Yesterday, the price on the futures contract for West Texas crude, that is due to expire Tuesday (today), went into negative territory of USD – 37.63 a barrel.

Yesterday, the oil market witnessed a never before seen event in its entire history, which is the price on the futures contract for West Texas crude, that is due to expire Tuesday (today), went into negative territory of USD – 37.63 a barrel. Such a movement could be attributed to the ongoing Covid-19 situation. To be specific, since the pandemic led to a global economic halt, there is already much unused oil stored that American energy companies have run out of space to store it. It is important to note that the settlement of the futures contract, which expires today, would involve a physical delivery of the oil, which comes with a burden of high carrying costs and the current low demand and almost no place of storing it. Such situation led to a selloff, which resulted in the WTI futures contract ending up in negative territory. Note that the futures contract due a month later settled at USD 20.43 per barrel, which is by far the largest spread the two contracts in history.

Since the start of the year, oil prices have plummeted on the back of the of the outbreak of Covid-19 and a breakdown in the original OPEC+ agreement. To put things into a perspective, Brent Crude recorded a 59.5% YTD decrease. According to the agreement, both OPEC producers and its competitors like the U.S., Mexico and Canada came together and agreed to a 9.7 million barrels per day production cut. From 9.7 million bpd in May to June, the cuts will decline to 7.7 million bpd for the period July to December 2020, and then further to 5.8 million bpd until the end of April 2022. Note that the original agreement would have seen a cut of 10 million bpd for an initial two-month period, however Mexico insisted on reducing their output by 100,000 bpd instead of the requested 400,000 bpd.

For today, we decided to present you with an update asset structure analysis of Croatian UCITS funds.

The Croatian Financial Supervisory Agency (HANFA) published their monthly update on the NAV of all Croatian UCTIS funds. Since the asset managers play a very significant role in the Croatian capital market, it is particularly interesting to see how they have been affected during the ongoing Covid-19 situation. According to the report, NAV of all funds in March 2020 decreased by 32.2% MoM (or HRK 7.42bn), amounting to HRK 15.65bn. This also represents a decrease of 18.9% YoY.

NAV of Croatian UCITS funds (HRK 000)

As a reminder, HANFA noted earlier this month that since 21 February (until 24 March) 86.1% of the decrease could be attributed to withdrawals from the funds, while the rest 13.9% can be attributed to a change in value of assets in which the funds invest.

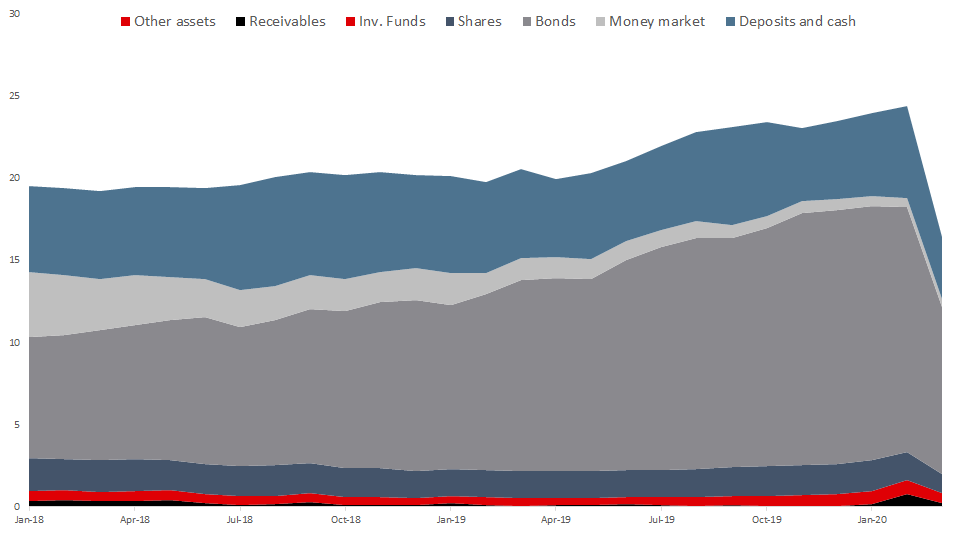

Asset Structure of UCITS funds (March 2020)

Looking at the asset composition of Croatian UCITS funds, it seems that asset managers have not changed significantly their composition, which can be seen in the graph above. Since the beginning of 2017, we witnessed a high increase of bonds in the assets structure which went from 31% in 2017 to 62% in the March of 2020. In the same period, we observed a sharp decrease of money market funds which decreased by 22 p.p. to 3% of the total composition.

Shares which currently account for 7.2% of the total asset structure of UCITS funds, remained relatively flat MoM.

Total Assets of All Croatian UCITS Funds (2018 – March 2020) (HRK bn)

Source: Croatian Financial Supervisory Agency, InterCapital Research

In Q1 of 2020, GWPs in Slovenia increased by 6.5% YoY. Of that, non-life segment increased by 6.5%, while life increased by 6.55%.

Q1 2020

The Slovenian Insurance Association published their monthly update on the GWP development in Slovenia. In the Q1 of 2020, The Slovenian insurance market observed a solid increase in both life and non-life segment, leading to a total GWP growth of 6.5% YoY, amounting to EUR 716.38m.

Non-life segment, which accounts for 72.2% of the total GWPs, recorded also an increase of 6.5%. Such an increase came on the back of a very strong health insurance performance, which recorded an increase of 13.4% YoY and is the largest non-life item in Slovenia (22.34% of total GWPs). It is noteworthy that land motor vehicles insurance remained relatively flat, amounting to EUR 89.08m, while motor vehicle liability insurance witnessed a slight decrease of 0.8%, amounting to EUR 75.8m.

Turning our attention to the life segment, it also recorded a 6.55% YoY increase, amounting to EUR 199.34m.

GWP Development (Q1 2019 vs Q1 2020) (EUR m)

Solely March 2020

When observing solely March, GWPs recorded a 1.8% increase YoY, which was geared by a strong performance of the life segment (+12.5%). Such a solid life performance was to some extent offset by a decrease in non-life segment by 2.3% YoY. The decrease in non-life could be attributed to the lower motor vehicle liability insurance (-18.7% or EUR 5.2m) and land motor vehicles insurance (-11.7% or EUR 3.6m). Note that this decrease was partially offset by a strong increase in health insurance, which recorded a 10.2% YoY increase (or EUR 5m)