With the IPO of Hidroelectrica successfully done after a strong book building, a new question naturally arises: will Romania become an Emerging market? You can find this topic pretty easily, however, we saw no actual specifics around it. Therefore, in this blog, you can find exactly how did IPO of Hidroelectrica contribute to the Romanian market.

Probably the hottest topic in the regional equity market – Hidroelectrica. At the outset of this article, we will provide just a brief overview of this topic. However, even though everyone is currently talking about it, we found no specific implications of Hidroelectrica’s IPO impact on the Romanian stock market. Therefore, we decided to dive into the specific MSCI criteria and demystify how exactly will Hidroelectrica contribute to Romania’s improvement into the Emerging market (from its current Frontier status).

We emphasize that the sale of the aforementioned share of Hidroelectrica is one of the conditions of the Romanian recovery plan! After the listing, Hidroelectrica immediately became the largest company listed on the Bucharest Stock Exchange with a market cap of >EUR 10bn. Let us just briefly remind you that this kind of strategy for development has still not been developed and implemented in Croatia, while Slovenia implemented it recently. Back to the topic – Hidroelectrica is the 7th Romanian company included in the FTSE Global All-World Index, FTSE Global Large Cap Index, and FTSE Emerging Index. However, let’s dive into its impact on the Romanian equity market on a country level as the listing of the company is over.

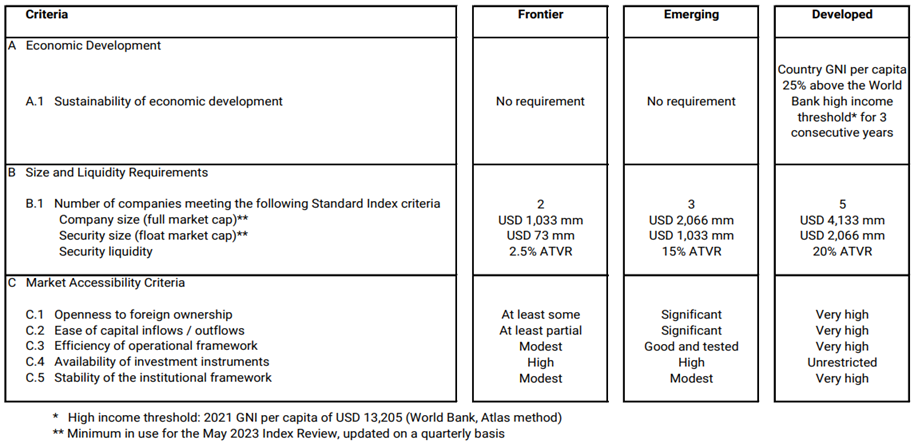

MSCI Market Classification Framework

Source: MSCI Global Market Accessibility Review

In the MSCI criteria above, one can notice that for MSCI to classify a company as „Emerging“, a country needs at least 3 companies that fulfill size & liquidity requirements. For companies to be considered „big enough“, it has to have a market capitalization of >USD 2,066m. However, looking at its free float market cap, it still needs to be >USD 1,033m. This somehow complicates the situation. Further, looking at liquidity criteria – those companies need their ATVR to be at least 15%. But what ATVR stands for? ATVR is Annual Traded Value Ratio, which is calculated as TTM equity turnover compared (read: divided) to its free float-adjusted market cap. Basically, ATVR reflects the proportion of the company’s free float market capitalization traded annually. However, we note that equity turnover does not include block trades so that turnover is potentially not under one-off effects. Now that this is out of the way, where does Romania stand?

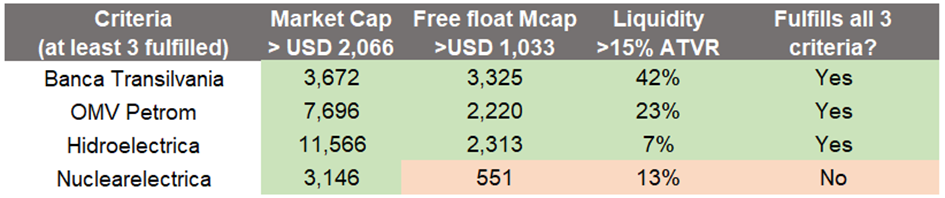

Source: Bloomberg, InterCapital Research

Upon analyzing the Romanian market with respect to MSCI’s criteria, it becomes evident that Hidroelectrica serves as the final catalyst for Romania’s improvement. Scanning through the first criteria, Romania already has „at least 3“ companies big enough. However, Nuclearelectrica does not fulfill the second screening: free float-adjusted market cap. And to be fair, it is far away from being considered „big enough“. Here, Hidroelectrica comes shining as that third company!

Also, looking at liquidity criteria, prior to H2O’s listing, Romania had „only“ two companies fulfilling MSCI criteria with Nuclearelectrica not being liquid enough. However, we emphasize that given ATVR in this calculation includes block trades due to simplification of the data derived from Bloomberg. In other words, real ATVR is slightly lower. However, we can see that both Banca Transilvania & OMV Petrom fulfill the criteria well enough, while Nuclearelectrica, again, fails to meet the criteria. Zooming our focus on Hidroelectrica, we can see it fairly above size criteria for both market cap and free float-adjusted one. Finally, H20 already stands at 7% of ATVR with only a few days of trading on the stock exchange. It is safe enough to say that the company with an IPO of this interest will definitely fulfill the criteria when 12 months of data will be available.

With this, we would like to conclude this brief analysis with a simple statement – Hidroelectrica actually is that final momentum and tipping point for Romania to be classified as „Emerging“ by MSCI. The third company is both big & liquid enough (yet to be confirmed, but safe enough to assume). From now on, MSCI could raise its status from a frontier market to an emerging one. The anticipated upgrade of Romania’s market status marks a pivotal turning point in the country’s financial landscape, resulting in well-deserved improvement in liquidity from new inflows. With this, the whole story of Romania should be wrapped up for now.

By the end of June 2023, the total AUM of Slovenian mutual funds amounted to EUR 4.44bn, an increase of 14.1% YoY, and 2.9% MoM.

The Slovenian Securities Market Agency, ATVP, has recently published its latest report on the developments recorded by the Slovenian mutual funds, for the month of June 2023. In the report, we can see that the total AUM of the Slovenian mutual funds amounted to EUR 4.44bn, an increase of 14.1% YoY, 12.2% YTD, and 2.9% MoM.

The YoY growth came both as a result of the base effect (as June 2022 recorded a decrease of app. EUR 200m MoM compared to May 2022), but also due to the surge in the AUM value, which can also be seen in the MoM, and YTD data. In fact, on an MoM basis, the 2.9% growth comes on the back of 2.5% MoM growth in May 2023, meaning that the growth was supported by other factors as well.

Breaking the YoY growth further, and looking at the asset structure of the mutual funds, in absolute terms the largest increases were recorded by shareholdings, which increased by EUR 494m, or 18.5%, followed by bonds at EUR 72m, or 11.3%, investment funds, at EUR 58m, or 24.3%, and finally, the money market holdings, which increased by EUR 22m, or 41.1%. On the other hand, cash holdings decreased by EUR 79m, or 34%, while deposits and loans decreased by EUR 18m or 69.4%.

Moving on to the monthly data, we can see that share holdings once again are the main driver of growth. In absolute terms, they increased by EUR 135.4m, or 4.5%, followed by bonds, with a growth of EUR 82m, or 1.2%, and investment funds, with an increase of EUR 78m, or 2.7%. Money market holdings also increased by EUR 22m, or 2.9%, while on the other hand, cash holdings decreased by EUR 22.7m, or 12.9%, while deposits and loans decreased by EUR 2.5m or 24%.

Total assets of Slovenian mutual funds (June 2007 – June 2023, EURbn)

Source: ATVP, InterCapital Research

The positive sentiment we have witnessed for the last couple of months, despite the still challenging macroeconomic and geopolitical situation, has clearly affected the returns of the funds as well. This is most evident in shareholdings, which even though the interest rate in the EU (which negatively impact equity valuations and thus make equity more riskier, and as such increase the expected returns by investors), have recorded solid growth both on a MoM and YoY level. Breaking these holdings down even further, foreign issuers’ equity securities amounted to EUR 3.12bn, an increase of 4.6% MoM, and 19% YoY. On the other hand, home issuers equity securities amounted to EUR 57.2m, a decrease of 2.6% MoM, and 6.5% YoY. Given that foreign issuers’ equity securities account for 98.2% of the total equity holdings, growth in the shares then is expected.

Equity holdings of Slovenian UCITS funds (October 2007 – June 2023, EURm)

Source: ATVP, InterCapital Research

Besides the increase in the inherent value of the assets, the growth of any of these assets can also come from the net contributions to the funds. In June 2023, the net contributions amounted to EUR 28.7m, a more than 4x increase YoY, and a 27% increase MoM. It should be noted that June 2022 was a low outlier in terms of these numbers, and the MoM data is more representative. On a trailing 12M basis, the net contributions amounted to EUR 242.9m, a decrease of 27% compared to the same period last year, which would indicate that even though the contributions are increasing, they’re still not at levels we’ve already seen.

Net contributions into the Slovenian mutual funds (January 2016 – June 2023, EURm)

Source: ATVP, InterCapital Research

Finally, taking a look at the share of all these assets in the total AUM, shares still hold the vast majority at 71.5%, an increase of 1 p.p. MoM, and 2.6 p.p. YoY. Following them we have bonds with 16%, a decrease of 0.3 p.p. MoM, and 0.4 p.p. YoY, as well as investment funds, which hold 6.7% of the total, remaining unchanged MoM, and increasing by 0.5 p.p. YoY. Lastly, we have the money market, deposits & cash, which hold 5.4% of the total AUM, a decrease of 0.7 p.p. MoM, and 2.7 p.p. YoY.

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 8 | 18.7.2023 | KRKG | Krka ex-date | Slovenia |

| 9 | 20.7.2023 | KRKG | Krka Q2 2023 Results | Slovenia |

| 10 | 20.7.2023 | ADPL | AD Plastik General Shareholders Meeting | Croatia |

| 11 | 21.7.2023 | PODR | Podravka Q2 2023 Results | Croatia |

| 12 | 25.7.2023 | ERNT | Ericsson NT Q2 2023 Results | Croatia |

| 13 | 25.7.2023 | ATGR | Atlantic Grupa Q2 2023 Results | Croatia |

| 14 | 25.7.2023 | TRP | Teraplast Q2 2023 Results | Romania |

| 15 | 25.7.2023 | ATPL | Atlantska Plovidba Supervisory Board Meeting | Croatia |

| 16 | 26.7.2023 | TRP | Teraplast Q2 2023 Results Conference Call | Romania |

| 17 | 26.7.2023 | ATPL | Atlantska Plovidba Management Board Meeting | Croatia |

| 18 | 26.7.2023 | ARNT | Arena Hospitality Group Supervisory Board Meeting | Croatia |

| 19 | 27.7.2023 | KOEI | Končar Q2 2023 Results | Croatia |

| 20 | 27.7.2023 | HT | Hrvatski Telekom Q2 2023 Results, Conference Call for investors and analysts | Croatia |

| 21 | 27.7.2023 | ARNT | Arena Hospitality Group Q2 2023 Results | Croatia |

| 22 | 27.7.2023 | ADPL | AD Plastik Q2 2023 Results | Croatia |

| 23 | 28.7.2023 | WINE | Purcari Wineries ex-date | Romania |

| 24 | 28.7.2023 | EQNX | Equinox Q2 2023 Results | Slovenia |

| 25 | 28.7.2023 | SNP | OMV Petrom Q2 2023 Results, Conference Call | Romania |

| 26 | 28.7.2023 | ATPL | Atlantska Plovidba Q2 2023 Results | Croatia |

| 27 | 31.7.2023 | RIVP | Valamar Riviera Q2 2023 Results | Croatia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).