Croatian Ministry of Finance decided to tap two bonds on local market this Tuesday and received HRK 6bn in total. Namely, they decided to issue third tranche of RHMF-O-26CA at 0.85% and second tranche of RHMF-O-282A at 0.94%. Meanwhile Croatian central bank maintained its 4th and 5th bond buying action. In this brief article you can read about recent actions on Croatian local market and what to expect next.

Last Friday Croatian central bank announced another bond buying action with almost all HRK papers (excluding RHMF-O-26CA and RHMF-O-282A) being eligible for banks’ buying and in the beginning of this week the bank bought HRK 4,068bn worth of Croatian HRK papers (in notional terms). Looking at the excel tables provided by CNB, it already bought HRK 17.885bn worth of papers to stabilize prices and provide liquidity on Croatian bond markets. Mentioned amount accounts of close to 4.5% of Croatian GDP (2019).

Talking about local bonds, two weeks ago, Mr Maric said that government will seek to enter local market one more time before parliamentary elections that are due this Sunday. It was mentioned that the Government will issue around HRK 5bn worth of papers probably in two tranches. Two days ago, 5 banks informed investors that Ministry of finance will tap two local papers and book is to be closed in early afternoon. In the end, Croatia issued third tranche of RHMF-O-26CA in amount of HRK 2.46bn at YTM of 0.85% and clean price of 121.307. Mentioned paper (excluding CROATI 2031) has the biggest notional among Croatian papers as in three tranches its notional amounts of HRK 12,46bn (EUR 1.65bn). Another bond that was tapped on Tuesday was RHMF-O-282A, in amount of HRK 2.59bn, YTM of 0.94% and clean price of 114.163.

With total amount issued being above HRK 6bn and more than EUR 1bn that will be left from latest foreign auction after CROATI 2020 is repaid, we expect government to stay on hold at least until autumn. Summing all the proceeds from bonds and loans that Croatian government already received it seems that Mr Maric’s plan to gather some HRK 65bn is now fulfilled. However, there are new sets of measures to be introduced especially in case second wave of coronavirus halts our economy once again. We doubt that scenario could happen as we see more and more economies fully opening despite rise of corona cases, but one cannot predict tourism revenues for the next two or three months that will be of crucial importance for Croatian economy. To sum it all, Croatian Ministry of Finance now secured all the funds for the summer at yields being close to the ones before corona crisis and that was made with some help of central bank that injected large amount of liquidity through several tools under its disposal.

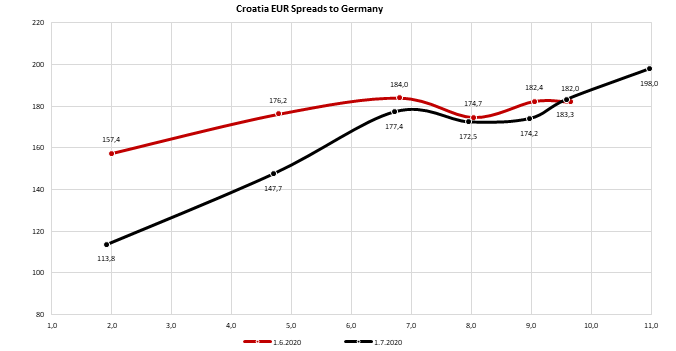

Mentioning our latest foreign issuance, its worth our while to look where does CROATI 2031 stands now. Well, in the last few days we have seen mostly buyers on the whole Croatian Eurobonds curve, both EUR and USD denominated. While USD curve seems to be carry-trade play supported by low financing costs, EUR denominated curve received bids from yield hungry investors that were also looking at some growth story due to higher duration on EUR papers. Bid on CROATI 2031 now stands above 100.00 while being issued at 98.572, reflecting total return of a bit more than 1.5% in only two weeks. In terms of benchmark, CROATI 2031 spread stands at 195bps versus above 205bps when issued, reflecting recent positive momentum on risky assets.

Source: Bloomberg, InterCapital

The Company made a regular solvency calculation for the Group as of 31 March 2020, which showed that the Group is still operating with a very high solvency ratio of 235%.

Croatia Osiguranje published an announcement on the Zagreb Stock Exchange regarding the impact of Covid-19 pandemic on the company’s operations and solvency. The Company noted that they made a regular solvency calculation for the Group as at 31 March 2020, which showed that despite the negative effects of COVID-19, the Group is still operating with a very high solvency ratio of 235% (239% as at 31 December 2019).

This confirmed earlier assessments that the solvency ratio should remain at levels significantly higher than those prescribed in the regulations, which is also a result of the fact that the solvency and operations of the Group are largely determined by the solvency and operations of the Company as the most important component of the Group (the solvency ratio of the Company as at 31 December 2019 was 277% and as at 31 March 2020 was 274%).

Croatia Osiguranje added that based on the information available at the moment of drafting this notice, further development of the situation with COVID-19 and its impact on the Group’s operations did not have any significant negative effects on the Group’s solvency. In regard to liquidity, members of the Group still have satisfactory amounts of liquid resources that are sufficient for discharging all obligations that have become due; they also have at their disposal instruments available for obtaining additional liquidity if necessary.

In regard to other information related to the Group’s operations and risk profile, it is emphasized that there have been no significant changes compared to the period before the appearance of COVID-19, and attention is drawn to the fact that additional information regarding the operations can be found in the published financial statements for Q1 2020.

In May GWPs recorded an increase of 3.7%. Of that Non-life observed an increase of 7.8% while Life decreased by 5.7%.

The Slovenian Insurance Association published their monthly update on the GWP development in Slovenia. In the first 5 months of 2020, the Slovenian insurance market observed an increase in both life and non-life segment, leading to a total GWP growth of 4.49% YoY, amounting to EUR 1.15bn.

Non-life segment, which accounts for 72.25% of the total GWPs, recorded also an increase of 5.79%. Such an increase came on the back of a very strong health insurance performance, which recorded an increase of 12.23% YoY and is the largest non-life item in Slovenia (23.8% of total GWPs). Such a solid increase arguably came mostly on the back of increasing prices of health insurance premiums.

It is noteworthy that land motor vehicles insurance observed an increase of 2.45%, amounting to EUR 149.1m. Meanwhile motor vehicle liability insurance witnessed an increase of 3%, amounting to EUR 131.3m. Credit insurance on the other hand, observed a sharp decrease of 27.9%. This does not come as a surprise given the expected lower loan issuance activity in Slovenia as a result of Covid-19 outbreak coupled with the restrictions on the consumer loans placed by the Bank of Slovenia in November 2019.

Turning our attention to the life segment, it also recorded a 1.24% YoY increase, amounting to EUR 320.47m.

GWPs by Insurance Segment (Jan – May 2020) (%)

Solely May 2020

When observing solely May, GWPs recorded a solid increase of 3.7% YoY after witnessing a slight decrease of 0.9% YoY in April. Such results indicate that insurers were so far only slightly grazed by the lockdown which occurred throughout the whole month of April, while in May we observed a pickup in insurance activity.

The mentioned increase came on the back of a solid non-life performance which observed an increase of 7.8% (or EUR 7.9m). Such an increase could be attributed mostly to a strong performance of Health insurance (+10.7% or EUR 5.2m) and land motor vehicles insurance (+14.1% or EUR 3.82m). On the flip side, a sharp decrease was observed in credit insurance segment, which dropped by 55.7% (or EUR 1.67m).

The solid performance of the non-life segment was partially offset by a decrease in life insurance of 5.7% (or EUR 3.59m). Such a decrease could arguably be attributed to the maturing of policies which were underwritten coupled with lower savings through life insurance and early termination of these policies.

In June, the Belgrade Stock Exchange observed an average daily turnover of EUR 0.10m. Meanwhile, BELEX15 recorded a decrease of 1.09%.

The Belgrade Stock Exchange reported a turnover of EUR 2.38m in June 2020 (when observing solely equity). This would translate to an average daily turnover of EUR 0.10m.

In June, the most traded share (excluding block transactions) was Komercijalna Banka with a turnover of EUR 1.1m. Next come NIS with EUR 0.34 and Alfa plam with EUR 0.23m. After seeing two consecutive months with solid BELEX15 performance, the index ended June in red with a decrease of 1.09% (ending the month at 665.85 points). As of end June, BELEX15 is still down 16.9% YTD.

Of the index constituents, Jedinstvo observed the highest increase of 13.3%, followed by Metalac with an increase of 5.56%. Next comes Impol Seval with an increase of 1.58%. On the filp side, Energoprojekt Holding observed the highest share price decrease of 13.64%.