In 2020, the company estimates a decrease in sales 9% and a decrease in net profit of 38%. Meanwhile, in 2021, Luka Koper expects a 6% YoY increase in sales and a 3% decrease in net profit.

On Friday Luka Koper published their FY 2020 and FY 2021 estimates which can be found below.

FY 2020 Estimates

Luka Koper noted that the throughput of containers is stable, whilst the throughput downturn will mark other product groups. The impact of the pandemic in liquid cargoes is directly resulting from the reduced sale of oil products, mainly in the aviation industry. The decline in vehicle production has affected the whole supply chain, which is reflected in the general cargoes throughput, and namely in iron ore products for car industry and at the bulk cargoes terminal, where raw materials destined to the steel industry are handled. Bulk cargoes are affected by the reduced consumption of the thermal coal as result of higher environmental taxes on emissions. In addition to the above stated, the competitivity of neighbouring ports and difficulties in the railway connection between the Port of Koper and the hinterland in previous years have been increasing, and consequently some logistic companies established alternative connections. The throughput of cars from the half-year 2020 onwards has been even rising, mostly due to the export to the Far East. Therefore, it is estimated that in 2020, the maritime throughput the Group should achieve 19.5m, which is a decrease of 14% YoY and 19% below the plan.

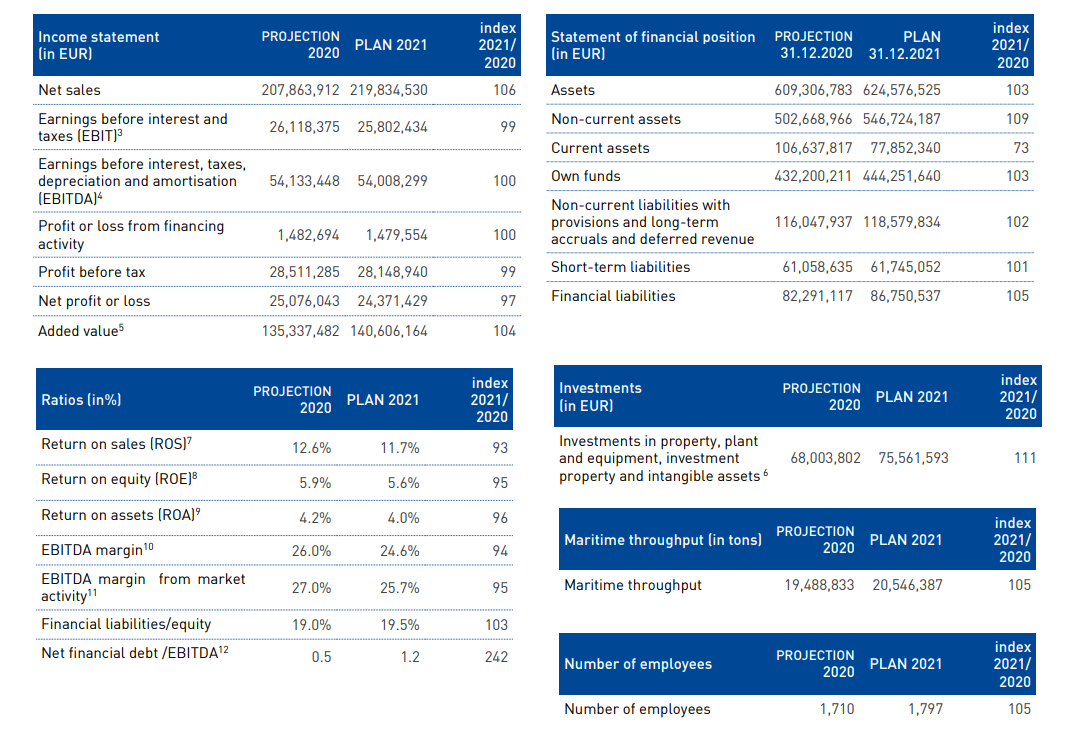

Net sales of the Group in 2020 are expected to amount to EUR 207.9m, which is a 9% YoY decrease and 13% below the plan. Meanwhile, EBITDA is estimated at EUR 54.13m, which puts EBITDA margin at 26%. Going further down the P&L, EBIT should amount to EUR 26.1m, noting a decrease of 42% YoY and is lower by 21% compared to the plan. Net profit is expected to drop by 38% YoY to EUR 25.1m. Such a figure is 21% below the company’s plan.

The company noted that the the estimates take into account the Covid-19 pandemic and related measures, economic downturn and higher labour costs due to higher number of employees as result of implementing the port service provision strategy.

FY 2020 & 2021 Estimates

Source: Luka Koper Group

FY 2021 Estimates

Luka Koper notes that with the favourable projection of the economic growth and on the basis of the estimates of global logistic providers, in 2021, the Group expects a 6% YoY increase in net sales to EUR 219.8m. Meanwhile a 5% increase in total maritime throughput is expected on the back of all product groups.

When looking at throughput by segments, Container throughput is expected to increase by 3% YoY (measured in container units TEU). Container shipping companies project a gradual throughput growth to the level from 2019 for the Northern Adriatic area in the beginning of 2021, since trade flows should be redirected from the air cargo traffic to the maritime transport, whilst the return to normal situation is foreseen in 2022.

Furthermore, among the European car ports, Luka Koper recorded the lowest fall in car transhipment. Alongside the economy recovery in 2021, the car sales rise is expected in 2021. In the strategic product group of cars, 8% increase is projected in 2021 in the car transhipment,

In 2021, the Group, is expected to see a relatively flat EBITDA and EBIT, while and net profit is expected to decrease by 3% to EUR 24.37m. Despite the planned growth of net sales, such results are expected to be affected by the State aid in compliance with the Act determining the intervention measures to contain the COVID-19 and mitigate its consequences for citizens and economy ZIUZEOP (COVID-19) and lower labours cost from performance bonuses in 2020.

In 2021, Luka Koper notes that they will continue the undertaken investments in the port infrastructure which are primarily related to the increase of the container terminal capacities. In the Q1 of 2021, the first stage of the extension of the Pier I will be completed, and namely the extension of the quayside for 100 meters. The works will continue with the construction of the second stage, which will be implemented at the end of 2022 and in which additional storage areas at the Pier I, measuring almost 25,000 m2 are planned. In Q1 of 2021, the garage with 6,000 parking lots will be constructed and will be ready for electric vehicles storage as well which have specific needs in terms of power supply and internal logistics. In the same period, a new, third truck entrance to the Port is projected to be put in use. This should help internal logistic and faster access for container trucks.

On Friday, Ericsson NT went ex-date, while the share price dropped by 2.65% to HRK 1,470 per share.

As a reminder, Ericsson Nikola Tesla held the Extraordinary General Meeting last week in which the shareholders of the company approved the dividend payment of HRK 49 per share. This translates into a dividend yield of 3.2%. Such a dividend per share is 31% lower than the one paid in the previous year.

As a reminder, in mid-May the Management and Supervisory Board of the company proposed HRK 95.51m to be allocated to retained earnings, while later in October proposed the aforementioned dividend payment.

In the graphs below, we are bringing you a historical overview of the company’s dividend per share and dividend yield.