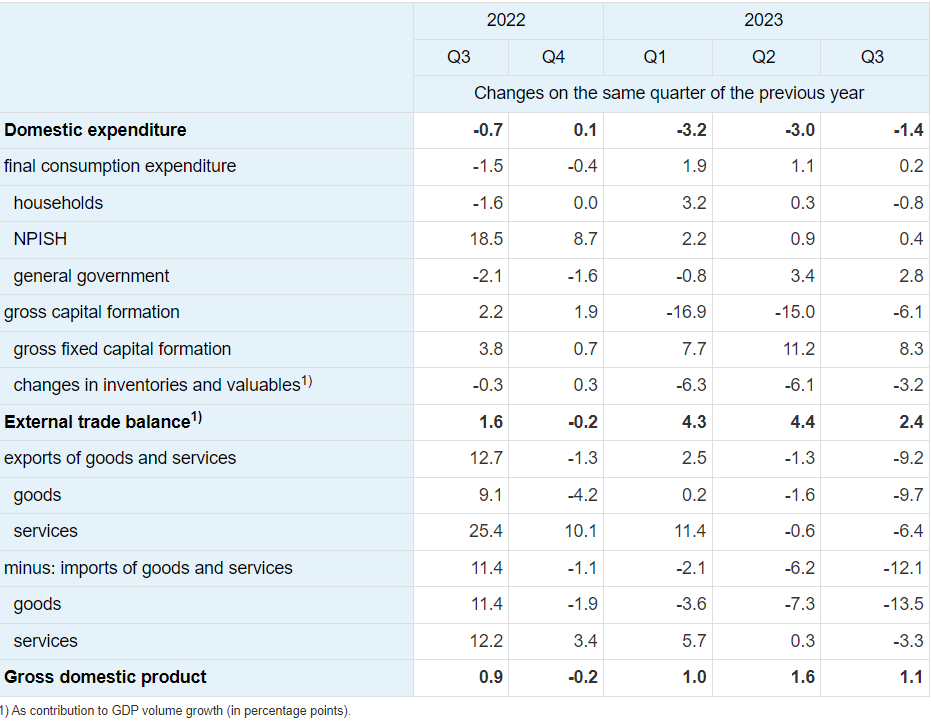

According to the latest GDP release by the Slovenian Statistical Office, GDP growth on a YoY basis slowed down to 1.1% in Q3 2023. Furthermore, during 9M 2023, it grew by 1.3% YoY.

The latest data for the Slovenian GDP has been released yesterday. According to the release, a significant decrease in imports and exports has been recorded during Q3. In fact, imports decreased by 12.1% YoY, while exports decreased by 9.2%. This also meant that the external trade balance amounted to EUR 1.15bn, and contributed 2.4 p.p. to GDP volume growth.

In terms of domestic expenditure, it decreased by 1.4%. Breaking this down further, final consumption expenditure increased by 0.2%, while fixed capital formation declined by 6.1%, mainly due to a decrease in inventories. Furthermore, gross fixed capital formation grew by 8.3%, mainly due to an increase in investments in buildings and structures. Finally, household consumption expenditure decreased by 0.8% YoY.

GDP by expenditures, constant prices, growth rates (%)

Source: SURS, InterCapital Research

All taken together, this led to a slowdown in the Slovenian GDP growth, as it grew by only 1.1% YoY in Q3 2023, and by 1.3% YoY in the first 9M 2023. If we were to look at the value added by activities, the largest growth rate was recorded by the Construction segment, which grew by 18.4% YoY in Q3 (21% in Q2 2023), contributing significantly to overall growth. Besides this category, no notable increases have been recorded, with most categories ranging from 0 to 2% YoY growth. On the other hand, the largest YoY decrease was recorded by financial and insurance activities, which declined by 3.6% YoY, while in Q2 2023 they grew by 9.7%. This segment was surely under the influence of the natural disasters that affected Slovenia in July and August, which led to higher insurance claims and higher costs across the board.

Slovenian GDP YoY growth rates (quarterly, real GDP growth rates, Q1 2015 – Q3 2023, %)

Source: SURS, InterCapital Research

By the end of September 2023, the NAV of Croatian pension funds amounted to EUR 19.3bn, increasing by 0.4% MoM, 10.5% YTD and 12.4% YoY.

Recently, the Croatian Financial Services Supervisory Agency, HANFA, released its latest report on the performance of the Croatian capital markets, including data on the performance of the Croatian pension funds. According to the report, the NAV of Croatian pension funds amounted to EUR 19.3bn, increasing by 0.4% MoM, 10.5% YTD, and 12.4% YoY. During the same month, the net contributions into the funds amounted to EUR 109.6m, while on a YTD basis, it amounted to almost EUR 924m.

Croatian mandatory pension funds AUM structure change (January 2018 – September 2023, EURm)

Source: HANFA, InterCapital Research

Moving on to the asset structure of the funds, on a MoM basis, the largest absolute increase was recorded by bonds, which increased by 1.4%, or EUR 168m to EUR 12bn. Following them there are other assets category, which increased by more than 2x, or EUR 18m to EUR 36m. On the other hand, deposits and cash decreased by EUR 55m, or 8.7% to EUR 575.6m. Inv. funds also decreased by EUR 26.6m, or 1.2% to EUR 2.15bn.

Meanwhile, on a YoY basis, the largest increases were recorded by share as well as bond holdings, which increased by EUR 919m (or 27.4%), and EUR 890m (or 8%), respectively. Inv. funds and the money market holdings also increased, by EUR 348m (or 19.3%), and EUR 109m (or 79%) YoY, respectively. On the other hand, deposits and cash declined by EUR 105.6m or 15.5%, while the other assets category decreased by EUR 78.9m or 69% YoY.

Looking a bit closer at the securities and deposits, in total they amounted to EUR 15.2bn in September 2023, increasing by 6% YoY, and remaining unchanged MoM. Of this, domestic securities and deposits accounted for 89% of the total, increasing by 4% YoY, while foreign securities and deposits accounted for the remaining 11%, with an increase of 4% YoY. Both domestic and foreign securities and deposits remained unchanged MoM.

Current AUM of Croatian mandatory pension funds (September 2023, % of the total)

Source: HANFA, InterCapital Research

In terms of the current asset structure of the pension funds, the vast majority of the total asset amount (62.6%) is held by bonds, with an increase of 0.62 p.p. MoM, but a decrease of 2.62 p.p. YoY. Following them there are shares at 22.1%, remaining roughly unchanged MoM, but increasing by 2.59 p.p. YoY. Finally, there are inv. funds, which hold 11.1% of the total, decreasing by 0.18 p.p. MoM, but increasing by 0.64 p.p. YoY.