As we brought the year 2019 to an end, we now turn back to look at how the global M&A market performed and what were the trends witnessed.

M&A activity in 2019 witnessed a downturn of 6.9% when compared to 2018. However, when compared looking at the observed period one can notice that both 2018 and 2015 look like outliers. Meanwhile other years are in line with results achieved in 2019. While this is above 2016 and 2017 levels, dealmaking slowed down significantly in the latter part of the year, with the second part of 2019 recording a 24.2% fall in value versus the first half.

When looking at the regional breakdown the US took the lion’s share. Despite a dip in activity which occurred in the second half of the year, the US was home to 47.2% of global M&A activity in 2019, the highest share since 2001. At the same time European activity fell 21.9% YoY in value, while APAC was down 22.5%, the US market, showed resistance and grew by 1.5% on 2018, supported by a relatively strong economy and a number of large domestic deals.

Global M&A Quarterly Breakdown Trend (USD bn)

According to Mergermarket, 15 of the top 20 deals of 2019 in value were the result of domestic consolidation among US-based corporations. As a result, the largest deal of the year also occurred in the US when United Technologies’ merged with Raytheon in a deal worth USD 88.9bn. Note that this was also the ninth largest deal on Mergermarket record.

Another important trend is that deals are getting larger. On the back of the longest equity bull market in history, and amid persistently low interest rates, corporates and private equity firms alike have ample cash reserves and appealing debt financing options at their disposal. The feeling that these conditions may not last and the desire to secure future growth are pushing valuations up. At USD 389m, the average size of deals with a disclosed value is up from USD 353m in 2018. The past year also recorded 38 megadeals (>USD 10bn), also the highest number of such deals since 2015. Finally, at 11.6x EV/EBITDA, the global median PE multiple across sectors, is also near the highs of 2017 (11.7x).

Turing our attention to the sector breakdown, Industrials and chemicals recorded the highest deal value in 2019 with a total value of EUR 523.8m.

Global Sector Breakdown Trend (USD bn)

Private Equity Plays Important Role Again

The proportion of deals with a private equity firm on either side of the negotiation table has reached 27.5% of all global M&A transactions in 2019, the third successive year above 25%. With a disclosed USD 556.4bn spent by private equity firms in 2019, buyout activity is not too far from the high levels of 2018 (USD 571bn). Sponsors continue to look for ways to deploy record amounts of dry powder, but after years of sustained buyout activity globally, the scarcity of quality family-owned assets has triggered a boom in take-private deals to USD 158.3bn in 2019, the highest value since 2007.

Buyouts – Quarterly Breakdown (2015-2019) USD bn

Exits – Quarterly Breakdown (2015-2019) USD bn

Krka stated that they consider all allegations on potential non-compliance comprehensively and in accordance with the rules on prevention, detection, and investigation of non-compliance and investigates the circumstances of such instances.

On Friday, Krka issued an official statement regarding the alleged irregularities in Romania.

As a reminder, the Romanian media reported last week that Krka is under investigation by the Romanian health ministry after confidential documents detailing controversial payments to doctors were leaked to the local media. Romanian media released certain documents and testimonials from employees claiming that Krka also bribed doctors for prescribing Biobil.

To this alleged irregularities Krka stated that they consider all allegations on potential non-compliance comprehensively and in accordance with the rules on prevention, detection, and investigation of non-compliance and investigates the circumstances of such instances.

A special team has been formed to investigate in detail the activities of Krka’s subsidiary in Romania. After concluding its assigned internal investigation, presumably by the end of January 2020, the team will report its findings to Krka’s Management Board, and the Management Board will then report to Krka’s Supervisory Board. Should the investigation identify irregularities that could have a material impact on Krka’s business performance, Krka will publicly report on these irregularities.

Krka adds that all of their activities in markets where thier pharmaceutical products are available are carried out in accordance with the applicable legislation, international standards pertaining to the pharmaceutical industry, and the adopted internal rules prescribed in the Code of Conduct, Code of Promotion, and the Rules on Fraud Prevention, Detection and Investigation.

Krka subsidiaries and representative offices must ensure that the activities carried out in countries where Krka is present are performed in line with these principles; any and all fraudulent and corrupt acts are strictly prohibited. Consequently, Krka subsidiaries and representative offices in countries where Krka is present are responsible for ensuring that their respective activities are carried out in compliance with the applicable national legislation and in line with Krka’s rules and policies. If any non-compliances are established in relation to the activities of Krka Romania employees, Krka will act resolutely and use all legal means at its disposal to sanction any potential perpetrators.

For 2020, Energoprojekt expects to record consolidated sales both in foreign and domestic market of EUR 273.9m.

Energoprojekt published an announcement on the Belgrade Stock Exchange stating that they have adopted the business plan for the period 2020-20204.

For 2020, the Group expects to record consolidated sales both in foreign and domestic market of EUR 273.9m. Also, they expect conclusion of new deals worth EUR 242.7m, while gross profit is expected to amount to EUR 18m. Meanwhile, Energoprojekt Holding in 2020 plans revenues of EUR 6.3m and a gross profit of EUR 2.4m.

According to the mid-term plan for 2020-2024, Energoprojekt forecasts the consolidated revenues of over EUR 300m by the end of the mid-term period. Besides that, the profit margin during the mentioned period is expected to be around 3% to 4%.

The change in the electricity transmission tariff was determined by a reduced monetary contribution owed by Transelectrica to the 2020 ANRE budget from 2.0% to 0.2% of the Company’s turnover.

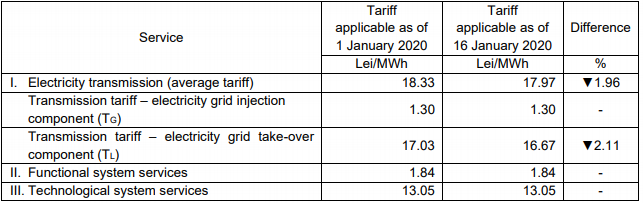

Transelectrica published a document on the Bucharest Stock Exchange regarding the publication of ANRE Order 10/2020 amending ANRE Order 218/2019 on the approval of average tariffs for transmission services, the tariff components for electricity grid injection (TG) and electricity grid take-over (TL), the system service tariffs and the regulated price of reactive electricity charged by the Company. Consequently, the regulated tariffs for the electricity transmission services and system services applicable beginning with 16 January 2020 are the following:

Source: Transelectrica,Bucharest Stock Exchange

Transelectrica adds that such change in the electricity transmission tariff was determined by a reduced monetary contribution owed by Transelectrica to the 2020 ANRE budget from 2.0% to 0.2% of the Company’s turnover