s NAV report (31 August 2022), Fondul reported a total NAV of RON 16.18bn (EUR 3.33bn), which translates into a NAV per share of RON 2.8190 (EUR 0.5800).

Comparing it on a YoY basis, the total NAV recorded an increase of 46.7%, while NAV per share grew by 50.8%.

Fondul Proprietatea’s portfolio structure still remains focused on the power utilities generation sector (77.6% of NAV) with Infrastructure (6.6%), Power & Gas supply and distribution (6.3%) and Oil & Gas (4.9%) following. This is also why the two biggest holdings, Hidroelectrica and OMV Petrom amount to 82.5% of the total NAV of the Fund. In terms of the Fund’s portfolio structure, unlisted equities accounted for the vast majority of NAV, standing at 92.1%. Following them, we have listed equities with 5.9%.

Turning our attention towards the share price’s performance, during the month, the Company’s share price remained mostly flat, decreasing slightly by 1.3%, ending the month at RON 1.96 per share. The current discount to NAV per share stands at 30.6%.

Fondul Share Price & NAV per Share

At the share price before the announcement, this would amount to a DY of 3.6%. Ex-date is set for 26 September 2022.

Valamar Riviera held its GSM meeting yesterday during which they approved the dividend payment for 2022. According to the Company announcement, HRK 128.1m out of the 2018 retained earnings, as well as HRK 18.2m out of the 2019 retained earnings, shall be used for the dividend payment. This would mean that the dividend per share would amount to HRK 1.2, representing a DY of 3.6% before the date of the dividend announcement (8 August 2022).

Considering that Valamar did not pay out a dividend in 2021 (due to receiving COVID-19-related government support), the 2022 dividend is the return to form for the Company, at the same level as 2019 (in terms of DPS), but slightly lower in terms of the DY.

The ex-date is set for 26 September 2022, while the payment date is set for 28 September 2022. Below we provide you with the historical dividends per share and the dividend yields of the Company.

Dividend per share (HRK) & dividend yield (%) (2015 – 2022)