It’s the last day of winter and tomorrow (Saturday, March 20th, 2021) at about 10.27 CET spring is officially coming to town. Apart from the change in seasons, there is a significant shift in FOMC’s reaction function to possible inflation rise, and the ambiguity of this shift has the market puzzled. For more clarification, as well as an insight of what can you expect from Croatian Eurobonds, read this brief research piece.

The key word of this week’s FOMC meeting seems to be ambiguity and the apparent lack of clarity comes from the notorious dots report. The focus of the FOMC members was on year 2023 – by then the pandemic would be ancient history and the economy would return to old normal. But it’s interesting what the median FOMC member expects about getting to the old normal: according to the dots report (page 4), 11 out of 18 members expect inflation above 2.1% (old inflation target), but only 7 out of 18 forecasts at least one rate hike. In a nutshell, that means that 4 FOMC members think inflation might exceed 2.1%, but no rate hikes would be necessary. This is what Jerome Powell’s was telegraphing to the markets since August 2020 – it’s FAIT (FED’s average inflation targeting), implying that inflation can briefly overshoot the 2.0% target in order to make up for the lost decade of weak inflation/disinflation. Actually, if you listened to Powell’s speech following the report, it was full of emphasis on labour market recovery, specifically on employment growth among disadvantaged groups (African Americans for instance). The inclusiveness of economic recovery might become the new factor significantly affecting FED’s decision, so if you weren’t watching unemployment on a more granular level, start now because it obviously matters to FED.

But back to the FOMC – so there are four members that think 2.1% inflation rate won’t be enough to trigger FED fund rate hikes. OK, but it might not be enough to move the needle, unless the big dots (Chair of the Federal Reserve, for instance) are among the four ultradoves. Also, it’s worth bearing in mind that 7 out of 11 members don’t see inflation rate above 2.1% in 2021, so they’re not event thinking about whether to hike or not. These 7 might be heavy enough to move the needle on the FOMC should inflation pick up, and just to be sure – the possible 2021 inflation overshoot might be temporary in nature, so the FOMC members are looking beyond this year. In other words, 2021 inflation rate might be a hiccup, not a pick up.

Seasoned rates traders have pointed out that by 2023 a lot of FOMC members might not be on the board because their term expires by then. Jerome Powell’s term expires in February 2022 and it’s a matter of debate whether he would serve another one. However, even if he would be replaced, it’s quite likely that Lael Brainard might take his place since currently she checks all the boxes necessary to be considered a Spitzenkandidat. Our point is that in her statements she appears even more dovish than Powell and the two of them switching chairs wouldn’t effectively mean a lot for the trajectory of interest rates.

So where does that leave us? The flavor of the March FOMC/DOTS was dovish, but risks persist and for further clarity look for June 2021 FOMC meeting. By then American economy will look significantly different than it does today. Perhaps you have noticed that Biden’s administration yesterday announced that they have already distributed 100mm doses, which is six weeks ahead of schedule. States are looking to open and get back to normal, so in the following weeks we’ll be looking at more granular data on the pace of recovery. Also, one big question is when would the FED start tapering asset purchase and the timing would likely be determined by the pace of recovery. So look for beginning of 2022 for the first cut in asset purchases since these would no longer be needed if the economy recovers and the Treasury Department returns to taxes as their main source of revenue instead of issuing bonds.

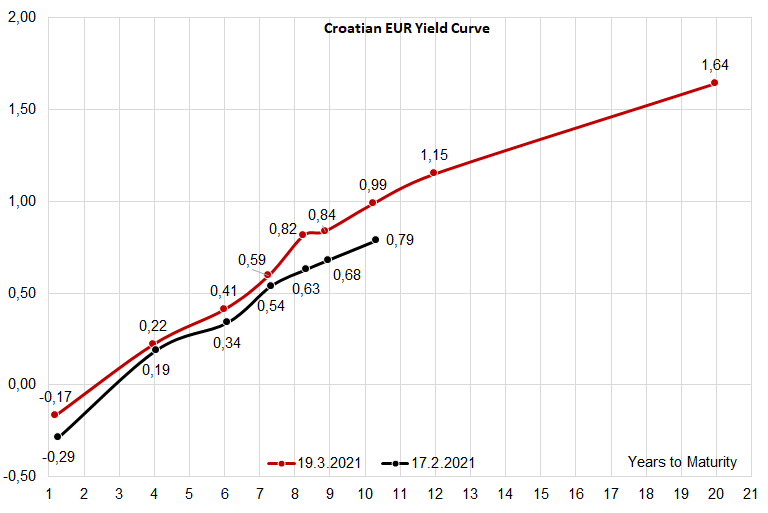

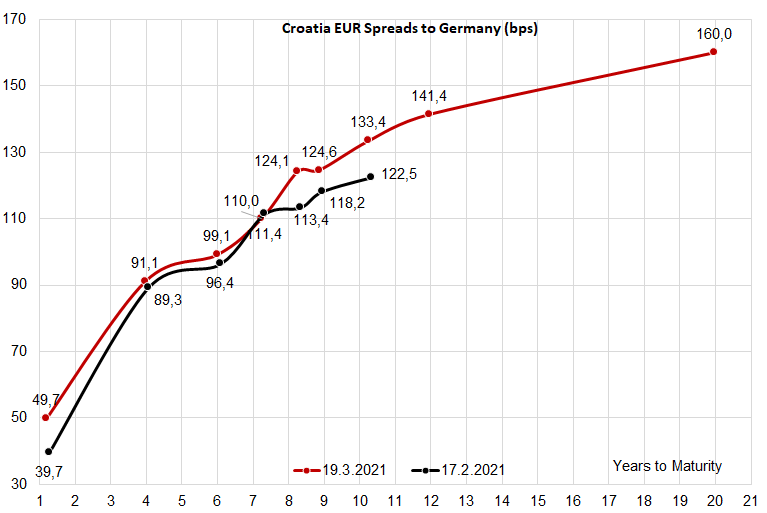

What about Croatian Eurobonds? Recent bout of volatility has moved the yield curve slightly to the north and a more detailed deconstruction of the move tells us that half of the yield rise in recent 30 days came from higher benchmark yields, while the remaining half came from wider spreads. Let’s take a look at one of the new bonds placed at the end of February (bond traders would say right in the eye of the storm). So CROATI 1.125 03/04/2033 was placed at 1.257% YTM (MS+105bps, DBR 0 02/15/2031+145.5bps). The two charts we have supplied suggest that the bond is currently traded at 1.15% YTM (DBR 0 02/15/2031+141.4bps), substantiating our claim that roughly half of the yield contraction came from the lower benchmark, and the remainder came from tighter risk premium. At this point in time we see a lot of buying interest on the belly of the curve, namely CROATI 3 03/11/2025, which is trading around 0.22% YTM. What we have noticed is that a lot of buying interest comes from banks’ ALM departments and the underlying calculation is pretty simple. If the buyer is lucky enough to buy these at 111.00 clean (0.21% YTM) and assuming that the yield curve stay where it is, then in three years he would be able to sell these around 103.20 (-0.30% YTM); the trader lost about 780 cents on the price, but pocketed some 900 cents on accrued interest, netting him a gain of 120 cents or some 40 cents annually (roughly 36bps in annualized return because the paper was purchased at 111.00 clean price). Not bad for such a short duration and the assumption that it might be unwound at -0.30% YTM one year ahead of the maturity is reasonable if one believes the yield curve would stay right where it is now.

The manner and content of non-financial reporting for companies will be specifically regulated by the NRFD (non-financial reporting directive), a directive that is still being finalized at EU level to comply with the SFDR and the Taxonomy Regulation.

HANFA published an announcement stating that they have adopted Guidelines for the preparation and publication of ESG information to be published by companies financed through the capital market. It is a document intended for issuers on the regulated market in the Republic of Croatia who are subject to non-financial reporting under the Accounting Act.

Following the Paris Agreement, the European Commission published its European Green Plan, following which the Republic of Croatia determined that in the next 10 years it will focus national and European funding sources on fostering a sustainable economy and society, recovery and strengthening resilience to crisis, green and digital transition and balanced regional development. The financial industry will play a key role in achieving these goals both on a local and global level, whose task is to direct capital flows towards sustainable investments, i.e. investments that support the goals of sustainable development.

HANFA’s Guidelines will be a guide for issuers in the development of non-financial ESG reporting in Croatia and serve as preparation for mandatory publication of company objectives under the Taxonomy Regulation for all financial institutions (banks, funds, investment companies). As of March, in both Croatia and EU, a mandatory application of the EU Regulation SFDR by publishing data (Sustainable Finance Disclosures Regulation) has begun, which regulates the method of considering financing and investments according to the ESG factors as well as the Taxonomy Regulation which defines economic areas that can be considered environmentally sustainable.

The manner and content of non-financial reporting for companies will be specifically regulated by the NRFD (non-financial reporting directive), a directive that is still being finalized at EU level to comply with the SFDR and the Taxonomy Regulation. In that interim period, the HANFA’s Guidelines will support companies to prepare for non-financial reporting according to the new standards in order to be ready for the full implementation of the harmonized NFRD Directive expected next year.

We have recently published a short blog on the growing popularity of ESG investing, which you can find on the link here. Besides that, last year we published ESG disclosure scores of Croatian and Slovenian blue chips which can be found on the link here.