US Core CPI surprised to the upside and now markets are getting anxious about what is FOMC going to do next week. Tough times for financial markets, especially if you’re after generating carry strategies. On the other hand, Bulgaria is placing a double 7Y/12Y tranche today. What are our thoughts on the placement? Check out in this brief research piece.

US CPI report for August has been multifaceted and although headline inflation appears to be slowing down (+8.3% YoY versus +8.5% YoY in July and +9.1% YoY in June), core inflation is slightly gearing up (+6.3% YoY versus +5.9% YoY in both July and June). The acceleration in core rate is the reason why all of a sudden everybody is talking about 100bps FOMC hike next week, EURUSD is consequently again below parity and both stocks and bonds are trading down.

The good thing about the headline rate is that energy prices are down again: gasoline has dropped 10.6% MoM in August and the national average is again at 3.71 USD/gallon (3AGSREG Index on Bloomberg). This is basically the same level recorded in early March, meaning that US gasoline prices are still higher than they were before Russia invaded Ukraine in late February. Moreover, gasoline prices are some 16.3% higher on an annual basis so there’s still a long road to go.

Speaking more about US CPI, about one-third of the CPI rise came from housing costs, which are +0.7% higher on a month-to-month basis and this is the basis for speculating on faster rate hikes going forward. Core inflation is where FED can really make a difference and housing is the most important pillar of US core inflation rate. With the present setup, 100bps in a single shot could be a bit much and so far we have heard only pundits talking about a full percentage point hike next week. Nevertheless, some analysts remind us of Jerome Powell’s words at a news conference on July 27th: “We wouldn’t hesitate to make an even larger move than we did today if the committee were to conclude that that was appropriate” (they raised by 75bps in July, FYI). We believe the context of this Powell’s statement was all about increasing the optionality of FOMC’s tools in the wake of persistent inflation pressures – in other words, FOMC speaks softly and carries a big stick.

In a nutshell, what Wednesday’s CPI print did was that it squashed expectations of a moderate 50bps hike next week and now it seems almost everybody favors 75bps rate rise with a few speculators eyeing a full percentage point. However, a full percentage point hike would not be out of the context with previous FOMC statements. So watch out, this is not something to play around with.

After Polish development bank BGK (Bank Gospodarstwa Krajowego) placed an international bond last week to test the depth of the markets for CEE issuers, Bulgaria (Baa1/BBB) decided to test the market for a pure sovereign placement and this morning the books are open for a 7Y/12Y double EUR tranche. Market sentiment looks relatively soft(er) and just a few days ago research pieces were circulating around about liquidity drying up and widening bid-ask spreads across the board. This is why Bulgarian placement is so important since this would be an accurate depiction of the real depth of European fixed income markets.

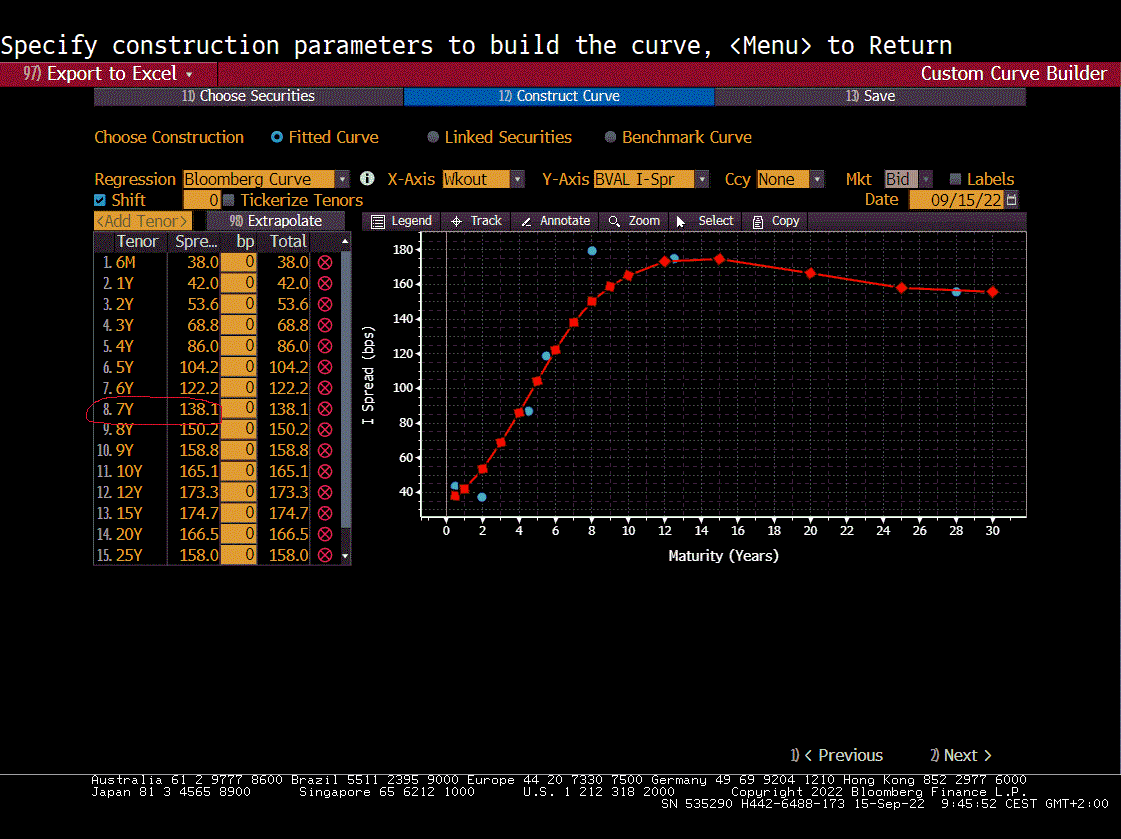

Yesterday we have tried to depict context on new BGARIA€ and what we concluded is that most of the domestic orderflow is going to focus on the shorter one (7Y), which is fairly valued at MS+138bps, although IPTs came at MS+200bps. To calculate the fair value we have used Bloomberg CRV function:

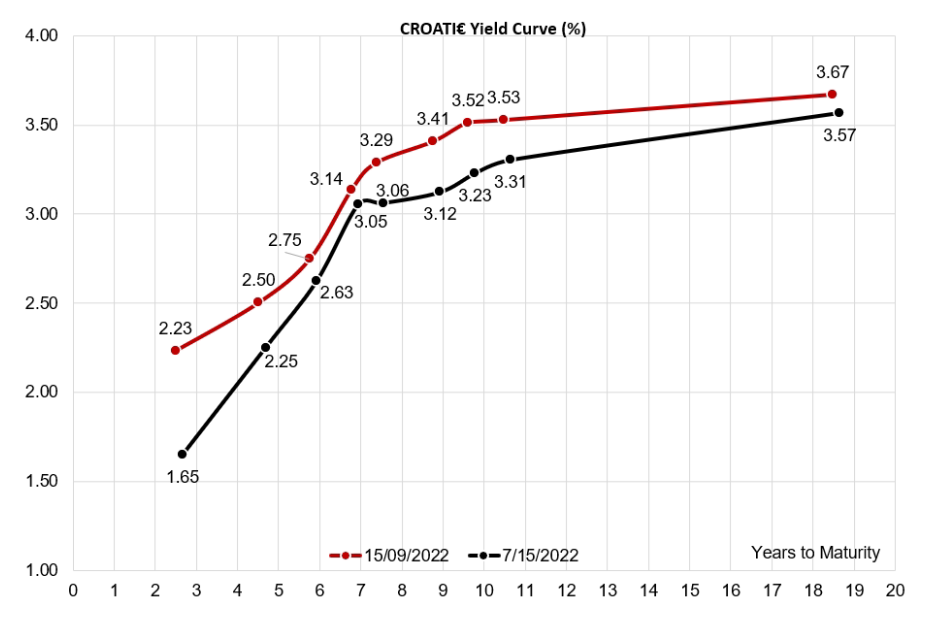

With the current setup, we don’t believe much room for tightening and with 50bps of NIP for instance (i.e. IPTs would tighten by merely 12bps) the yield would net some 4.40% YTM on the 7Y paper (440bps=252bps EUSA7 + 138bps fair credit spread + 50bps NIP). For reference, Croatia is rated one notch better and is currently traded at 3.14% YTM on the same spot on the curve. Does this mean new BGARIA 09/23/2029€ is a buy?

We advise caution on this particular paper. The reason is that although BGARIA€ holds a certain scarcity value, it’s still placed by a country with complex political conditions and is placed in times of globally rising interest rates. With accelerated QT in the United States and still no conclusive evidence that US liquidity is getting drained out of 2.2tn USD RRF (the so-called “well behaved QT scenario”) spelling deteriorating liquidity conditions even in the USA, it might be the case that only real money accounts buy these two placements (BGARIA 09/23/2029€ and BGARIA 09/23/2034€). We would like to remind you that with central banks exiting the bond market one way or the other, global bond markets are searching for a new marginal buyer. This buyer might come in form of domestic EA investors reducing their USD assets because of high FX hedging costs and returning back to EBG/EA IG, however, to see that happen we would need to see a radical improvement in EU fundamental macroeconomic outlook.

Sometimes the smartest move to make is to do nothing or start deploying hedging strategies against more rapid interest rate rises. Let’s wait and see.

The mentioned buyback program started on 15 September 2022 and will last until 15 September 2024.

Arena Hospitality Group held the meetings of the Management and Supervisory Board in which the Group approved the launching of a Treasury Share Buyback Program with the intention to purchase up to 100,000 of its shares. The mentioned buyback program started on 15 September 2022 and will last until 15 September 2024. Note that the Company is not obliged to purchase the shares at any time but will act as purchaser depending on the market conditions.

We are also proud to announce that share buyback program for Arena Hospitality will be conducted by InterCapital Securities.

In accordance with the decisions approving the program, the purchase price for the shares should not be above 10% or below 10% of the average market price for a share achieved during the previous trading day. The program can be executed through the trading system of Zagreb Stock Exchange (in and outside the order book).

Today, we decided to present you with a brief overview of SBITOP constituents’ free float.

In our analysis we considered free float to equal all individual shareholdings lower than 5%, while pension funds and UCITS funds were considered as free float regardless of their shareholding percentage.

Free Float of SBITOP Constituents (%)

Among the SBITOP constituents, five of them have a free float higher than 50%, while the other five constituents are still mostly held by a small group of majority shareholders. Of the constituents, Salus and Krka have by far the highest free float amounting to 84.1% and 73.1%, respectively. On the other hand, Luka Koper, Telekom Slovenije, Sava Re and Triglav have less than 50% of free float. Unior and Luka Koper have a free float of 42.8% and 37.9%, respectively. They are followed by Telekom Slovenije with a free float of 31.9%, and Triglav being the last on the list with a free float amounting to 30.7%.

Comparing both medians and mean of the free float of CROBEX and SBITOP constituents, as main indices on ZSE and LJSE, a similar situation occurs. Free float of SBITOP constituents median amounts to 49.9%, while CROBEX median for the same parameter amounts to 46.8%. Meanwhile, the mean for SBITOP constituents amounts to 51%, while the mean for CROBEX amounts to a slightly lower number of 48.9%. The important thing to stress out is that the data range for CROBEX constituents is wider and has a higher deviation than the data range for SBITOP constituents, which shouldn’t come as a surprise as CROBEX has more constituents within the index itself.

We should emphasize that the Prime market is the most demanding market on the Ljubljana Stock Exchange regarding the requirements set before the issuer. It is worth noting that it requires the issuer to fulfill additional liquidity criteria, which will result in greater volume, a higher number of trades and therefore reducing “hidden” costs (like high bid-ask spread resulting from illiquidity).