Yesterday, CROBEX noted a decrease of 1.5%, while SBITOP dropped by 2%.

Almost all global equity markets ended yesterday’s trading day in red, amid the intensified uncertainty that Evergrande, China’s second largest property developer, is on the brink of default. The regional markets were not spared of the market turbulence, with CROBEX decreasing by 1.48%, while SBITOP dropped by 2.03%. To be specific, this notes the worst performing day of SBITOP in 2021.

Among the SBITOP constituents, Sava Re witnessed the biggest drop of 4.14%, ending the trading day at EUR 25.5 per share. Index heavyweights, Petrol and Krka follow with a 2.52% and 2.24% decrease, respectively. Telekom Slovenije was the only constituent to end the day in green (+1.13%).

On the ZSE’s prime market, Valamar Rivera noted a decrease of 2.04%, while AD Plastik noted a decrease of 1.4%. On the flip side, Podravka, the most traded share, was the only prime market member to observe a slight increase of +0.33%.

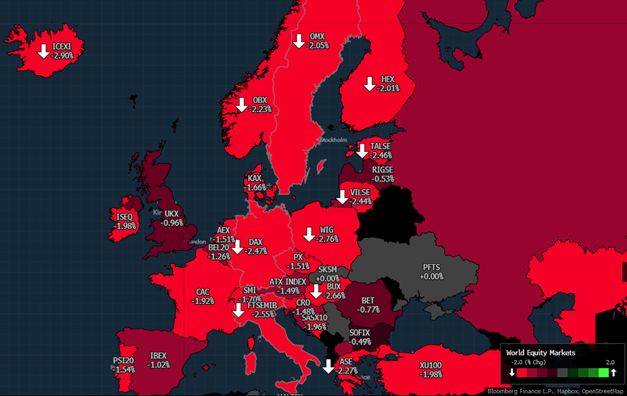

Turning our attention to the European equity markets, as visible from the graph, virtually all equity indices ended the day in red.

European Equity Markets (20.9.2021)

Source: Bloomberg

The loan is due on 30 June 2025 and carries a fixed interest rate of 0.9% p.a.

Arena Hospitality Group announced that they entered into a new long-term working capital financing loan agreement with Zagrebačka banka in a total amount of HRK 150m, within HBOR’s Covid-19 Measures Programme for the portfolio insurance of liquidity loans for exporters. The company states that this additional facility further improves the Group’s current strong cash position of HRK 503m as of 31 August 2021.

Cooperation of HBOR and Zagrebačka banka within the said program provides loans at favorable conditions and the Group’s Management Board found it prudent to take advantage of these conditions as the Group recovers from the impact of the COVID-19 pandemic. The loan is due on 30 June 2025 and carries a fixed interest rate of 0.9% p.a. As a reminder, as of 6M 2021, the Group’s net debt stands at HRK 1.1bn.