Several weeks have passed since the banking crisis spurred volatility and uncertainty in the markets. Silicon Valley Bank went bankrupt, Credit Suisse has been taken over by UBS and the rollover to the other banks seems to be contained at least for now. In the aftermath of the crisis, bond yields both in the US and Eurozone plunged by more than 100 bps. Nowadays, they have given back about half of the drop as the economy is still not losing steam as expected.

Following the crisis, central banks’ rhetoric is more data-dependent and careful similar to the start of the tightening cycle. Both the Federal Reserve and ECB insisted on the separation of instruments that ensure the stability of the financial system and short-term interest rates that are used to curb inflation. As time passed, the market began to believe in the mentioned separation. As both central banks stated, further rate hikes are still possible as the backstop for financial institutions guarantees the security of the financial system.

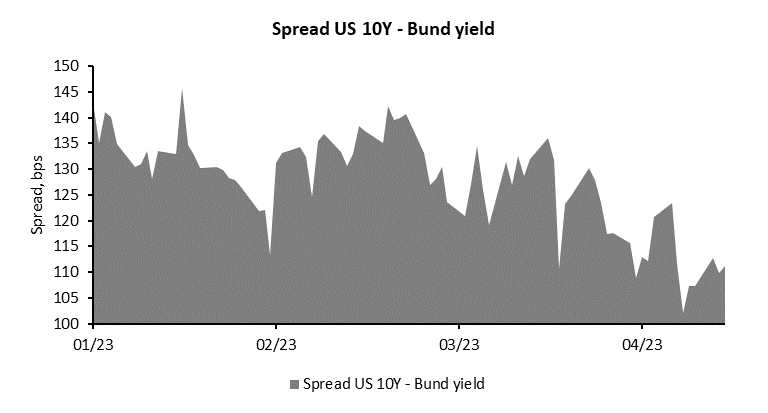

Since the peak of uncertainty on the markets when bond yields bottomed both in the US (US 10-year Treasury at 3.25%, US 2-year Treasury at 3.55%) and Europe (Bund at 1.92%, Schatz at 2.10%), markets have sold bonds as the core inflation still runs higher than expected. Since then, the US 10-year Treasury rose to 3.61% and the US 2-year Treasury rose to 4.26%. Furthermore, in Europe Bund rose to 2.51% and Schatz to 2.97%. Simply calculating the difference they managed to return, implies that Bund and Schatz rose more in yield than their US bond equal-duration counterparts. Before SVB collapsed, the Bund yield reached a high of 2.77% and Schatz at 3.38%. Currently the former is just 26 bps off its highs and the latter 41 bps. Across the Atlantic, the 10-year Treasury is at 47 bps and the 2-year Treasury currently stands at 82bps off the highs. Taking into account all of the above, the spread between US 10Y and Bund yield narrowed by 30 bps since the start of the year. The explanation for that lies in the hawkishness of the European Central Bank as no major risks emerged in the Eurozone.

To conclude, over the past month, both 2-year and 10-year bonds erased part of the gains on both sides of the Atlantic. As described, US bonds outperform their European counterparts as the hawkishness of the European Central Bank is still ongoing. European Central Bank for now seems to have no imminent crises and further hikes are still on the table. To be exact, according to OIS, three more rate hikes are priced for the European Central Bank and just one more for the Fed this year. In my opinion, yields can hardly go much higher as inflation is falling in both the US and Eurozone. Also, in case of more hikes, yields might not stem higher as the market anticipates more rate cutting amid a higher risk of financial instability.

Source: Bloomberg, InterCapital

At the share price before the announcement, this would amount to a DY of 2.5%. The ex-date is set for 25 April 2023.

Salus published a resolution from its GSM that was held on 14 April in which shareholders approved the proposed amount of dividend of EUR 70 (this includes interim dividend of EUR 35 paid in January 2023). The approved EUR 35 DPS represents the 2nd dividend payment in 2023, which at the share price before the announcement would amount to 2.5%.

As a reminder, Salus already paid out a dividend of EUR 35 back in January 2023, with a similar dividend yield. This would mean that in total, Salus paid out EUR 70 DPS, which at the share price before the announcement of proposal, would amount to a dividend yield of 5%.

The ex-date for the 2nd dividend payment is set for 25 April 2023, while the payment date is set for 28 April 2023.

Below, we provide you with a historical overview of Salus’s dividend payments and dividend yields.

Salus dividend per share (EUR) and dividend yield (%) (2014-2023)

Source: Salus, InterCapital Research

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 49 | 28.4.2023 | TTS | Transport Trade Services General Assembly Meeting | Romania |

| 50 | 28.4.2023 | TTS | Transport Trade Services 2022 Annual Report | Romania |

| 51 | 28.4.2023 | EL | Electrica 2022 Annual Report | Romania |

| 52 | 28.4.2023 | M | MedLife 2022 Annual Report | Romania |

| 53 | 28.4.2023 | TEL | Transelectrica 2022 Annual Report | Romania |

| 54 | 28.4.2023 | AQ | Aquila 2022 Annual Report | Romania |

| 55 | 28.4.2023 | AQ | Aquila General Assembly Meeting | Romania |

| 56 | 28.4.2023 | WINE | Purcari 2022 Annual Report | Romania |

| 57 | 28.4.2023 | TRP | Teraplast General Assembly Meeting | Romania |

| 58 | 28.4.2023 | TRP | Teraplast 2022 Annual Report | Romania |

| 59 | 28.4.2023 | SNP | OMV Petrom Q1 2023 Results, Conference Call | Romania |

| 60 | 28.4.2023 | COTE | Conpet 2022 Annual Report | Romania |

| 61 | 28.4.2023 | RIVP | Valamar Riviera Q1 2023 Results | Croatia |

| 62 | 28.4.2023 | PODR | Podravka Q1 2023 Results | Croatia |

| 63 | 28.4.2023 | HT | Hrvatski Telekom Q1 2023 results, Conference Call for analysts and investors | Croatia |

| 64 | 28.4.2023 | ATPL | Atlantska Plovidba Audited 2022 Annual Report, Q1 2023 Results | Croatia |

| 65 | 28.4.2023 | TLSG | Telekom Slovenije 2022 Annual Report | Slovenia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).