Last week, we presented you with an overview of FY results of major (listed) Croatian banks: ZABA, PBZ and HPB, which you can find on the link here. As observable from that blog, the banks faced similar challenges in 2020 due to the Covid-19 pandemic. For today, we decided to take a step back and present you with a brief summary of CNB’s Macroprudential diagnostics for Q4 2020.

The Croatian National Bank noted in their Macroprudential diagnostics that the exposure to systemic risks in the Q4 of 2020 remained high. Compared to the Q3 estimate, there was an increase in short-term risks in the non-financial sector. Risks in the non-financial private sector increased further in Q4 from an already raised level, with corporate weakness in affected activities largely depending on dynamics of the economic recovery and the efficacy and duration of the measures intended for easing the economic impacts of the crisis. Meanwhile, the buffers accumulated in previous years coupled with the package of government measures enabled them, so far, to weather the pandemic.

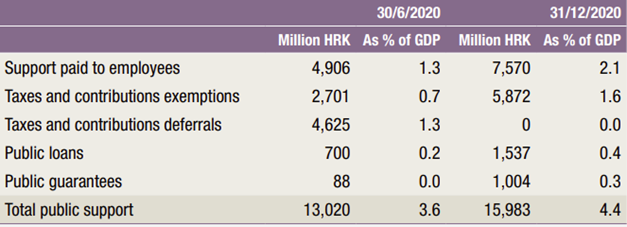

In H1 of 2020, companies reduced liquidity difficulties by using the moratoria on the existing loans and new liquidity loans, with many companies receiving direct government support to finance a part of their obligations. The fiscal policy measures in the form of direct government support, guarantees and public loans to non-financial corporations and their employees amounted to approximately 4.4% of GDP or HRK 15.98bn. The majority of that amount was provided in the form of support paid to employees (HRK 7.75bn) for companies with a significant fall in income. Taxes and contributions exemptions follow with HRK 5.87bn.

Public measures of support to companies affected by COVID-19

Source: Croatian National Bank

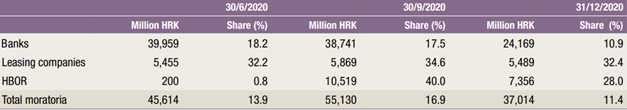

Turning our attention to moratoriums, amid the outbreak of the pandemic, the banks started granting temporary payment deferrals to debtors unable to meet their due loan payment obligations. According to CNB, total moratoria as of end 2020 reached HRK 37bn, representing 11.4% of all loans. To be specific, aprox. 17% of corporate loans and less than 3% of household loans were under moratoria as of year end.

According to bank data for end-September, by end-2020 almost two thirds of the moratoria granted to households should have expired; by end-2020 slightly below one half of the longer moratoria granted to non-financial corporations should have expired; and by end-September 2021 a further 44% of them will expire (probably mostly those granted to debtors in the tourist activity). We also note that as of end 2020, NPL ratio stood at 5.4%, showing a slight decrease 0.1 p.p. YoY. However, in 2021 it is reasonable to expect an increase in the ratio following the expiration of moratoriums. To put things into a perspective, total moratoria exceed non-performing loans by 1.75x (as of end 2020).

Moratoria on debtors’ obligations to financial institutions

Source: Croatian National Bank

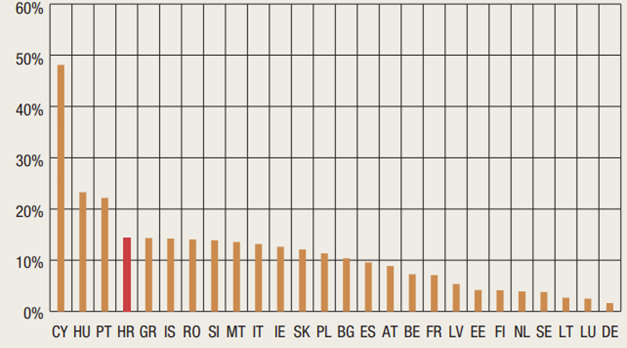

We also note that when looking at the share of the moratoria in total loans, credit institutions in Croatia in mid-2020 were among the top EU member states, behind only Cyprus, Hungary and Portugal. This indicates that the pandemic could have a bigger negative impact on bank operations in Croatia than in the rest of Europe.

Comparison of the share of COVID-19 moratoria in total household and corporate loans of banks

Source: Croatian National Bank

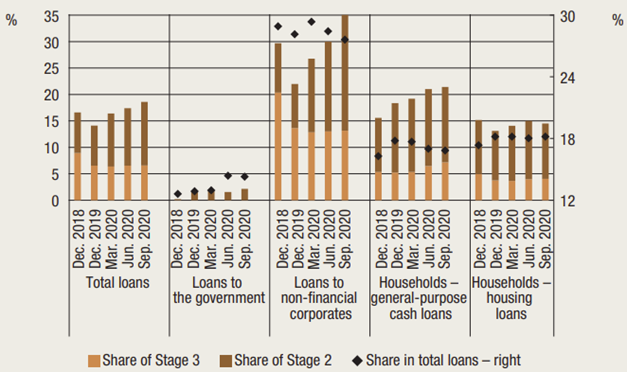

In the Q3 of 2020, credit risk continued to materialize in performing exposures with loans in Stage 2 (in total loans) reaching 12% vs 7.6% in 2019. This was mostly influenced by developments in the segment of non-financial corporations (increasing from 8.4% in 2019 to 21.9%). As a result of the adjustment of the rules on classification relating to granted moratoria, the share Stage 3 (non-performing exposure) in total loans continued to hold steady. Consequently, in the 9M of 2020, the share of total bank loans with increased credit risk rose from 14.1% by 4.5 p.p. to 18.6%. Together with the surge in costs of impairments of financial assets, the aforementioned increase in credit risk (Stage 2) was one of the reasons of the sharp drop in net profit of banks in 2020 (-53.1% YoY). The drop was also due to increased costs of provisions for non-performing cash loans to households as well as a fall in net operating income (lower net interest income and income from dividend of subsidiaries).

Loan quality by portfolio and share of credit portfolio in total bank loans

Source: Croatian National Bank

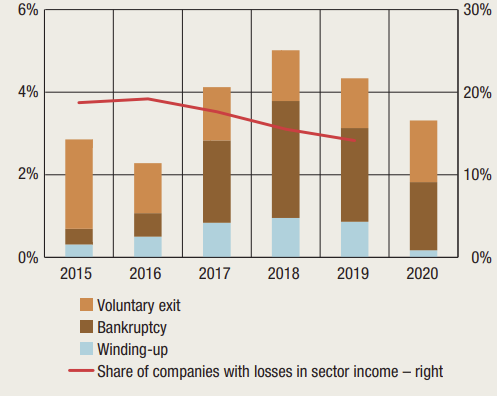

If we were to take a closer look at how Croatian companies operate, we can note that roughly 20% of the companies keep on generating losses, while in 2019 that figure was at roughly 14%. In 2020 the market observed the lowest company exits since 2016. However, such a figure might be misleading arguably due to moratoriums. Besides that, the Central Bank notes that the pandemic and the earthquakes slowed down court proceedings and consequently the exit from the market of companies with unsustainable operations was also slower.

Share of companies exiting the market

Source: Croatian National Bank

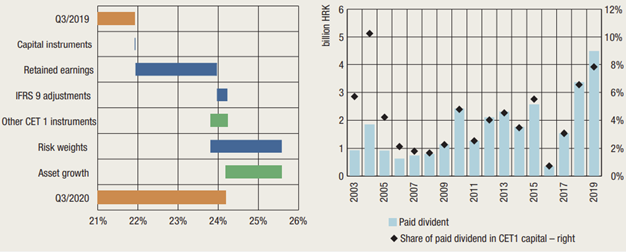

Lastly, we note that the Croatian banking system entered the pandemic highly liquid and well capitalized.

The increase in the CET 1 ratio by 2.3 p.p. YoY up to September 2020 was mostly driven by the CNB’s order on the inclusion in the capital of the profit generated in 2019 (up by 2.0 p.p.) and the effects of changes in the European regulatory framework (“quick fix”) towards the end of the Q2 of 2020 (total increase of 1.6 p.p.).

The re-introduction of the temporary possibility of use of the 0% risk weight for exposures to the Republic of Croatia denominated in EUR, together with the profit retention, had the biggest positive impact on CET 1.

However, the fall in the CAR was driven by increased assets as a result of higher lending. The Central Bank notes that had the trend of distribution of almost the entire profit through dividends continued in 2020 and had the regulatory changes introduced under the “quick fix” not been introduced, the CET 1 ratio in 2020 would have declined and certainly fallen below 20%. When observing two largest Croatian banks – Zaba and PBZ; both operate with a very high CET 1 of 33.16% and 28.99%, respectively.

Increase in the CET 1 ratio in 2020

Source: Croatian National Bank

At the current share price dividend yield is 4.4%, while ex-date is 9 June 2021.

BVB published the Convocation to the GSM in which the Board of Governors proposed the distribution of net profit from 2020. The shareholders will be voting on the approval of the distribution of Company’s net profit achieved in 2020, amounting RON 9.12m as follows: the disbursement of RON 528k for legal reserve and distribution of RON 8.59m as dividends. This translates into a dividend per share of RON 1.0672, implying a dividend yield of 4.4%.

Note that the ex-date is 9 June 2021.

The dividend payment is subject to approval at the GSM, which will be held of 19 April 2021.

Below we are bringing you an overview of the Company’s historical dividends per share and dividend yields.

Dividend per Share (RON) & Dividend Yield (%) (2016 – 2021)