2019 was another central bankers’ year. Looking at the performance of major global assets, it’s not an easy task to find negative performance, despite global economic slowdown. Equity, bonds, EM assets, commodities, almost all went up by double digits. Furthermore, volatility fell across all assets and stayed low for a whole year. At home, Croatia reentered investment class resulting in massive spread tightening compared to benchmarks. In this brief article we are looking at most important events in 2019 and what to expect from the new decade.

In the end of 2018, there were still some hopes that ECB could start tightening its policy sometime during 2019, despite slowdown of manufacturing and overall economy that kicked in in the beginning of 2018. However, on the other side of the Atlantic, FED decided to stop hiking rates in December 2018 and announced it could reverse its policy due to slower GDP growth and meltdown of equity markets that almost reached ‘momentous’ 20% drop right on Christmas eve. FED then decided to cut rates three times during 2019, while ECB cut ‘only’ once but also decided to restart its APP due to economic slowdown and prolonged risks of messy Brexit and constant tensions between US and China.

Safe-haven assets were bid strongly, with Bund yield falling from +20bps in the beginning of the year all the way to -70bps in September 2019, as fear dominated that trade war could escalate completely. In the same time, US 10Y yield fell from 2.70% to 1.40%. However, in Q4 Trump and China agreed on Phase one and removed some of the tariffs (although we think we are still far from the deal) and it seems theirs is now a majority government in UK that is expected to ensure ‘softer’ Brexit. Those two Q4 events have driven solid risk-on that supported world equity markets while bond yields of developed countries increased. This week we have seen SPX breaching 3.200 (TR 27.5% YTD) and Euro Stoxx 50 almost reaching levels seen in 2014 (3.800) with year-to-date performance of 25.2% (dividends included). On the other hand, risk-on sentiment caused outflows from safe havens, so Bund yield rose to -30bps while US10Y yield went to 1.85%. As more positive news came, FED decided to stop cutting rates for now while ECB doesn’t have much tools left to use so we expect ECB to be on autopilot for some time urging euro area politicians to open their budgets to support economy. ECB didn’t manage to lift inflation at their targeted level in 2019 and without fiscal push or some supply side frictions we do not expect it to come out of the woods in 2020 as well.

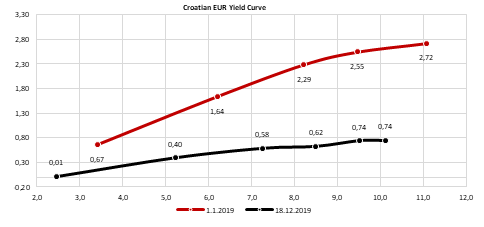

Talking about performance, 2019 was one of the best years ever recorded for holders of Croatian debt, especially for longer EUR denominated papers. First, in March 2019 one of the big three credit rating houses lifted Croatian rating to investment grade while another one did the same in June. Coming back to investment grade coupled with risk-off and another easing round of central bankers ensured only one way for Croatian yields: south. Namely, the longest Croatian EUR denominated Eurobond, CROATI 2030, stood at 100.25 (YTD of 2.72%) in the beginning of 2019 while today you could sell the paper at 119.00 (0.78%), reflecting total return of 21.75% (capital gain + coupon of 2.75%). Spread tightened from 2.5% to around 1.0% which was due to improved credit rating but also due to correlation of spreads and yield benchmarks. Just for the record, in 2019 we witnessed Croatian Ministry of Finance issuing 1Y EUR denominated paper at negative yield. Also, there were several interesting auctions at both Eurobond and local market out of which most interesting was last one when Croatia issued 5Y paper at 36bps and 15Y EUR indexed one at 1.20%. In March 2020 we have another important event for local market as there are two papers maturing (in total amount of HRK 5bn and EUR 1bn) but we do not expect yields at much lower levels, especially in case more positive news from global economy kick in.

Source: Bloomberg, InterCapital

Only’ a year ago, there were many articles saying that 30-year bond era is over, with US 10Y surpassing 3.20%. However, several factors ‘forced’ central banks to act again, resulting in another stellar year for bonds and capital markets. We kind of doubt that this will repeat in 2020 as central bank do not have so much ammunition left. FED could cut few times before zero, but their QE is already happening, even if they are not calling it by name. We expect low growth and low inflation to continue despite some positive news from US lately. In any case, central banks could have minor role next year compared to past couple of years so seems like all eyes will be on fundamentals once again. And on fiscal policy.

We want to thank to all our readers and hope that you had great year, wishing you happy holidays and rich yields!

Kristina, Ivan and Marin

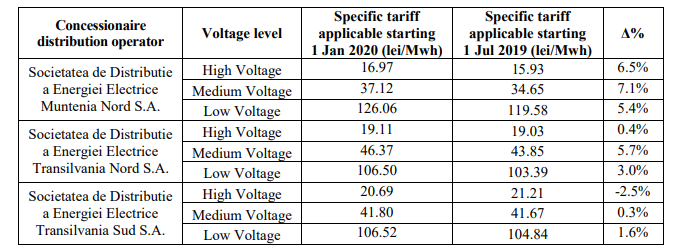

The Romanian Energy Regulatory Authority (ANRE) declared orders related to the specific tariffs for the electricity distribution service, applicable in 2020 for the distribution subsidiaries of Electrica Group.

Electrica published a document on the Bucharest Stock Exchange announcing that the Romanian Energy Regulatory Authority (ANRE) declared orders related to the specific tariffs for the electricity distribution service, applicable in 2020 for the distribution subsidiaries of Electrica Group.

According to the ANRE orders, the specific tariffs for electricity distribution service for the three concessionaire distribution operators of Electrica Group, applicable starting with 1 January 2020, compared to the ones applicable starting with 1 July 2019, are the following:

Source: Societatea Energetica Electrica

The company states that the electricity tariff charged for invoicing is calculated by adding the specific tariffs for the electricity distribution service depending on the voltage in the point for delimitation of electric installations belonging to the concessionaire distribution operator from those belonging to the end consumer, as established under the electricity distribution agreement. The income achieved from distributing electricity by distribution operators with the Group in 2020 will rely on the electricity distribution tariffs.