The agreement is a part of the process of disinvestment of smaller and non-core operations in accordance with the corporate strategy of Atlantic Grupa.

Atlantic Grupa published an announcement stating that they have signed an agreement for the sale of the baby food brand Bebi with Nelt Grupa, a company with headquarters in Belgrade, Serbia. The sale was concluded for an undisclosed amount.

Selling the Bebi brand is a part of the process of disinvestment of smaller and non-core operations in accordance with the corporate strategy of Atlantic Grupa. The process began two and a half years ago with the company’s exit from the sports and functional food segments, and continued after the company sold its cosmetics and food supplements businesses as well as its segment of distribution of water in water dispenser bottles. At the same time, the company states that they are placing a strong focus on the key areas which are major generators of growth (food and drinks as well as pharmacy business) and the basis for future transformation. This process includes targeted internationalization of brands with international potential (Argeta, Donat Mg) as well as the development of distribution as an important catalyst for growth of business, and mergers and acquisitions.

It is important to add that the existing production site of the Bebi brand in Mirna, Slovenia, is not a part of the agreement. The factory and its employees in Mirna will remain within Atlantic Grupa. The Bebi range will still be produced in this factory during the disinvesting of the basic brand and the transition period, after which Atlantic Grupa will find an alternative range of products to engage its production capacities and employ its skilled workers.

Bebi’s wide portfolio of products for infants and children is placed primarily on the markets of Russia and other CIS countries. In 2019 it generated EUR 11m in sales revenue.

As of end July, total financial institution’s loans amounted to HRK 271.26bn, which represents a 7.5% increase YoY and a 0.4% decrease MoM.

Croatian National Bank (HNB) published their monthly statistical report on loans placement of other monetary financial institutions. According to the monthly statistical report as of end July, total financial institution’s loans amounted to HRK 271.26bn, which represents a 7.5% increase YoY and a 0.4% decrease MoM.

Its biggest categories household loans and corporate loans evidenced growth of 4.1% YoY and 4.9% YoY, respectively. Note that corporate loans have since April been observing a negative trend, recording MoM decreases. As of end July, corporate loans amount to HRK 85.57bn, representing a decrease of 0.83% MoM.

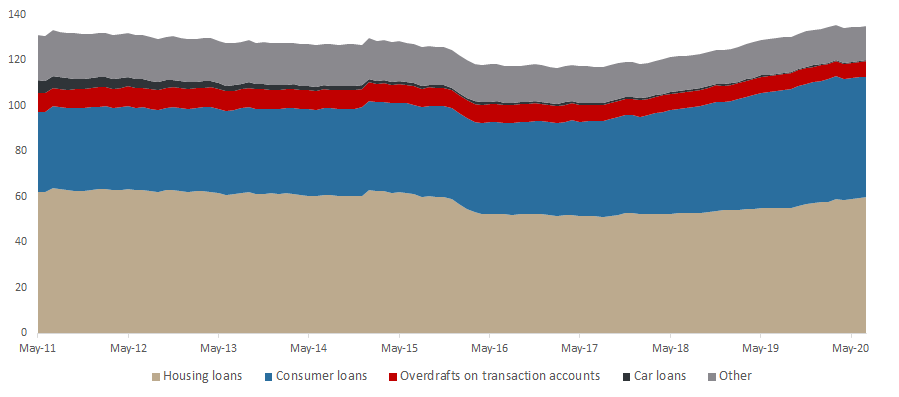

Total loans issued to households amounted to HRK 134.97bn, representing an increase of 4.1% YoY (or HRK 5.26bn). Such an increase was mainly driven by a rise in housing loans (+8.8% YoY or HRK 4.86bn) and consumer loans (+2.7% YoY or HRK 1.38bn). It is worth noting that these two items account for 83.5% of the total loans to households. The mentioned increase was partially offset by a decrease in almost all other loan segments. It is worth noting that car loans observed a sharp drop of 20.7% or HRK 120.6m. This does not come as a surprise, given the low car sale trend which has been observed throughout this year.

Loans to Households (Jan 2016 – July 2020) (HRK bn)

If we were to compare total loans issued to households since the beginning of the pandemic, one can notice a slight decrease of 0.3% or HRK 398m. Such a decrease mostly came on the back of a decrease in consumer loans of 2.2% or HRK 1.165bn, while being somewhat offset by an increase in housing loans by 1.7% or HRK 1bn. Meanwhile. the majority of other loan segments also recorded a decrease in the observed period. It is worth noting that we expect consumer loans to further decrease by the end of the year, given the shaken consumer confidence caused by the Covid-19 crisis. This has been a steady trend since the outbreak of the pandemic (when observing MoM development). On the flip side, housing loans continue recording MoM increases, with the exception of April (lockdown period), when housing loans observed a 0.6% decrease.

Structure of Loans to Households (July 2020)

Trading statistics for August 2020 show an average daily turnover of EUR 1.22m (+18% YoY). Meanwhile, SBI TOP ended the month with a 0.54% increase.

The Ljubljana Stock Exchange (LJSE) published their trading statistics for August 2020, showing a somewhat lower equity turnover compared to previous months of EUR 25.57m. This translates into an average daily turnover of EUR 1.22m (+18% YoY).

Of the total value traded in the period, Krka generated EUR 13.1m or 51%, followed by NLB with EUR 6m or 24%. Next come Petrol with EUR 2.58m or 10% and Triglav with EUR 1.2m or 5%. Sava Re follows with EUR 0.96m or 4%. These 5 shares generated 93.3% of the turnover recorded by the entire (equity) market.

When observing the total equity market capitalization, it observed a 1.7% MoM increase (or EUR 111.66m) as a result of the continuation of the positive sentiment and currently amounts to EUR 6.53bn.

In August, the Slovenian equity market continued to witness continuation of the positive sentiment as SBI TOP ended the month in green, increasing slightly by 0.54% (ending the month at 848.89 points). Note that SBI TOP is still down by 8.33% on a YTD basis, which is the lowest decrease compared to all other regional indices. Of the SBI TOP constituents, Sava Re observed the highest share price performance of +8.97%, which arguably came on the back of solid H1 results.

Share Price Performance of SBITOP Constituents (August 2020)