For today, we decided to present you with an updated asset structure analysis of Croatian Mandatory Pension funds.

Pension funds could be seen as the key player on the Croatian capital market, as their current domestic equity holdings account for more than 40% of the free float market cap of ZSE. Therefore, it is particularly interesting to see how they have been affected by the ongoing Covid-19 situation. As the global financial markets, as well as the Croatian capital market, observed a partial rebound in April and the following months, it is worth seeing how Croatian mandatory pension funds performed during that period.

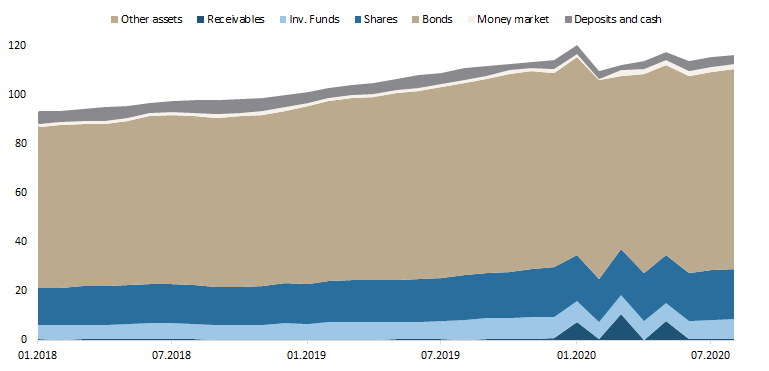

NAV of pension funds has witnessed a steady increase for each consecutive month since April, and as of end September stood at HRK 115.76bn (+0.8% MoM or HRK 925.3m). This also represents an increase of 2.8% YTD. As a reminder, in March (the worst performing month for almost all asset classes) the pension funds recorded a decrease of 3.3% MoM or HRK 3.76bn.

It is also worth adding that in September net contribution payments amounted to HRK 641.54m, which is by HRK 32.24m higher compared to the previous month.

Asset Structure of Croatian Mandatory Pension Funds (September 2020)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research

Looking at the asset composition of pension funds, it seems that asset managers have not changed significantly their composition, which can be seen in the graph above. Bonds account for the vast majority of total assets (70.1%) which as of September amounted to HRK 81.545bn (increase of HRK 693m MoM or 0.9%). Shares come next, with 17.2% or HRK 20.06bn. Unlike Croatian UCITS funds whose majority of equity holdings are foreign, mandatory pension funds have 58% (or HRK 11.70bn) of their equity holdings allocated in domestic shares. Note that since the beginning of the pandemic, August represents the first-time that the shares are up on a YTD basis (+1%). Meanwhile, domestic equity holdings are still down by -5.3%.

Total Assets of Croatian Mandatory Pension Funds (2018 – September 2020) (HRK bn)

Aleš Šabeder, the President of the Management Board noted that in order to avoid any damage to the company and consequently liability for damages of Supervisory Board members, he expects the rest of the Supervisory Board to follow his suit.

Yesterday, Telekom Slovenije announced that the President of the Supervisory Board of Telekom Slovenije, Aleš Šabeder, and two Members of the Supervisory Board, Barbara Cerovšek Zupančič and Bernarda Babič, submitted their resignations from their positions. All resignations come into effect as of the date the new Supervisory Board President or Member is appointed.

The President of the Supervisory Board wrote in his resignation that “because of the current situation, disagreements and different perspectives on the role of the Supervisory Board I can no longer perform my duties with sufficient measure of due diligence befitting a supervisor, and therefore my continued function as a Supervisory Board President and Member is no longer possible. Consequently, I submit my unequivocal resignation. In order to avoid any damage to the company and consequently liability for damages of Supervisory Board members, I expect the rest of the Supervisory Board to follow my suit.”

Member of the Supervisory Board, Barbara Cerovšek Zupančič wrote in her resignation that “because of the current situation in the Supervisory Board, I can no longer perform my duties with sufficient due diligence befitting a supervisor of the company”.

Bernarda Babič is resigning from her position of Member of Supervisory Board of Telekom Slovenije, as of 19 January 2021 (i.e. within three months of signing her resignation) or on the date a replacement or a new member is appointed by the General Meeting, should it be held before this date.