Given that inflation has been a key topic of financial markets for quite some time now, it is interesting to see the real returns of Croatian and US equities. For this, we looked at the total (11 year) return of both CROBEX and S&P500 and deducted the reported average annual CPI (inflation).

For today we decided to present you with a brief analysis of the real return of two equity indices – CROBEX and S&P500 since 2010. Note that both indices are total return indices, meaning that they account for the reinvestment of dividends.

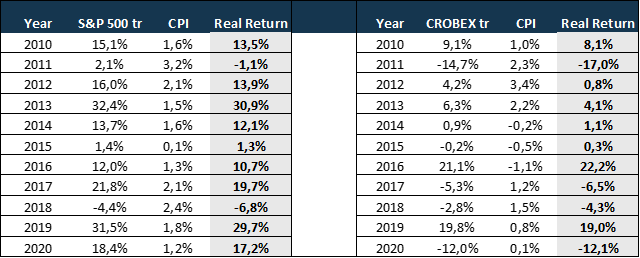

Annual Return of the Index vs. Annual Average CPI

Source: Bloomberg, InterCapital Research

As visible from the table above, the 2010s were depicted with relatively low inflation figures and solid performance of especially US equity market. Therefore, one can note that the S&P500 noted a positive annual real return in 9 observed years, while CROBEX noted a positive return in 7 observed years.

2011 was the only year in which the US market witnessed a negative real return, despite noting a positive nominal return. Meanwhile, in Croatia, CPI showed negative figures from 2014 – 2016, somewhat boosting the real return of CROBEX. Therefore, despite a slight decrease of CROBEX in 2015, the real return of the index remained positive.

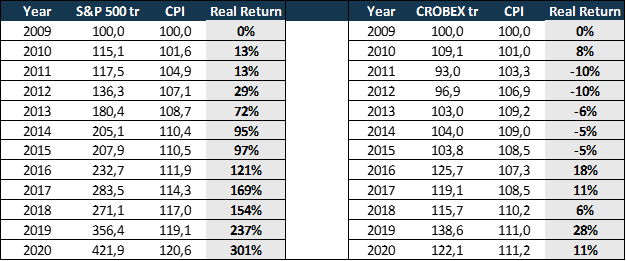

Additionally, it is interesting to see how the markets performed in real terms if an investor decided to invest in both indices in 2010. As visible from the table below, investing in CROBEX in 2010, resulted actually in a negative real return from 2011 to 2015. However, despite this in 2020 one would observe a real return of 11%. If we were to also take into consideration the YTD performance of CROBEX and adjust it for Jan – Sep 2021 CPI, one would note a total real return of 34%. Such a relatively better performance could be attributed to a strong YTD performance of CROBEX.

When looking at S&P 500, one could note that the index noted a significantly higher real return, which does not surprise given that the observed period refers to the longest bull run of US equities. Adjusting for inflation, S&P500 returned (total return) 301% from 2010 – 2020.

Real Return of Investing in S&P 500 & CROBEX (total return) (2010 – 2020)

Source: Bloomberg, InterCapital Research

Pressure on prices continues as CPI increases in September to 3.3%. The growth was mostly driven by food and non-alcoholic beverages prices, which as the largest component of CPI of 27.2%, grew 2.9% YoY. The growth was also driven by transport prices, which as the second largest component of CPI with 13.3%, rose 10.8% YoY.

In September 2021, the prices of goods and services for personal consumption, measured by the consumer price index, increased by 3.3% YoY on average. Meanwhile, on the annual average, they increased by 1.3%.

CPI for the first nine months of this year compared to the same period last year shows a rise in consumer prices of 1.8%, while we expect 2021 annual average slightly above this level. The growth was mostly driven by food and non-alcoholic beverages prices, which as the largest component of CPI of 27.2%, grew 2.9% YoY. The growth was also driven by transport prices, which as the second largest component of CPI with 13.3%, rose 10.8% YoY.

CPI (January 2013 – September 2021)*

Source: Croatian Bureau of Statistics, InterCapital Research

*Annual change

Viewed by main groups by purpose of consumption, in September 2021, the highest relative increase was observed in the transport segment which noted an increase of 10.8%. Within the segment, operation of personal transport equipment increased by 14.6%, while air transport increased by as much as 39.3%. At the same time, Food and non-alcoholic beverages segment noted an increase of 2.9%. Alcoholic beverages and tobacco noted an increase of 5.6%, which mostly came on the higher tobacco prices (+7.1% YoY).

Housing, water, electricity, gas and other fuels noted an increase of 2.4%. Within the segment, liquid fuels noted a sharp increase of 56.8% YoY, while gas increased by 11.9%.

The only segment to note a YoY decrease is clothing and footwear (-2.6%), which holds a share of 5.68% in CPI. However, on a MoM basis, the highest increase was recorded in this segment, by 17.1% on average. This could be attributed to new collection of clothing and footwear.

Looking at the MoM basis, prices of Transport increased by 0.9% on average, while the prices of Furnishings, household equipment and routine household maintenance increased by 0.5% on average. The increase in the consumer price indices in September 2021, as compared to August 2021, was alleviated by a decrease of 1.9% on average in the prices of Restaurants and hotels (lower prices of accommodation services), of 0.1% (in each group) on average in the prices of Food and non-alcoholic beverages as well as in the prices of Recreation and culture.

CPI Sector Breakdown – September 2021 (%)

Source: Croatian Bureau of Statistics, InterCapital Research

As of September, Fondul’s NAV reached RON 12.03bn (+23.8% YoY).

According to the latest NAV report (30 September 2021), Fondul reported a total NAV of RON 12.26bn (EUR 2.48bn), which translates into a NAV per share of RON 2.0812 (EUR 0.4207).

When comparing it to the same period last year, their total NAV recorded an increase of 23.84%, while NAV per share is up by 31% YoY.

Fondul Proprietatea’s portfolio structure remains largely oriented towards the power utilities generation sector (58.98% of NAV) and oil and gas sector (14.77% of NAV), which is why the two largest holdings, Hidroelectrica and OMV Petrom account for 73.75% of the total NAV.

In terms of the Fund’s portfolio structure, unlisted equities make up the majority, accounting for 79.08%, which represents an increase of 7.4 p.p. YoY. Listed equities follow with 16.9% (-1.2 p.p. YoY), while net cash and receivables account for 4.68% of the structure (-6.23 p.p. YoY).

The premium to NAV per share currently stands at 14.9%.