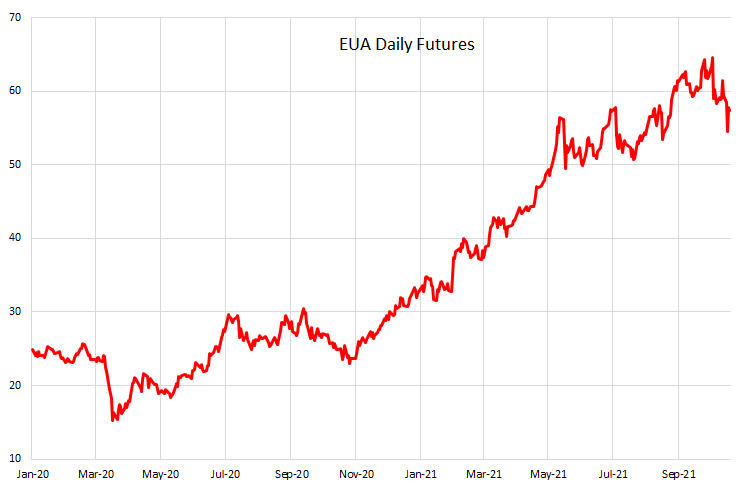

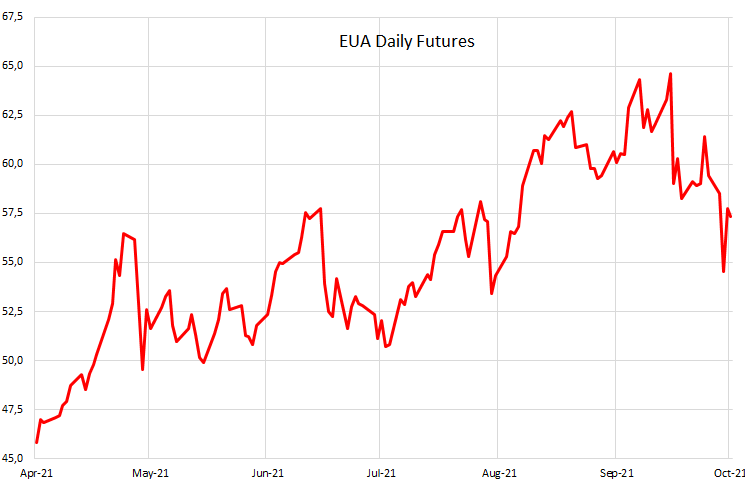

If you ask the traders of energy complex, it’s been a wild ride this last couple of sessions. Natural gas and carbon certificates in particular have been zig zagging in a seemingly unpredictable manner. Speaking about the carbon price, it’s worth mentioning that on Tuesday EUA spot (approximated by daily futures, ICEDEU3 Index on Bloomberg) dipped by full 4€ from 58€/t to 54€/t. You don’t see that every day. What was the catalyst? Well, that’s the story we’re going to tell you this morning.

So far in the last few months EUA spot (European Union Allowances, carbon emission certificates traded on EU ETS) closely followed the natural gas price – you can look at TZTX1 Comdty on Bloomberg, for instance. Higher gas prices are a metanarrative of the story about higher EUA and in contrast to popular opinion that tight(er) Russian supply to Europe is behind most of the price surge, we offer a different angle to the story that is instead focused on Asian LNG buyers. Just last winter a unique meteorological phenomenon called La Nina brought about exceptionally cold weather to northeast Asia, leading some countries (Japan in particular) to boost natural gas spending for heating purposes. The timing of La Nina couldn’t have been worse because Japanese nuclear power plants operated at lower capacity, meaning that natural gas had to be used both for heating and energy production. In order to fill the gap, Japanese companies had to buy natural gas on the spot market, pushing prices to an all time high. Well this year the same companies were instructed to build stocks in order to have a buffer in case of extreme weather event.

As a matter of fact, National Oceanic and Atmospheric Administration (NOAA) has estimated the probability of La Nina happening all over again in November 2021 – January 2022 at 79%. With this in mind Japanese power agency (OCCTO) released a warning in April for power companies to stock up supplies early on so that detrimental effects of winter 2020 don’t happen all over again again. And stockpile they did – in September 2021 Japanese LNG stock was up by +54% compared to a year earlier (2.5mm t in September 2021 versus 1.62mm t a year earlier).

What are the odds of these stocks being a bit excessive? Don’t be so sure about it since even Japanese meteorological agency puts a 30%-40% probability of average temperature this winter gong below the 30Y average. It pays to be prepared, especially when you think about global cargo ports being congested and geopolitical wrangling in Europe.

And oh, yeah – don’t forget Europe. What’s the story here? Well, on 26th September Germany held a general election and Annalena Baerbock’s Green party emerged as the kingmaker, together with the FDP. Current German Finance Minister Mr. Olaf Scholz (SPD) has once in a lifetime opportunity to become the chancellor, but only of he appeases the Green party. This is where things start to get difficult. The Greens are opposed to new gas pipeline Nord Stream 2 (which is built and ready to be put into function) on the grounds that it violates European law because the operator of NS2 and producer of the gas that flows through the pipeline are one and the same – namely, Gazprom. Even if that would be changed, the Greens would most likely oppose the NS2 on some other topic (methane emissions for instance). And so far they have proven to be a hard cookie because they aware of the clout they have. Moreover, even some of the SPD members are opposed to NS2 on different grounds, but they remain relatively silent and let the Greens do all the dirty work. Russian Gazprom answered to this political horse trading in Berlin by not booking an extra capacity in the existing Yamal pipeline in order to send a clear message to Europe that NS2 is the only way to go, at least if they want their homes warm this winter. This story is still unfolding before our eyes and for now all options are open – even the possibility of new elections in Germany if Greens stand their ground.

So far we were talking about natural gas, but what about carbon allowance prices per se? The dip on Tuesday came about at the same time as Chinese regulatory agency announced that it’s looking into intervening into thermal coal prices. Looking at the Zhengzhou Commodity Exchange (which will soon offer it’s data stream on Bloomberg as well), thermal coal futures fell peak to through by 11%, bottoming at about 1.587,4 CNY/t (248,37$/t). The surge in coal prices had many causes, but the strongest effect came from recent floods in China that even managed to bring down the payments system (putting Chinese long term shift to digital currency in question) and Chinese companies being prohibited to import coal from Australia due to geopolitical skirmishing.

The story of the energy complex (natural gas and carbon emission certificates) tends to be complex as HBO’s Game of Thrones, and has at least as many twists and turns. It’s difficult to forecast the price of EUA into year end, but that was not our intention – instead, it’s enough to know the drivers and risks emanating from trading these instruments. Stay tuned for more in the coming weeks.

In 9M 2021 A1 Croatia revenues were up 7.7% YoY, EBITDAaL up 14.6% and EBIT increased 41% YoY to EUR 51.3m.

The parent company of HT’s largest competitors, Telekom Austria (A1) published their 9M 2021 results and we are bringing you some key takes regarding their performance on the Croatian market. Note that Tele2 is the third largest provider of telephony services in Croatia and also one of HT’s competitors. It was acquired by United Group which is not listed, so we are unable to obtain their quarterly results.

Q3 was marked by the acquisition of 5G spectrum in July 2021 for all mobile network operators in Croatia. Therefore, A1 also acquired spectrum for 700 MHz, 3.6 GHz and 26 GHz frequencies for the amount of EUR 14.0m ( HRK 107m). So from July A1 has included 5G propositions in its portfolios. In the mobile business, A1 Croatia recorded a strong growth in Q3 2021, owing to a newly redesigned portfolio with attractive hardware and increased subsidies, supported by roaming rebound resulting from exceptionally strong tourist season and almost record number of visitors during summer months. In the fixed-line business, successful up-selling to high-bandwidth products bundled with exclusive TV content remained in focus.

In 9M 2021 A1 Croatia recorded EUR 336.2m in revenues which represents a 7.7% YoY growth. Revenue growth seen is 9M comes from a strong performance in Q3 when total revenues increased by 8.7% YoY, following a strong service revenue growth while equipment revenues remained at the level of the previous year. Mobile service revenues grew due to solid performance in the mobile core, continued strong performance of mobile Wi-Fi routers and increased visitor roaming. Retail fixed-line service revenues remained stable as the successful up-selling activities to high-bandwidth products compensated for the ongoing shift of customers from the fixed-line bistream access to mobile Wi-Fi routers.

EBITDA is up 13.1% YoY, amounting to EUR 125.8m. Meanwhile EBITDA after leases amounted to EUR 114.6m which represents a 14.6% YoY increase. However, one should note that the growth seen is 9M comes from a strong performance in Q3 when successful translation of service revenues has resulted in strong EBITDA growth of 15.1 % YoY. Operating expenses were up mainly due to positive one-off effect of EUR 2.6m in the comparison period (reimbursement of frequency fees) as well as higher advertising and commission costs in the reporting period. As a result of sales growth and lower depreciation stemming for lower investments during pandemic times, 41% YoY growth in EBIT to EUR 51.3m was realized.

Meanwhile CAPEX expenditures are measured on the level of whole Group and they increased by 41.1% YoY. Investments in the reporting period are back to normal levels after their cuts in the Group’s entire footprint taken in the comparison period as a precautionary measure in the course of the COVID-19 pandemic.

A1 Revenue & EBITDA (9M 2019- 9M 2021 EURm)

*EBITDA after leases is defined as EBITDA plus depreciation of right-of-use assets and interest expense on lease liabilities