CROBEX has long been known for its broadness which somewhat affected the index’s ability to accurately portray the situation on the market. Therefore, we decided to examine the index’s movement more closely by reviewing the individual contribution of each component in a period spanning from 2013 up until today.

Market indices are supposed to serve as proxies for investors which would allow them to easily follow the direction in which the observed market is moving. However, in order to function properly, the index must be comprised out of shares that attract enough turnover to actually represent the current market movement and not be exposed to frequent price fluctuations. Meanwhile, CROBEX is currently not that type of index as it consists of a large number of shares which many fund managers would not even include in their investment universe (due to extremely low liquidity, poor corporate governance, going in and out of pre-bankruptcy procedures, etc).

The value of the CROBEX index increased by 17.8% in the observed period (Mar 2013- Mar 2022), which might lead some investors to believe that the Croatian market has either missed most of the bull market or that the coronavirus was able to erase almost an entire decade of gains. Fortunately, none of that is true.

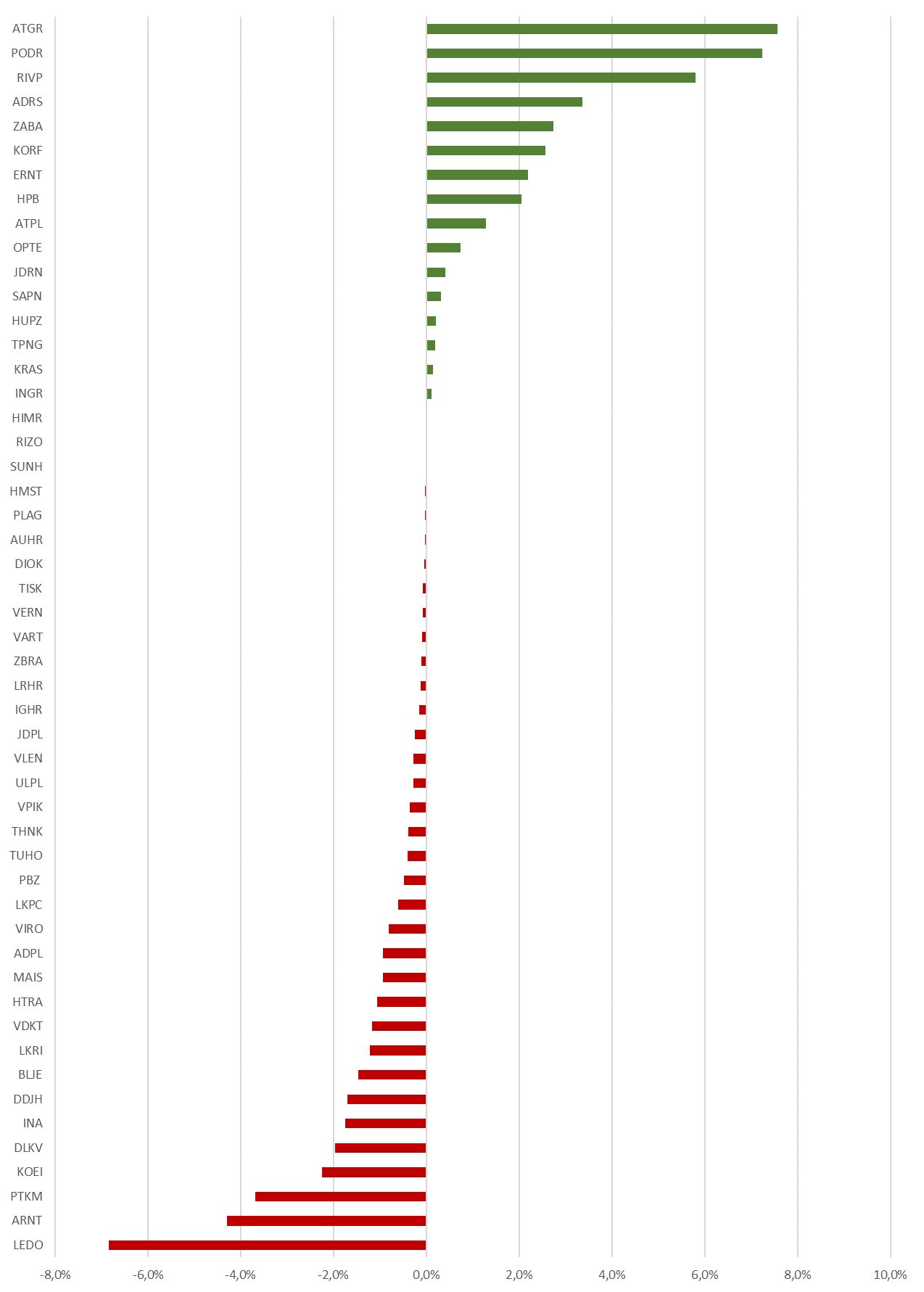

Individual Impact of Shares on CROBEX Movement in the Observed Period (in %)

As one can notice, shares such as Atlantic Grupa, Valamar, Podravka and Adris all had a positive impact on the index’s performance. Atlantic Grupa managed to increase its share price by 2.5x in the observed period due to the successful acquisition and integration of Slovenian Droge Kolineske, successful portfolio management and sell-off its non-core assets. Considering that these shares are among the most popular shares for investors, the decrease stated previously seems a bit misleading. On the flip side, the shares which dragged the index down were mostly poor performing companies from the industrial sector which are prone to share price fluctuations due to their low liquidity and poor corporate governance which puts off many institutional investors from buying those shares. Furthermore, the index was hit hard by the Agrokor crisis with Ledo accounting for a 7% decrease in value. An exception from this group would clearly be Koncar and Arena Hospitality who, despite the strong interest from investors, were some of the leading contributors to CROBEX’s negative performance. Končar’s negative contribution to the Index happened mostly as a result of the whole market reporting bullish sentiment in those periods. We should mention that Končar’s share price reported a high increase in price during the time Končar was not in the index, overestimating its negative performance in the observed period, even if it did negatively impact the Crobex value.

To conclude, the Croatian market has certainly been through a rough patch over the past couple of years. However, we believe that the performance of the main market index is slightly exaggerated as its broad size led to the inclusion of shares which unjustifiably dragged it further down. Therefore, we believe that despite the negative performance of the index, the Croatian market still offers some gems hidden in the pile.

Furthermore, the Index Committee has concluded a regular revision of the ZSE indices. It was carried out after the close of trading in Friday, March 18th. The new composition will effectively start as of today, March 21st.

S&P expects that Croatia’s economy will expand by 2.5% in 2022, supported by the recovery in the tourism sector and a pick-up in investments.

On Friday, Standard & Poor’s agency affirmed its ‘BBB-A-3’ ratings for Croatia, with a stable outlook, on the expectation that Croatia’s economic growth will remain steady in the coming two years despite inflationary headwinds and the pan-European macroeconomic consequences from the conflict in Ukraine. They also expect that the govt. will remain committed to its reform program, successfully absorb EU financing, and gradually rebuild the fiscal space it lost in the aftermath of the pandemic.

Upside scenario

The agency could raise the ratings if Croatia satisfies the remaining ascension requirements for euro adoption, setting the economy for a speedy entry into the European Monetary Union. An upgrade would also find support if the economic growth were to accelerate beyond the agency’s expectations, leading to a step-up in economic wealth.

Downside scenario

The agency would consider a downgrade if the economic growth was materially lower than in their forecast, which would result in significantly higher fiscal deficits.

Rationale

S&P projects that the Croatian economy will expand by 2.5% in 2022, as the country benefits from higher investment and tourism activity close to pre-pandemic levels. This follows a strong GDP rebound of 10.4% in 2021, which enabled Croatia’s GDP to exceed its pre-pandemic level following the 8% decline in 2020. This rebound was supported by the tourism sector, which benefitted from a reduction of COVID-19 cases during the summer months.

The agency estimates that the tourism and hospitality sectors will account for almost 20% of value-added in Croatia and about 1/3 of its current account receipts, exposing the country to swings in tourism flows. Private consumption should also be an important growth driver in 2022, although to a lesser degree since elevated prices will likely curb consumer spending.

The economic growth should remain strong in 2023-2025, supported by investment spending. This is supported by significant EU funds over the coming years; EUR 10bn under the Next Generation EU program 2022-2024, of which about EUR 6bn is in the form of grants, as well as EUR 10bn under the EU’s new Multiannual Financial Framework 2022-2029. Additional funds are available from various other programs.

The agency projects a general govt. Deficit of 3.5% of GDP in 2022, with expenditure benefitting from roll-back of pandemic support programs, while subsidy schemes alleviate price pressures on fuel and energy (which should add 1.1% of GDP to the expenditure bill).

They also expect the fiscal deficit to narrow over 2022-2025, to about 2% of GDP by 2025, due to the prudent fiscal policies from the govt.

The central bank also remains committed to stabilizing HRK to EUR exchange rate, including via foreign exchange interventions in 2020 and 2021. At the end of 2021, the central bank’s FX reserves stood at USD 28.3bn or 42% of GDP.

Croatia aims for eurozone ascension by 1 January 2023. In July 2022, Croatia will have completed the two years within the European Exchange Rate Mechanism (ERM) II framework, the precursor to euro ascension.

Moving forward to the Russian invasion of Ukraine, the agency says it has added pressure on energy prices, which will have an impact on inflation in 2022. Because of this, they expect CPI to average at 6%, due to the rising energy prices, increasing wages, and rising hospitality sector costs.

The agency also anticipates that asset quality will remain a key issue for the Croatian banking sector. Private-sector debt remains among the highest of Central and Eastern European peer countries. Nevertheless, nonfinancial entities are less indebted than they were 10 years ago, during the last financial crisis. The agency also believes that the recent takeover of the Croatian subsidiary of Sberbank by HPB will not cause any disruptions to the country’s financial system, which remains profitable, well-capitalized, and well-funded by domestic customer deposits.

At the closing price before the announcement, this would amount to a DY of 7.4%. Ex-date is set for May 12, 2022.

Executive Board of OMV Petrom proposed the distribution of dividends for the financial year 2021. The proposed dividend amounts to RON 0.0341 per share, translating into a DY of 7.4% at the closing price before the dividend announcement.

This dividend is subject to approval by the OGSM, which would be held on 27/28 April 2022. The dividend implies a 10% YoY increase, at the high end of the 5-10% range stated in the dividend guidance, published in its 2030 strategy.

The record date for the dividend is set for 13 May 2022, the ex-date is set for 12 May 2022, while the proposed payment date is set for 6 June 2022.

OMV Petrom dividend per share (RON) and dividend yield (%)