Croatian Ministry of Finance announced its plans yesterday to issue two new local bonds today – 5Y HRK paper and 15Y EUR-indexed paper. Total amount is planned at HRK 10bn, with distribution among the two papers unknown. The books are opening today while settlement will take place on November 27th, two days before RHMF-O-19BA matures.

As expected, Croatian Ministry of Finance decided to enter capital markets for the last time this year in order to secure funds for maturing RHMF-O-19BA. Two bonds are to be issued today in total amount of HRK 10bn, around HRK 2.5bn more than Ministry needs to proceed to holders of RHMF-O-19BA. As we stated above, investors will be able to choose between 5Y HRK paper and 15Y EUR-indexed one; something for everybody as banks will probably have 5Y HRK paper as their darling while insurance companies and pensions funds could likely invest more in the other one due to its higher yield, indexation and/or longer maturity. As both papers are to be settled two days before RHMF-O-19BA matures, holders of RHMF-O-19BA have the opportunity to pay for the new bonds with the maturing paper but 2 days of accrued interest should be deducted from the full coupon.

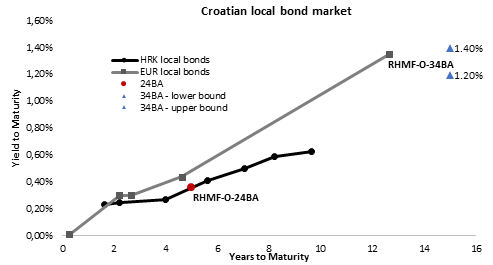

Let’s talk some numbers know and see what could we expect from today’s pricing. For 5Y HRK paper calculation should be quite straight forward. Simple interpolation between RHMF-O-23BA and RHMF-O-257A (based on bid prices) indicates yield of 0.36%. We find that realistic as high liquidity could be poured in mid-term paper that yields slightly below 40bps; level that only month ago you could attain by investing in longest HRK papers.

On the other hand, 15Y EUR-indexed paper is not such an easy one to price. The obvious choice was to start form existing local EUR-indexed paper, RHMF-O-327A, that was also 15Y paper when issued two years ago (back then yield stood at 3.355%). At the moment dealers’ bid for RHMF-O-327A varies hugely from 120.4 up to 125.0 while last transaction was done just few days ago above 126.0 (1.05%), so we used average of all bids on BBG resulting in price of 122.37, i.e. YTM of 1.32%. On the top of that some additional basis points are expected to be paid for 2,5y longer maturity placing YTM around 1.40%.

Second method we used was based on spread occurring on the Eurobond market between CROATI 2028 and BGARIA 2028 (both EUR denominated) which currently stands at 44bps. Adding that to current YTM of interpolated BGARIA 2034 (0.94%) leads to expected yield of 1.38%, similar end result as with the first method. However, the third method shifted expectation towards a bit lower yield. Using extrapolation method with EUR denominated Eurobonds, CROATI 2028 (0.62%) and CROATI 2030 (0.77%), we ended up with YTM of 1.22%. The crucial detail here of course will be the distribution among the two papers and demand of pension and investment funds, as we expect insurances to bid that paper heavily due to long term liabilities.

With today’s auction coupled with the foreign one in the beginning of summer when EUR 1.5bn worth of CROATI 2029 was issued, Croatian Ministry of Finance will secure funds for the year but also finance small deficit planned for the year. Under the assumption that Ministry issues HRK 5bn of shorter and HRK 5bn of 15Y paper at 36bps and 130bps respectively, i.e. 83bps in aggregate, on notional of EUR 1bn, that means that Croatian Ministry of Finance will save EUR50m a year or EUR 750m in 15 years. Thank you Mr. Draghi once again.

Source: Bloomberg, InterCapital

In the first 9M of 2019, the company recorded an increase in sales of 0.6%, a decrease in operating profit of 44.1% and a net profit decrease of 43%.

As Cinkarna Celje published their 9M 2019 results, we are bringing you key takes from the report. According to it, sales witnessed a slight increase of 0.6% YoY, amounting to EUR 134.78m. Such a result is 7% higher than planned. Of the total sales, foreign sales recorded a 2.6% increase and now account for 89% (+1.8 p.p. YoY). On the other hand, sales on the domestic market observed a decrease of 13.1% or EUR 2.3m, amounting to EUR 15.39m. The increase in sales on the Group level could be attributed to the focus on the core activities, while abandoning the unprofitable ones.

When comparing the Q3 to Q2, the situation on the titanium pigment market did not change the dioxide Additional customs duties on Chinese material that are reflected in increased pressure of the Chinese material in the EU and neighboring markets. As the company announced in H1, their sales prices were up, while they slightly decreased in Q3. Average global sales prices are down by 1.3% YoY. The downward trend, which began last year, has not had a significant impact on the Group this year.

When looking at the change in the value of finished product inventories and work in progress item, one can notice a sharp decrease of EUR 16.2m, amounting to EUR -5.56m. Such a result affected all other results down the P&L. The company attributes the mentioned decrease to a drop in pigment inventories due to increased sales volume.

In the first nine months of 2019, operating expenses amounted to EUR 113.46m, noting a decrease of 1.8%. Such a result can be attributed to lower material costs by 1.4% or EUR 1.2m and lower employee costs by 4.4% or 1.02m.

Going further down the P&L, operating profit amounted to EUR 18.73m, showing a drop of 44.1%. Such a result could be attributed to above-mentioned decrease in change in the value of finished product inventories and work in progress. In the first nine months of 2019, net profit amounted to EUR 15.9m, showing a decrease of 43% YoY. However, it is important to note that this result is 91% higher that the managements plan.

Turning our attention to CAPEX, in the first 9M of 2019, the company invested EUR 8m in purchasing fixed assets and replacement equipment and environmental investments spent, representing 95% of the planned amount for the period. Most of the funds invested were for the production of titanium dioxide for improvement product quality, ensuring planned production volumes and reducing environmental impacts.

AM Best reaffirmed the Financial Strength Rating of A and the Long-Term Issuer Credit Ratings of “a” of both Zavarovalnica Triglav and Pozavarovalnica Triglav Re.

Earlier this morning, Triglav Group published a document on the Ljubljana Stock Exchange stating that the AM Best credit rating agency re-affirmed the Financial Strength Rating of A (Excellent) and the Long-Term Issuer Credit Ratings of “a” of both Zavarovalnica Triglav and Pozavarovalnica Triglav Re. The both ratings have a stable medium-term outlook, which reflects the rating agency’s expectations that Triglav Group will maintain very strong balance sheet strength, strong operating performance and the dominant market position both in Slovenia and the region where the Group operates.

According to AM Best, the Group’s balance sheet strength and its operating performance are strong, while the impact of both the business profile and the majority shareholding on the credit rating is neutral. It further points out that the Group’s enterprise risk management is developed and appropriate for its risk profile and operational scope and complexity. AM Best points out that Triglav’s solid operating performance over the years has been driven by the excellent non-life insurance technical earnings in the domestic market and healthy investment income. Besides that Triglav has a well-diversified portfolio by both product and geography. Moreover, outside of Slovenia, Triglav continues to demonstrate improvement in earnings on the basis of additional scale and actively seeking alternative lower cost distribution channels.