If you talked recently to an inter-dealer broker in London and asked him/her about the CROATI€ flow, you would probably receive an answer that it’s one sided, “buyers only“. What’s driving this buying spree and is it focused on Croatian international bonds only, or is it widely spread on other CEESEE countries? Find out in this brief research piece.

Last week Bloomberg reported that emerging market ETFs received inflows in the size of 1.74bn USD in the week ending May 27th, which marks the second consecutive week of EM inflows. Speaking about asset class breakdown, equity funds got some 1.13bn USD, while the remaining 602.1mm USD went into fixed income funds. It’s difficult to point out a single reason why EMs would look so attractive, but before we search for the underlying cause maybe it’s worth putting things in the context first and argue that EM ETFs have about 310bn USD AUM, meaning that 1.74bn USD comes just a hair’s breadth higher than half a percentage point. Country breakdown tells us that investors favoured China, so it’s possible that inflows were initiated on the prospects of ending Shanghai lockdown. We would like to point out that Beijing has just entered lockdown and it might take some time before China is back to business in full shape.

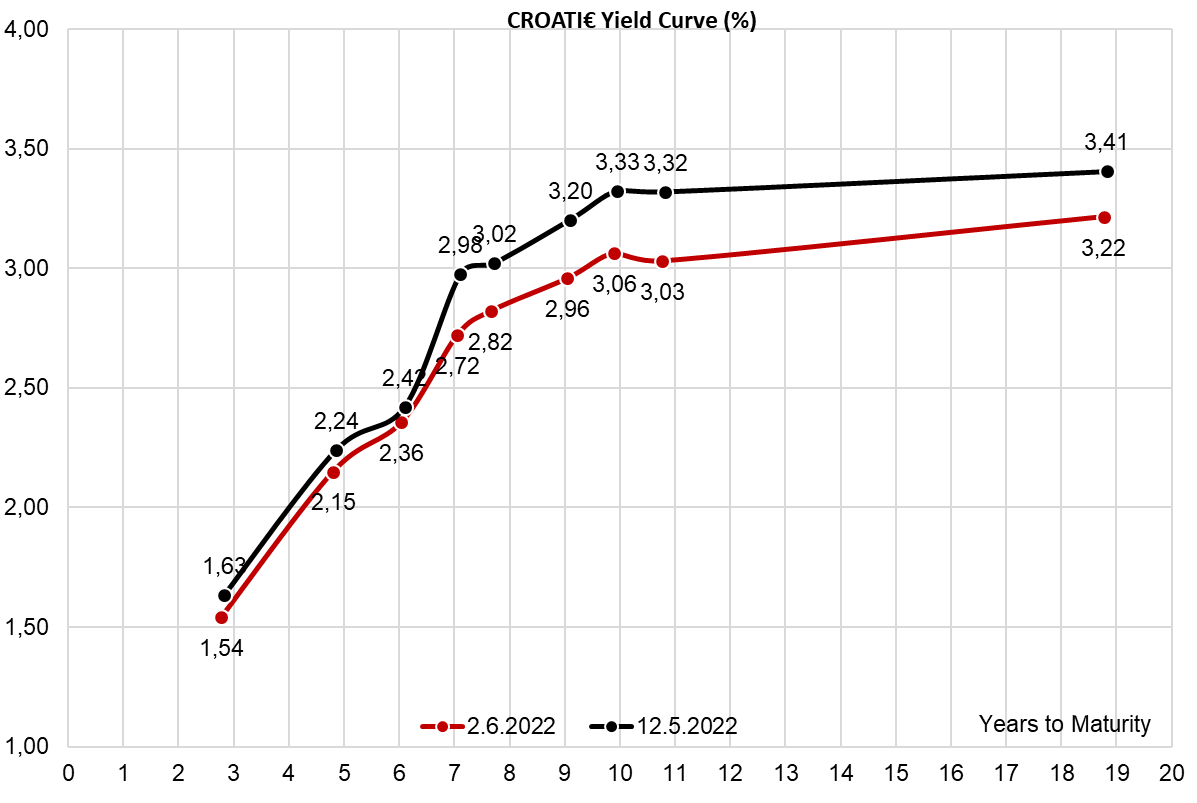

EM inflows have initiated a limited risk on, meaning that a lot of CEESEE bonds are now traded at significantly tighter spreads compared to mid-May. Take a look at CROATI€ yield curve and spread curve:

What we have seen essentially is a contraction of risk premia by at least 60bps on the long end, however, EM ETF inflows are not the only thing to blame here. It’s worth mentioning that CROATI 3.875 05/30/2022€ matured on Monday, meaning that 1.25bn EUR of proceeds was distributed to the holders. Our data suggests that at least 136mm EUR was distributed to the local banks and some 100mm EUR more went to asset managers, insurances, and pension funds. This all added to the aggregated bid on CROATI€ and yesterday we learned that a couple of Street banks were bidding 10mm EUR of CROATI€ across the curve. We also heard that most of the big local banks that were holders of CROATI 3.875 05/30/2022€ reinvested the proceeds into any CROATI 3 03/11/2025€ and CROATI 3 03/20/2027€ they could find on the Street, and after that source of demand was exhausted, they switched into buying longer end paper such as CROATI 2.875 04/22/2032€. This unusual local bank demand for CROATI€ and Street banks being able to offer CROATI€ only on a short offer created a scramble for paper and left some asset managers/pension funds holding the bag. So far nobody was willing to switch demand to HRK bonds which are still in ample supply and do offer 10bps-15bps pickup in illiquidity premium. We also stick to the belief that bag holders would rather wait for the supply to turn up on CROATI€ instead of buying RHMF-O-327A and RHMF-O-34BA (FX-linked local bonds). The underlying reason is that RHMF-O-327A is a small size paper that settles in HRK and most of it is either at the central bank or buried deeply in hold-to-collect portfolios, while RHMF-O-34BA has a modified duration that scares even the bravest investors. With the current market structure, it’s quite likely that CROATI€ would keep on reporting spread tightening as long as the German yields keep on marching higher, but eventually, something’s got to give and it’s more likely that foreign accounts would start to switch away from CROATIA and into countries such as Italy. If you doubt that, take a look at the spread between mid YTMs of CROATI 1.5 06/17/2031€ and BTPS 0.9 04/01/2031€ and notice that for the first time in a while CROATI€ is traded some 15bps below Italy:

The spread tightening story got another twist yesterday when the European Commission issued a favorable convergence report stating that Croatia has fulfilled all of the conditions necessary to become a full member of the euro area by January 01st, 2023. And it gets better – just yesterday Croatian PM Plenkovic reported that the country is doing all in its power to enter Schengen in 2023 as well. Seems difficult at first, but then you remember the importance of the Croatian LNG terminal in the current geopolitical setup and the prospects of Croatian entering Schengen in nearer future are no longer slim. The idea of letting Croatia in Schengen is currently anathema to the standing Slovenian government, but it’s still possible that Croatian diplomacy could find a way around it.

In simple words, CROATI€ spreads are tightening based on the flow and fundamental story, but don’t get too accustomed to it. German 10Y YTM is knocking on 1.20% YTM door and with rising German yields some of the CEESEE sellers might start coming out of the woods and start switching to more liquid paper. Don’t tell us we didn’t warn you!

In April 2022, total loans of Croatian financial institutions amounted to HRK 292.3bn, an increase of 6.6% YoY, and 2.6% MoM.

The Croatian National Bank (HNB) has published its monthly report on the development of the Croatian financial institutions. According to the report, as of the end of April 2022, the total loans of all financial institutions equaled HRK 292.3bn, an increase of 6.6% YoY, and 2.6% MoM.

Household loans which represent the largest segment, grew by 4.5% (or HRK 6.13bn) YoY, 0.4% (or HRK 523m) MoM. Meanwhile, corporate loans grew by 8.5% YoY, 2.0% MoM, and amounted to HRK 93.7bn.

Corporate and Household Loans Growth Rate (YoY, %)

In total, loans issued to households amounted to HRK 143.7bn. The increase was primarily driven by the increase in housing loans, which grew by HRK 5.25bn (or 8.2%) YoY, and HRK 163m (or 0.2%) MoM. Housing loans also constitute the largest segment of the household loans, at 48%, roughly the same as the month before, but an increase of 1.67 p.p. YoY. At the same time, the 2nd largest category of household loans, the consumer loans (accounting for 37.5% of total household loans), grew by 2.6% (or HRK 1.3bn) YoY, and 0.31% (or HRK 167.1m) MoM.

Meanwhile, the household loan growth was offset by the lower result of credit card loans, which decreased by HRK 710.2 (or -20.6%) YoY but experienced a slight increase of HRK 15.7m (or 0.58%) MoM. The 3rd largest category of household loans, other loans, experienced an increase of HRK 82.3m (or 0.91%) YoY while increasing by HRK 128.6(or 1.43%) MoM. Lastly, the 4th largest category of household loans, overdrafts on transaction accounts, increased by HRK 106.2(or 1.7% YoY) and grew by HRK 49.2m (or 0.8%) MoM.

Even though we have a still-present geopolitical situation, a negative month-to-month decline regarding issued loans reversed. Virtually all segments reported a MoM growth. As stated above, household loans, as the largest segment, representing 58% of all issued loans, increased by 0.4% MoM. To further amplify growth in issued loans, corporate loans grew by as much as 2% MoM, representing a positive current sentiment in monetary institutions.

Composition of Croatian loans to households (HRKm)