If you have no idea what the title of this article means, let’s take it step by step. In the first three months, PCE core came slightly above the consensus. Markets started believing the FED might ditch the “dovish bias” by reintroducing rate hikes. That didn’t happen yesterday. And it didn’t happen because there was no need for additional tightening since financial markets essentially delivered a par excellence rate hike beforehand. Bazinga!

FED’s rate setting committee reiterated the rapid drop in inflation throughout the past year, however, it acknowledged that “there has been a lack of progress toward the Committee’s 2 percent inflation objective” (this is hawkish). On the other hand, FOMC also stated that the risks of achieving its employment and inflation objectives have moved in a “better balance over the past year” and corroborated this notion with tapering quantitative tightening by reducing the monthly redemption cap on treasuries from 60bn USD to 25bn USD. Well, if this is not dovish, then we don’t know what is.

Markets were preparing/hedging for a hawkish tilt that could have come to a possible change in wording implying possible rate hikes to curb newly formed inflation tailwinds. Chairman Powell reiterated on the Q&A session that housing components of PCE are relatively lazy variables that need to catch up with flatlining rents; when this happens, PCE Core is going to get closer to the 2% target, setting the stage for cuts to take place (we do believe that when Powell talks about inflation, he’s actually referring to PCE Core, although during the Q&A session, he couldn’t remember the exact level of peak PCE Core).

In our modest opinion, the main “hike killer” came in the form of a question asked by WSJ’s Nick Timiraos, focusing on this year’s rise in US yields and whether this move represented a rate hike par excellence. Chairman Powell confirmed that markets tightened financial conditions before the FED needed to act and it’s possible that this question has in itself an answer to why FED managed to maintain the so-called “dovish bias”.

What Powell essentially said was: we don’t need to hike even if inflation pressures stay with us because the bond market did that job for us. Thanks guys! Oh, and OER is going down. Take my word for it.

If your capacity to memorize exceeds the one-sentence limit, let this be the second sentence to remember from today’s research piece: without rate hikes on the agenda, there are three main paths of development for FED fund target band – “hold off” on rate cuts where FED waits for more confirmatory hard data that the inflation is under control, gradual rate cuts if the inflation starts to ease all over again and swift rate cuts if the labor market resilience starts fading away.

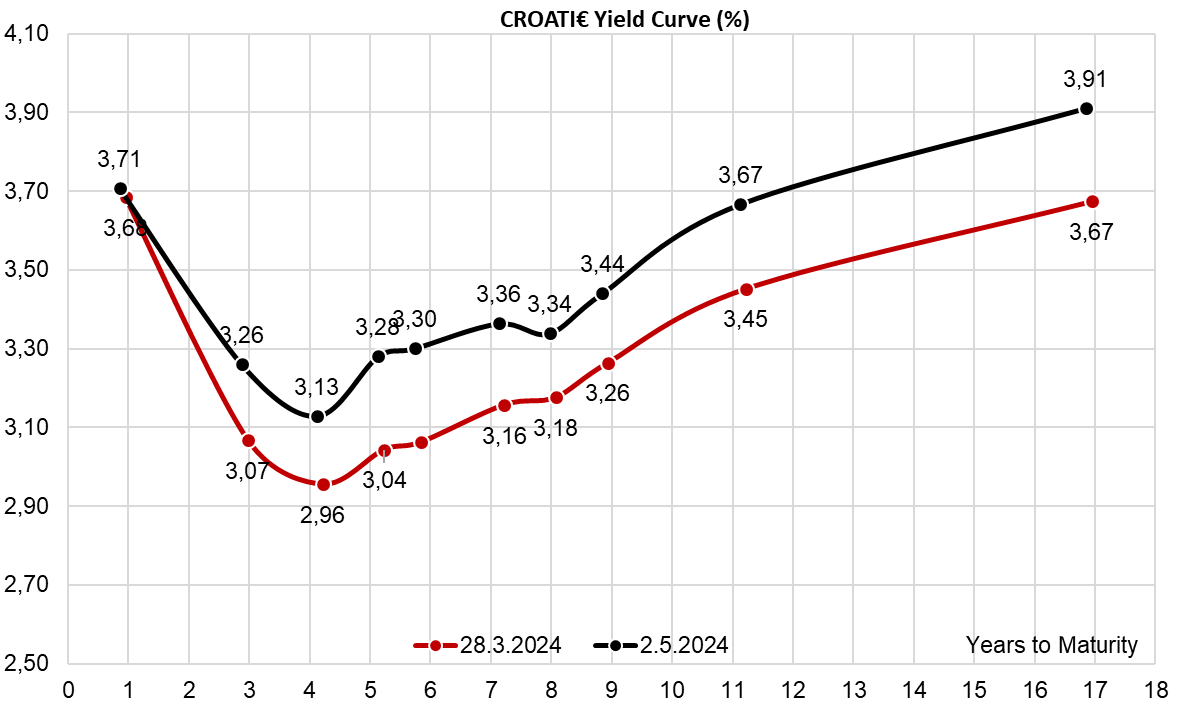

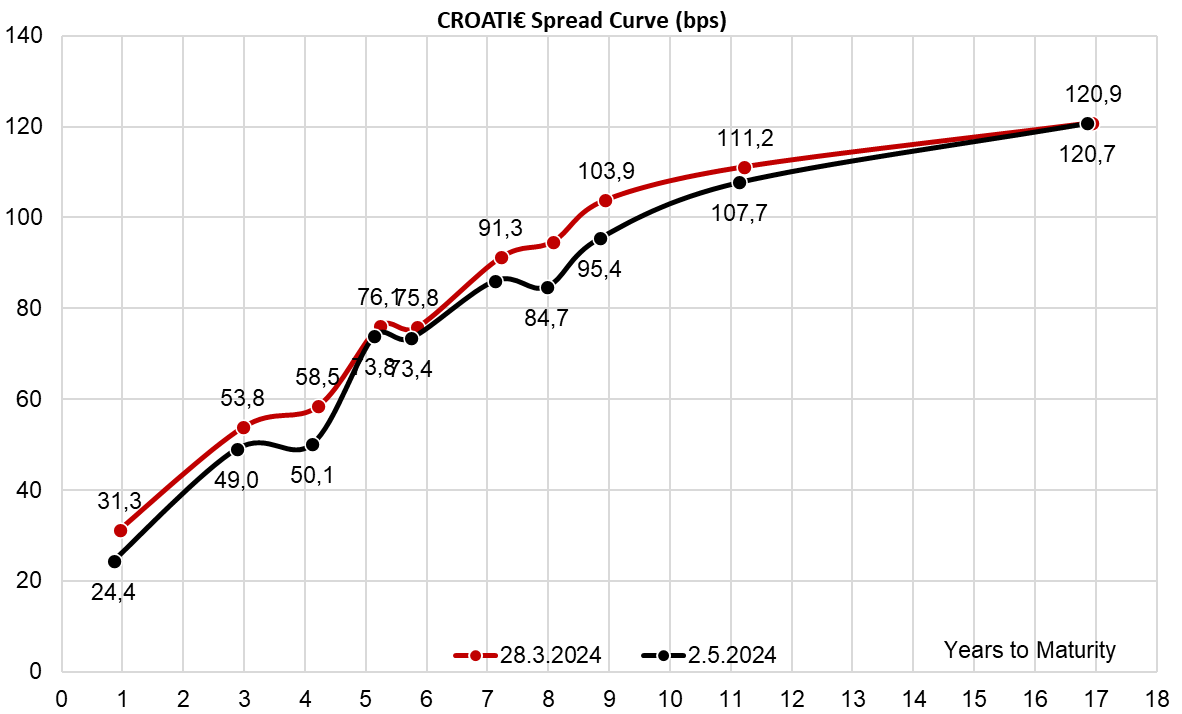

How are Croatian international bonds doing? The spreads to Germany seem to be contained and have managed to tighten significantly YTD, but there is the other side to this coin. Take a look at lo spread (10Y Italy – 10Y Germany, ref. 131.8bps) and notice that YTD it managed to contract by 36bps (from 168bps to 131.8bps). Can you remember how much the German 10Y yield went up YTD? Some 50bps, right? Well, there’s your tightening, most of it came from higher benchmark yields. Croatian bonds are in the same basket and it’s an open debate what’s going to happen when yields start dropping at some time this year. Are CEE bonds going to give back all of the spread tightening envisioned in the first half of the year?

At the share price before the announcement, this would imply a DY of 0.7%. The ex-date is set for 21 June 2024, while the payment date is set for 5 July 2024.

On Thursday, Span released its 2023 annual report, Q1 2024 results, and made the proposal for the distribution of profit from the year 2023 and from the retained earnings from previous years. According to the proposal, EUR 0.3 per share will be distributed in the form of dividends, which at the share price before the announcement would imply a DY of 0.7%.

The ex-date is set for 21 June 2024, while the payment date is set for 5 July 2024. Below we provide you with the historical dividend per share and dividend yield of the Company.

Span dividend per share (EUR) and dividend yield (%) (2022 – 2024)

Source: Span, InterCapital Research

At the share price before the announcement, this would imply a DY of 4.4%. the ex-date is set for 2 May 2024, while the payment date is set for 23 May 2024.

On Friday, Valamar Riviera’s Subsidiary Imperial Riviera held its General Meeting of Shareholders. After the meeting, the resolutions were published, and according to them, the distribution of profit in the form of dividends was approved. In total, EUR 10.5m will be paid out in the form of dividends from the retained earnings of the year 2023. On a per share basis, this would imply a dividend of EUR 4.63.

At the share price before the announcement, the dividend yield amounts to 4.4%. The ex-date is set for 2 May 2024, while the payment date is set for 23 May 2024. Below we provide you with the historical dividends per share and dividend yields of the Company.

Imperial Riviera dividend per share (EUR) and dividend yield (%) (2020 – 2024)

Source: Imperial Riviera, InterCapital Research