For today, we decided to present you with a brief analysis of cash per share of Croatian companies.

In July, most Croatian companies published their H1 results, while the market observed a slight recovery compared to a sharp decrease seen in March. As a result, we decided to revisit (update) our cash per share analysis, with H1 figures in order to see the strength of the balance sheet and how liquid selected Croatian companies are. This figure as the percentage of a company’s share price can give us more insight on the company’s strength on returning the money to shareholders (either through dividends or buybacks), paying down debt etc.

It is important to note that looking at solely cash per share of a company could lead to misleading conclusions if we did not also take into consideration the company’s indebtedness. To see the H1 indebtedness of Croatian companies click here.

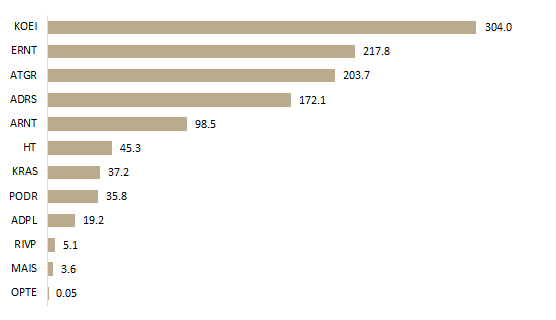

Cash per Share of Croatian Blue Chips (HRK)

A high level of cash per share indicates a solid performance of the company, reinsuring the shareholders that the company is operating with “enough room” to cover for any potential difficulties and that the company has adequate capital.

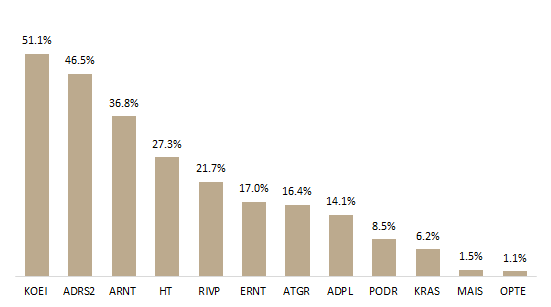

Cash per Share as a Percentage of the Current Share Price

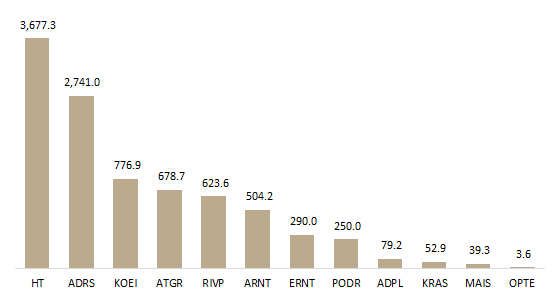

As visible in the graph, of the selected companies, Končar operates with the highest cash per share as a percentage of their current share price of 51.1%, while their cash per share amounts to HRK 304. Adris pref. comes next with 46.5%. Note that the company has a very solid cash position of 2.74bn.

On the flip side, Optima Telekom has the lowest cash per share of HRK 0.05, which translates into 1.1% of its current share price. As a reminder, the company’s cash position has significantly decreased to HRK 3.6m as it has been operating with losses in the recent years. Optima’s share price has also been hit the most of the observed companies this year (-39.8%).

Cash Position of Croatian Blue Chips (HRK m)*

*Cash and short term financial assets (from H1 2020 reports)

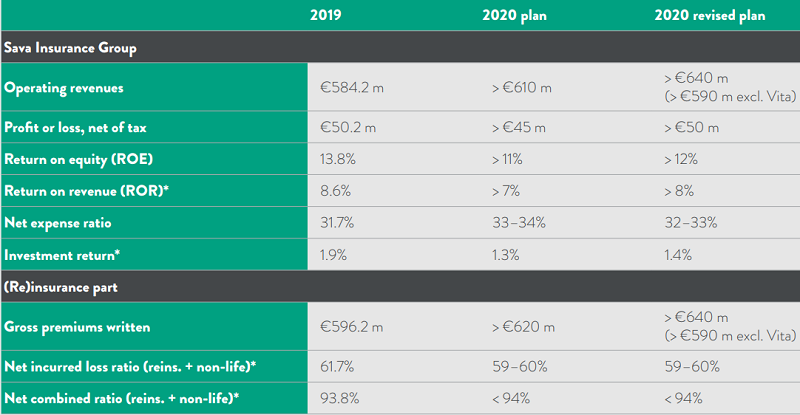

Despite the negative impacts of Covid-19, Sava Re expects to see higher revenues and higher net profit than originally planned, because of the acquisition of Vita.

Sava Insurance Group has published a revised 2020 plan for two reasons: the acquisition of the life insurance company NLB Vita, which was integrated into the Group on 31 May 2020, and Covid-19 and the related impacts on Group companies’ operations.

Sava Insurance Group Revised 2020 Plan

Source: Sava Insurance Group

*Excluded effect of exchange differences for 2019. The rate of return on investment does not include subordinated debt expenses. The net expense ratio of the Group for 2019 and 2020 does not include the positive difference between fair value of net assets acquired and purchase value of the investment (2019: ERGO, 2020: Vita).

Compared to the previous year, the Group expects GWPs on the non-life segment in Slovenia to decline by 2%, reflecting the decline in new car sales aggravated by Covid-19 (original plan: 3% growth). Regarding Life GWPs in Slovenia, the Group expects an increase of 43%, which can be attributed solely to Vita’s integration into the Group starting with June 2020, whereas the volume of life business of Zavarovalnica Sava has been shrinking due to the large number of policies maturing (original plan: 9% decline in gross premiums). Covid-19 has also made underwriting of these policies difficult due to required social distancing and movement restrictions.

Also as regards insurance business outside Slovenia, the Group expects a decline in gross premiums in 2020 due to the impacts of Covid-19. Non-life insurers outside Slovenia expect premiums to decline by 5% (original plan: 6% growth), whereas life insurers still expect premiums to grow at 9%, which is more modest than originally planned (original plan: 15%).

In 2020, the Group’s non-life insurers will focus in particular on the development and expansion of the existing sales network, the diversification of their portfolios by means of new products, and the strengthening of bancassurance as a sales channel. In their development of insurance products and services, the Group’s life insurers will focus in particular on reducing or discontinuing guaranteed rates in 2020 in view of the low interest rates prevailing in the financial markets.

As regards reinsurance business, the Group expects gross premiums to grow by 6% (original plan: 8%), reflecting increased business volume in new markets, and it will seek to diversify the portfolio by both region and partner. The downward revision of planned growth is explained with the expected cooling of the majority of economies abroad where the reinsurer operates.

As regards its investment policy, the Group will try to maintain high security and low price volatility of assets covering liabilities under insurance contracts, high liquidity and risk diversification. Investment management in 2020 will be affected by the continued low interest rates. The investment return is planned at 1.4%, which is 0.1 p.p. higher than originally planned, reflecting the slightly longer duration of Vita’s portfolio. The investment portfolio structure will also remain relatively conservative in 2020, featuring a high share of bonds and other fixed-income investments and a high credit rating profile, with the share of equity securities and infrastructure projects increasing slightly. Vita excluded, the revised plan provides for a lower investment portfolio value, reflecting the financial markets decline in 2020.

The Group intends to increase its cost-effectiveness in 2020. Compared to the original plan, the net expense ratio will improve by 1 p.p., mainly due to the following: the expected decline in the ratio in the reinsurance segment, Vita’s integration into the Group, as the company has a net expense ratio that is below the Group’s average, and certain cost optimisation measures adopted to mitigate the negative impacts of Covid-19 on the Group’s operations.

The Group expects its net profit to exceed EUR 50m (original plan: > EUR 45m) and operating revenues to exceed EUR 640m (original plan: EUR 610m). Excluding the impact of Vita’s acquisition, the net profit of the Group is planned at the level of EUR 41m (down 9% compared to the original plan), and its operating revenues at EUR 590m (down 3% compared to the original plan).

If any of the supervised entities fails to comply with this recommendation, it is required to notify the Agency at least one month before the intended payment of dividend and it must justify its decision and reasons for it.

Slovenian insurers received yesterday a leter from the Slovenian Insurance Supervision Agency recommending them to suspend the payment of dividends even after 1 October 2020, with the aim of ensuring financial stability during the COVID-19 epidemic. As a reminder, earlier this year the supervisor reccomended suspension of dividends until 1 October 2020.

The Supervision Agency recommends that the management boards of supervised entities propose to their supervisory boards and general meetings of shareholders to extend the moratorium on dividend payments at least until the moment of issuing the auditors’ opinions on the 2020 annual reports.

However, the Agency states that they are aware that the operations of supervised entities are impacted differently due to their different business models. If any of the supervised entities fails to comply with this recommendation, it is required to notify the Agency at least one month before the intended payment of dividends. In the notification, the supervised entity must justify its decision and reasons for it, both qualitatively and quantitatively, on previously performed reliable stress test results with precise stress test assumptions and calculations of impacts on assets, liabilities, available capital and capital adequacy of the supervised entity for at least until the end of 2024. The Agency expects that, even in the case of paying out dividends, the supervised entity will ensure the target capital adequacy during that period.