This week we have seen most important central banks in the world doing their last move for the year and they justified the thrill. Fed decided to end its purchase program in March, while dots showed 3 hikes in 2022. Then yesterday first BoE decided to hike its reference rate by 15bps, and ECB announced it will close its PEPP in March 2022 as expected. In this article we are looking into more details on Fed’s and ECB’s decisions and what could we expect in the following year.

Few weeks ago, Fed’s chair Jerome Powell on the Senate Banking Committee stated that it is time to retire the word transitory and that Fed’s purchases could be wrapped up few months sooner than previously expected. This was Powell’s U-turn and market started to calculate those purchases should end in March or April while 2-3 hikes were priced in for next year. Fast forward to Wednesday, Fed decided to double its taper starting from January 2022 meaning that Fed’s program will end in mid-March next year. Namely, In November 2021 it was announced that USD 120bn program a month should decrease by modest 15bn in both November and December while latest Fed’s decision means that in 2022 Fed plans to buy “only” USD 180bn of both treasuries and MBSs. Furthermore, dot plot showed that officials expect 3 hikes in 2022, up from only one hike expected in September. 10 out of 18 Committee members expect three hikes while dot plot shows fed funds rate at 2.1% in 2024. Regarding forward guidance, Mr Powell stated that inflation targets have been met and now there is another mandate to be met, namely maximum employment. Talking about labor market, new economic projections see unemployment rate at 4.3% in 2021 and 3.5% afterwards. Inflation in terms of PCE is expected to average 5.3% in 2021, 2.6% in 2022 and 2.3% in 2023, reflecting Feds surrender in respect of transitory.

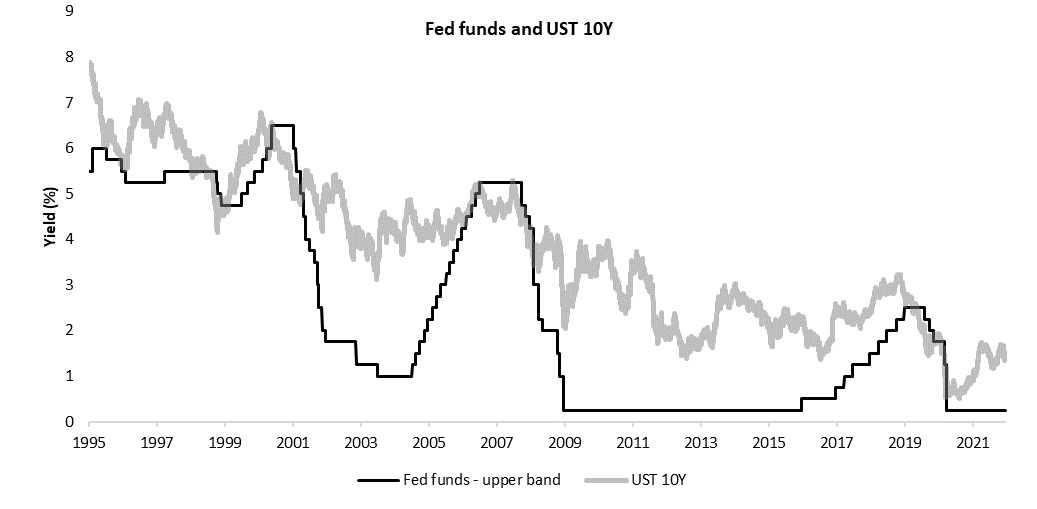

To sum it up, this week’s FOMC meeting went as expected as Mr Powell announced all the moves several weeks ago. Purchase program will end in March, and most likely there will be 3 hikes in 2022. Questions that remain are whether Fed could hike already in March or wait a bit longer i.e., May or June while another one is when Fed is to start with its QT. Furthermore, market now expects that Fed will stop with its tightening somewhere in 2024 with fed fund rates being slightly above 2.0% which seems likely looking at the past, but the thing is that 2020 recession was way different than the ones in the past. Looking at the move in long dated USTs (10Y close to 1.40%) one would correctly conclude that all actions were already calculated in the market although we saw quite significant fall of volatility and rise of equity markets, most likely due to another uncertainty being behind us.

On the other side of the Atlantic, Ms Lagarde did not telegraph ECB’s intentions last month, so a lot of scrutiny was on yesterday’s meeting. First, as expected, ECB decided to shut its PEPP program in March, however it decided to start decreasing PEPP purchases already in January 2022, meaning that they do not expect EUR 1.85t to be spent in full. Staying a bit more with PEPP, ECB’s statement says that principal payments will be reinvested until at least 2024, extending reinvestments by one year. ECB thought about Greece as well as it said that “PEPP reinvestments can be adjusted flexibly across time, asset classes and jurisdictions at any time which include purchasing bonds issued by the Hellenic Republic over and above rollovers of redemptions..”. To be sure that financial conditions would not deteriorate too much, ECB decided to increase APP by EUR 20bn in Q2 to 40bn a month, and to EUR 30bn in Q3 while after October 1st, APP should continue at pace of EUR 20bn a month for the foreseeable future, as confirmed by Ms Lagarde in the Q&A session. As in the previous meeting, Ms Lagarde stated that rates are very unlikely to be lifted in 2023 as there is still work to be done to see inflation to stabilize at the 2.0% in the medium term. Talking about inflation aim, ECB now expects inflation to reach 3.2% in the next year and 1.8% in both 2022 and 2023 which ensures ECB to keep accommodative monetary policy for some time. After the meeting bund stood at -35bps meaning that it did not move significantly in any way.

To wrap it up, it seems that central banks in developed world are finally starting to tighten their policies as inflation showed to be more stubborn than previously expected. However, market still does not expect tightening to last long which is best seen in yield curves which are flattening day by day. So the question is whether market really expects economy to decelerate drastically which would drive central banks to stop tightening process or flow is still the most important thing to focus on as central banks are decreasing their purchases, but sovereign deficits are expected to decrease even faster next year. Let’s see in 2022, when we hopefully get rid of corona virus.

Source: Bloomberg, InterCapital

Petrol Group’s plan for 2022 is to generate sales revenue of EUR 5.9 bn and an adjusted gross profit of EUR 643.9 m.

Today, Petrol adopted Business Plan for 2022. The plan is focused on implementing and achieving strategic targets. The plan details business activities for carbon footprints of a company, transition to renewables and company’s view of 2022 and their main risks in achieving strategic targets.

The main component of the plan for 2022 includes reducing the carbon footprints of Petrol Group. The company is aware of its customers becoming increasingly engaged and environmentally conscious. In this adoption of a business plan, Petrol highlighted the company’s activities of increasing energy independence, energy efficiency and a higher share of renewables. Also, the company highlighted their involvement in wastewater treatment – recycling of carwash water and re-using of industrial wastewater. Furthermore, Petrol will reduce its current packaging with recycled and biodegradable materials.

The plan for 2022 is relatively optimistic. Petrol’s plan heavily relies on a positive macroeconomic view – energy prices not furtherly increasing and the government’s adoption of various measures to promote economic activity and consumption level.

The company noted the main risks underlying the achievement of the set plan for 2022. The main risk in Petrol’s view is the negative impact of the energy crisis on both inflation and Petrol’s operating costs. Other risks Petrol highlighted are supply chain cancellation, energy product selling price regulation and other macroeconomic risks.

Petrol Group’s plan for 2022 is to generate sales revenue of EUR 5.9 bn and an adjusted gross profit of EUR 643.9 m. Group plans to achieve the results planned by selling 3.6 m tons of petroleum products, 164.2 k tons of liquefied petroleum gas, etc. As a result, Group’s EBITDA is planned to amount EUR 297.8 m.

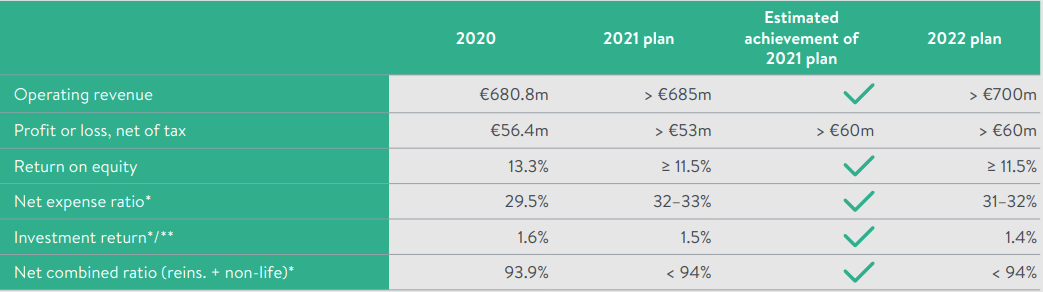

Sava Insurance Group has announced its business plan for 2022, outlining its strategy and expectations for the end of 2021 and the plan for 2022.

Based on is 2020-2022 strategy, Sava Insurance Group has prepared its business plan for 2022. The Company is planning to surpass EUR 700m in operating revenue, as well as to generate profit after tax of EUR 60m, which would translate into a ROE of more than 11.5% in 2022.

Key Performance Metrics

Source: Sava Re

The Company believes that despite the impacts of the COVID-19 pandemic on the macroeconomic situation, and the expected volatility of financial markets that the plan can deliver sustainable long-term development, risk management and profit generation. The Company will put the emphasis on the customers and introduce new core IT systems, all in order to improve enterprise efficiency and service.

Regarding the planned revenue of EUR 700m for 2022, the Company says this forecast is based on several assumptions; autumn forecasts for GDP growth where the Company is present, no major fluctuations in the financial markets, no major lockdowns or restrictions of movement in 2022 similar to those imposed in 2020 and 2021.

Consolidate Operating Revenues by segment (2022 plan):

- Reinssurance: -16%

- Non-life Slovenia: -2%

- Life, Slovenia: +2%

- Non life, international: + 6%

- Life, international: +17%

- Pension and asset management: + 4%

- Other: +4%

The Group expects Slovenian non-life insurance revenue to decline slightly. The projected decline reflects lower premium income from Freedom of Service (FOS) business, largely discontinued in 2021. In the Slovenian insurance market, the Group is targeting 2% growth in revenue against the backdrop of expected lower growth in car sales and potential lower insurance sales due to inflation. For international non-life insurance, the Group is targeting 6% organic growth in operating revenue.

The life insurance business in Slovenia is forecast to grow by 2%. While new annual premiums are planned to be slightly higher, revenue is projected to grow at a slightly lower rate due to the impact of the maturing of large parts of the life portfolio. These effects on revenue trends will largely fade away by the end of 2022. This operating segment has seen a significant boost in revenue since the takeover of Vita in 2020. In international markets, revenue growth of 17% is planned in this segment.

Reinsurance is expected to see a 16% drop in revenue in 2022. This decline is due to the expected one-off effects on growth in 2021 (positive development of income from the 2020 underwriting year) and unwavering underwriting discipline with a strong focus on profitability, risk and portfolio diversification by both region and partner.

Revenue from the pensions and asset management operating segment is expected to increase by 13%.

Dividend yield is 4.5%. Ex-date is 22 December.

The NLB General Meeting decided on additional allocation of distributable profit for 2020, as the Bank of Slovenia’s decision restricting the payment of dividends expired at the end of September. They confirmed the proposal made by the NLB Management and Supervisory Board, which is that EUR 67.4m of distributable profit or EUR 3.37 per share be paid to the NLB Shareholders on 24 December 2021.

NLB will therefore pay out a total of EUR 92.2m (EUR 4.61 per share) as dividends to the Shareholders this year (EUR 12m on 22 June, EUR 12.8m on 18 October and EUR 67.4m on 24 December). This is in line with the initially communicated dividend payment by the Management and is in line with our estimates as well.

As a reminder, the company already paid out EUR 1.24 this year, in two installments. To read more about it click here.

We note that the ex-date is 22 December.

In 2022, the Company expects revenue from sale of products and services to reach HRK 3.78bn (c. +8% YoY)

Končar’s Supervisory Board accepted the consolidated business plan of the Group for 2022.

The business plan for 2022 is based on the substantial number of contracts concluded by Končar by the end of the business year 2021. The value of contracted projects (backlog) at the end of 2021 is estimated at approximately HRK 5bn, which represents a significant increase compared to the balance at the beginning of the year.

Končar Group is expected to end the business year 2021 with historically highest revenue from sales in the amount exceeding HRK 3.5bn. We do note that this is above our initial estimates for 2021.

In 2022, the Company expects revenue from sale of products and services to reach HRK 3.78bn (c. +8% YoY). A further 5.4% growth in export revenue is projected, with export accounting for 60% of the planned revenue from sales. The EU market is expected to contribute the majority of 2022 income, with a planned share of HRK 1.5bn.

In terms of other markets, the Group plans to generate more income than predicted for 2021, with the greatest rise expected in neighbouring countries and on Asian and African markets. In 2022, the value of newly contracted transactions is expected to be HRK 4.4bn. The value of contracted transactions (backlog) at the end of 2022 is expected to reach HRK 5.6bn. The expected backlog provides a solid basis for achieving the Group’s strategic objectives until 2024

CAPEX

In accordance with the adopted Integrated Strategy of Končar Group, investments planned for 2022 amount to HRK 209m. We note that this is also quite above our initial estimates. The planned CAPEX pertains primarily to investments in plant and equipment, increased production capacities in several Group companies, continued digitalization, and further development of environmentally friendly products.

The majority of the planned investments will be financed using the Group’s own resources. The substantial number of contracts concluded, ensured liquidity and a stable balance sheet enable further growth and development of the Group in the next business year.

Priorities will remain the same in 2022 – organisation and continuation of production, compliance with the agreed-upon delivery deadlines, efficient cost management, reduction of carbon footprint, and, most importantly, protection of health and safety of employees and business partners if the pandemic continues in the coming year.

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 7 | 17.12.2021. | PETG | Petrol Business Plan for 2022 | Slovenia |

| 8 | 17.12.2021. | LKPG | Luka Koper Business Plan for 2022 | Slovenia |

Given the current Covid-19 situation, some of these events might be subject to change (postponed or cancelled).