In recent days we have seen ample demand for CROATI and ROMANI, especially the long end. This means the summer of carry has just begun – contained rates volatility and dovish central banks seem to be the bodyguards of the current shift into yield generating assets. Is the time right to jump back in?

Throughout the past few weeks the only question that seemed to preoccupy our clients was: how come the global yields are so low? After reaching 52-week high sometime between end-March (US 10-year @ 1.77%) and mid-May (German Bund @ -0.07%), at first it seemed that reflation trade paused to take a breather. Two months later people on global Wall Street are asking themselves: is the current rates pullback (US 10-year currently @ 1.31%, German Bund @ -0.34%) a technical/temporary thing or are we seeing a regime shift?

Looking at macroeconomic environment, not much has changed. On Wednesday the A1 page of Wall Street Journal covered the 5.4% YoY rise in US CPI, one third of which came from – you guessed it, used cars. The used cars component of CPI basket is the bedrock of theories that current CPI prints are transitory and should fade away as bottlenecks are removed from supply chains. There’s more to it: airfares were up in June by 24.6% YoY, while hotel prices made a 16.9% YoY jump as US economy opened up and people were eager to travel. There’s of course a backdrop to this: both categories are below levels recorded in June 2019, so they could rise a bit more. If this really proves to be transitory, it won’t be transitory yet – expect more strong US CPI prints in months to come.

Jerome Powell’s life is much easier now because lower rates and an inverted inflation-swap curve means that bond market is buying his narrative The bond market is proverbially never wrong, which is the reason some people would like to be reborn as the „bond market“. But that’s not all that’s going on: on Wednesday’s Humphrey-Hawkins testimony Powell stressed that the FED would act if the inflation doesn’t show up as transitory. We all know what Jerome and the FEDs did last summer: the switch from 2.0% being the cap to 2.0% being some sort of average around PCE can move in a narrow range (it’s also worth remembering that PCE is a third of a percentage point lower than CPI. This switch from “cap” to “average” spelled worry in the minds of bond traders since this strategy overhaul meant FED might let inflation run amok and act only when it becomes too late. In recent weeks markets have gradually removed „policy mistake“ from the equation, hence lower yields.

But the narrative appears to be a bit more complex than the current “two wheel explanation” of dovish FED and markets now believing Powell hasn’t lost his touch for predicting whether inflation is temporary or not. JP Morgan stressed that CTAs and pension funds were buying bonds in recent months: former based on momentum, the latter because their funding level reached an all time high and it seemed like a good idea to put some money off the table in case growth really does slow down in 2022/2023. Speaking about economic growth, Biden has faced some trouble in pushing his big infrastructure bill through Congress and he’s running out of time because as soon as next year there are mid term elections on the calendar and certain members f the Congress would be reluctant to risk their seats to back his mammoth infrastructure spending. Apart from JPM, some banks regard the bull flattening of the US yield curve as technical – that means there were many leveraged speculators that got burned on the direction and simply had to close their positions, pushing the curve down in the process.

But let’s get more down to earth, shall we?

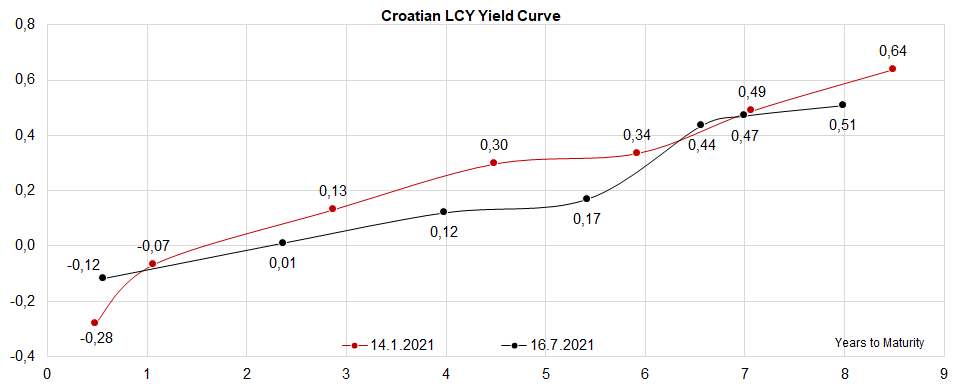

First of all, how is the new Croatian HRK bond doing? In the past two weeks’ trading, the price has moved up by about 40 cents (last price 100.20, rf 99.774) and we have seen predominantly buying interest. Looking at the shape of the yield curve, we still stick to belief that there’s plenty of value left on the long end (282A, 287A and 297A bonds) because this part of the curve is trading on the same level as in mid-January, while the rest of the curve bull flattened. You can look at it this way: by extrapolating the slope between 24BA and 257A, the hypothetical 7Y HRK paper should be traded in mid 0.20s, while it’s really traded around 0.47% YTM. It’s quite likely that by end-year the demand would start to push the long end further down, especially if FX interventions continue to push the excess liquidity up and banks have to buy HRK bonds to meet their liquidity requirements, squeezing UCITS funds further away on the curve.

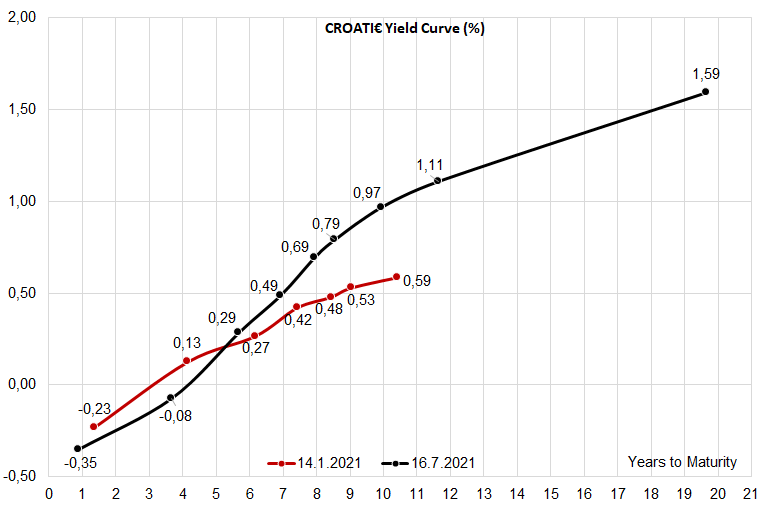

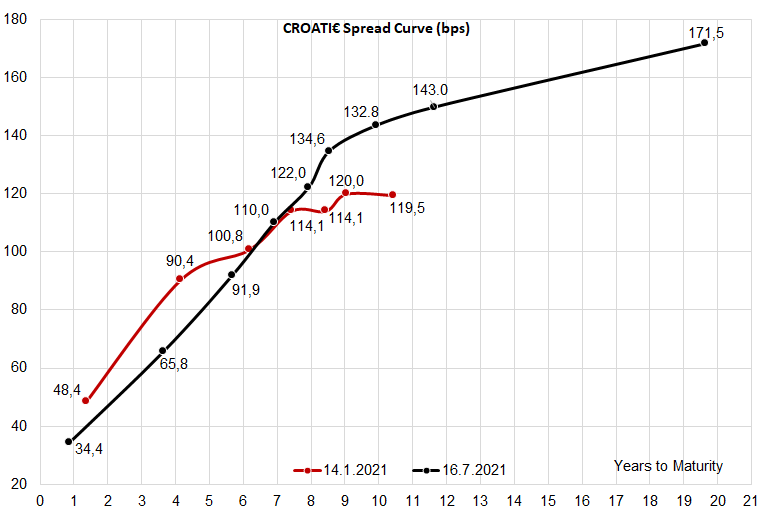

What about Croatian € eurobonds? Compared to where we were six months ago, the yield and the spread curve look like Harvey Dent villain from Batman (he was famously dubbed „Two-Face“). The shorter part of the curve looks quite good and whoever flew into lower duration paper probably made a decent buck on the move down in yields. The longer part of the curve resembles Harvey Dent’s ugly face: this part steepened (yields) and widened (spreads), leaving some scars on portfolios that were carrying this paper around. The spread widening means that even if you hedged rates move, you still lost some money. Nevertheless, we see a silver lining because the summer of carry has barely started. In recent days we have seen clients adding ROMANIs to their portfolios in order to enhance their income generating capabilities. With dovish central banks still around and inflation that (for now) looks like temporary, it’s quite likely that going long on everything that generates ample carry (in this space, this applies to CROATI and ROMANI). Also, it’s worth remembering that neither Croatia, nor Romania, would be placing any bonds before the turn of the year (this however, doesn’t exclude potential Romanian pre-financing, but that won’t happen in the coming three months).

Harvey Dent is notorious for his habit of tossing coins in order to decide whether his victims live or not. For CROATI investors (you can call them CROATI victims if you like) the coin fell too many times on the wrong side. It’s a bout time the coin finally falls on the right one and the spread starts to widen. With lower rates volatility, initiation of carry trades and lack of supply, it looks like the right time this finally happens.

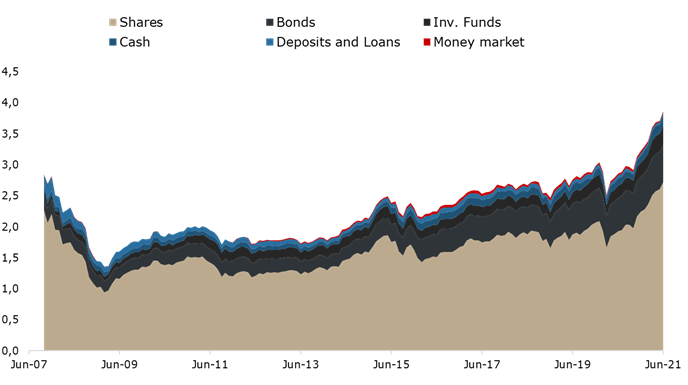

In H1, net contributions in Slovenian mutual funds reached EUR 252.8m, which is higher than any (full) year since 2007 (available data).

As of June 2021, Slovenian mutual funds manage EUR 3.88bn, recording an increase for the eight consecutive month (+4.2% MoM).

Moreover, total AUM of Slovenian UCTIS funds reached their high since June 2007, which also represents 19.9% YTD growth.

Following a continuous positive trend in net contributions in 2021, June’s contribution amounted to EUR 37.46m. Meanwhile, this year’s net contributions reached EUR 252.82m so far. To put things into perspective, the net contributions seen in H1 2021 already by far surpassed total yearly contributions since 2007 (available data).

When talking about asset structure, as of June 2021, shares, which account for 70.2% of the total assets (or EUR 2.7bn), observed a slight increase of 0.1% MoM.

Of that, domestic equity holdings amounted to EUR 63.71m, representing a decrease of 1.7% MoM and a drop of 15.8% when compared to pre-pandemic times (January 2020). However, on a YTD basis, domestic equity holdings are up by 7.7%.

On the other hand, foreign equity holdings have reached EUR 2.66bn and are making up the majority of Slovenian mutual funds.

Bonds come second, accounting for 15.7% (or EUR 611.1m), followed by investment funds with 7.8%.

Dividend yield is 4.2%. Ex-date is 21 July 2021.

AD Plastik published the resolutions from the GSM in which the shareholders approved a dividend payment. To be specific, a dividend of HRK 8 per share was approved, from profit realized in 2020.

This translates into a dividend yield of 4.2% (compared to the share price a day before the announcement). We note that the ex-date is 21 July 2021.

As a reminder, back in March, an unanimous decision was made on dividend payment from retained earnings in 2019 in the amount of HRK 8 per share. The dividend was paid to shareholders on 26 March 2021. If we take into consideration both dividend payments, ADPL’s dividend yield in 2021 is 8.5%.

In the graphs below, we are bringing you a historical overview of the company’s dividends per share and dividend yield.

Dividend per Share (2013 – 2021) (HRK)

Dividend Yield (2013 – 2021) (%)