We anticipated 6 interest rate cuts (142 basis points) by the end of 2024. However, based on the current data, we now expect only 2 cuts (48 basis points) by the end of the year.

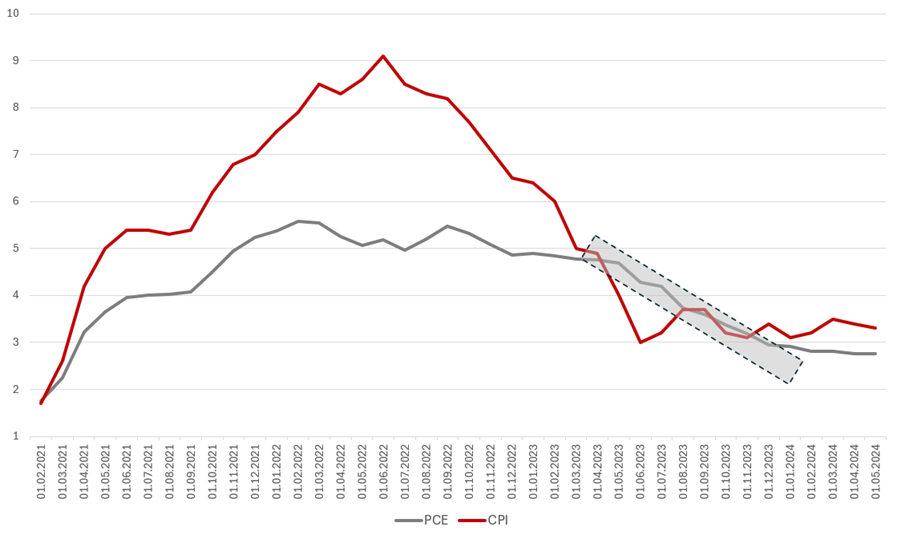

Observing the PCE and CPI, as shown in the graph, it’s evident that both measures have shifted from a clear downward trend to a more sideways movement.

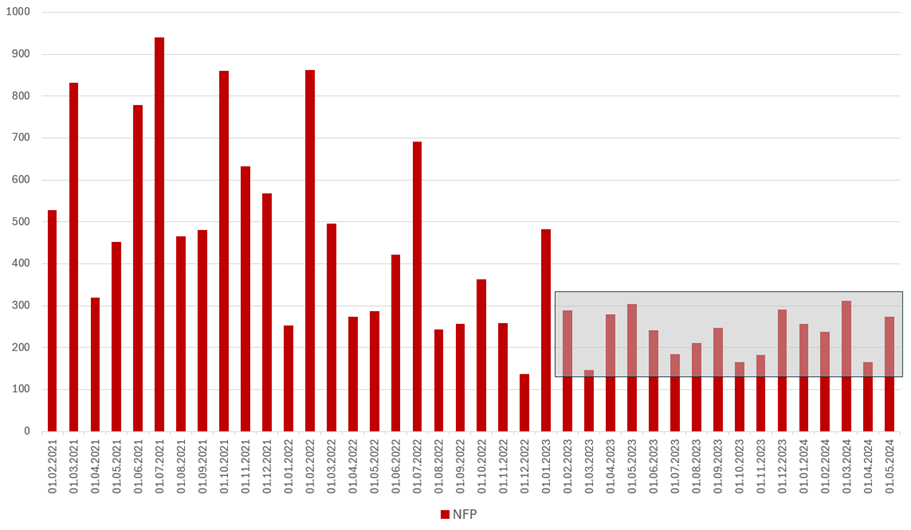

The next important data is NFP which shows newly added jobs (except jobs in farming, private households, and non-profits).

The non-farm payroll (NFP) has shown resilience over the past year and a half, maintaining levels similar to those seen before the pandemic. If NFP readings were to decrease, it would indicate weakness in the labor market, potentially increasing pressure on the Fed to cut interest rates.

At this moment, it is pertinent to discuss US migration policies. It is widely accepted that 1 in 6 workers in the US are immigrants and that immigrants are responsible for creating about 1 in 4 new businesses.

In recent years, the United States has experienced an increase in immigration from the south. In 2023, 3.2 million immigrants were either arrested or denied entry at US borders due to illegal entry, marking the highest number since at least 1985. Net immigration in the US in 2023 was around 3.5 million, which is approximately 2 million higher than previous projections by the Congressional Budget Office.

Immigrants alleviate labor market pressure and suppress wage growth. Some projections suggest immigrants contributed approximately 100k to monthly NFP change over the last 18 months, lowering core PCE inflation by 25-50 bps.

In the latest report, there were concerning developments in the labor market. The unemployment rate increased to 4.0%, up from 3.9% and 3.8% in previous readings, while the nonfarm payrolls (NFP) grew to 272k from 165k the month before. On June 12th, Powell mentioned that unexpected weakness in the labor market might require a response. He also emphasized that although unemployment is still low, it has softened a bit, which is an important statistic.

On June 5th, President Biden signed a law that allows officials to quickly and legally remove all immigrants entering the country illegally without processing their asylum requests during periods of high illegal entry. Additionally, approximately three-fourths of undocumented immigrants are classified as essential workers in the labor force.

It’s important to note that the US elections will take place this autumn, featuring a rematch between Trump and Biden. The US appears to be moving towards stricter migrant policies, so it will be interesting to see how this will impact US economic data.

At the share price before the announcement, this would imply a DY of 1.3%. The ex-date is set for 24 June 2024, while the payment date is set for 24 July 2024.

Yesterday, Kraš held its GSM, after which the resolutions were published. According to the resolutions, Kraš approved EUR 1.5 per share to be paid out in the form of dividends. At the share price before the announcement, this would imply a DY of 1.3%.

The ex-date is set for 24 June 2024, while the payment date is set for 24 July 2024. Below we provide you with the historical overview of the Company’s dividend per share and dividend yield.

Kraš dividend per share (EUR) and dividend yield (%) (2015 – 2024)

Source: Kraš, InterCapital Research

Cinkarna Celje held the GSM yesterday in which the shareholders approved a dividend payment of EUR 0.9 per share, implying a DY of 4.2%. The ex-date is set for 26 June 2024, while the payment date is set for 28 June 2024.

Cinkarna Celje held the GSM yesterday in which the shareholders approved a dividend payment of EUR 0.9 per share and implies the dividend yield is 4.2%. The ex-date is 26 June 2024. The payment date is set for 28 June 2024.

Due to the restrictions on dividend payments related to government subsidies received in 2023 (more on which you can read here), the distribution will be made as follows: EUR 6.3m of 2023 net profit will be allocated to other profit reserves, representing a special account within profit reserves that cannot be paid out to shareholders. EUR 7m of the balance sheet profit, (from retained earnings before 2023), will be paid out in the form of dividends. This represents a payout ratio of 18% and excl. the 2023 net profit, a payout ratio of 22%.

As a reminder, due to the restrictions on the payment of dividends to shareholders from the 2022 net profit, the same restrictions related to government subsidy received in that year, Cinkarna Celje also paid out the dividend from that year’s profit this year, in the amount of EUR 3.2 DPS. Before the announcement, the DY of this payment amounted to 15.3%. In other words, this proposal represents the 2nd, additional, dividend payment during this year s a result of aforementioned developments. As such, if the GSM approves this dividend, the total amount to be paid to shareholders in 2024 would amount to EUR 4.1 per share, implying an overall dividend yield of 19.4%.

In the graph below, we are bringing you a historical overview of the company’s dividend per share and dividend yield.

Dividend per Share (EUR) and Dividend Yield (%) (2012 – 2024*)

Source: LJSE, InterCapital Research

*2024 includes both the approved dividend and the newly proposed dividend

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 13 | 27.6.2024 | ATGR | Atlantic Grupa General Assembly Meeting | Croatia |

| 14 | 27.6.2024 | ATPL | Atlantska Plovidba Board of Directors Meeting | Croatia |

| 15 | 27.6.2024 | CICG | Cinkarna Celje dividend cut-off date | Slovenia |

| 16 | 28.6.2024 | ATPL | Atlantska Plovidba General Assembly Meeting | Croatia |

| 17 | 28.6.2024 | CICG | Cinkarna Celje dividend payment date | Slovenia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).