After a tough summer for the bond market with yields skyrocketing and the absence of talks about easing the monetary policy, markets decided to provide a little bit of relief at least in the last week. Yields have certainly been in a strong uptrend since May, but it seems that the relief and the reversion of the trend may happen until the end of the year.

Since the 4th of October when yields reached multi-year highs, they dropped significantly. Bund yield fell from its intraday high of 3.02% to 2.73% in a matter of a week. The US 10-year Treasury yield reached a high at the level of 4.88%, also followed by a plummet to 4.57%. I would argue that it happened due to two different reasons. Firstly, West Intermediate crude oil (WTI) fell from an intraday high of 95.03$ on the 28th of September to 84$ which alleviated the market’s concerns about the secondary inflation wave led by rising oil prices. Secondly, new global uncertainty emerged as the Israeli-Hamas war started and the regional escalation may be the headline tomorrow. Flight to safety pushed the bond prices up swiftly. However, regional escalation is both bullish and bearish for bonds. Bearish as the oil prices due to Iran’s and Saudi’s possible involvement may push oil prices significantly higher and bullish as the war would strengthen the flight to safety mood.

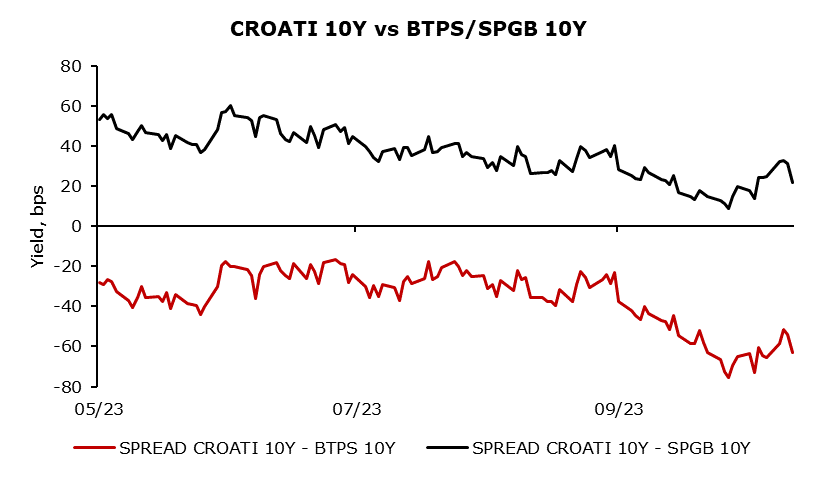

Bonds of the peripheral countries in Europe such as Italy, Spain, and Croatia have appreciated less than Bunds resulting in widening the spreads as the move in bonds was towards core countries. The spread between the Bund and the 10Y Italian Bond briefly reached 207 bps on the 6th of October, but it has been narrowing since then. A huge headwind for the mentioned spread is the higher Italian deficit than previously expected which even spurred concerns of Italy and France entering an Excessive deficit procedure in 2024 if the program restarts in 2024 based on deficits at the end of 2023. 10Y Spanish bond is following the same trend as Italy due to both countries having significant portions of their debt under ECB programs such as PEPP. In the case of active QT or at least speeding up the passive QT, selling pressure on both Italian and Spanish bonds would be notable. On the other hand, this would not influence Croatian bonds as there are no Croatian bonds held under the ECB programs. Fleeing from Italy and Spain would probably incentivize investors to leave Croatian bonds too, but the magnitude should be lesser than in Italy and Spain. That implies that the spread between Croatian bonds or Croatian bonds and Spanish bonds should narrow further. Also, the 10Y Treasury – Bund spread widening swiftly should continue as long as the data from the US economy stays positive and above expectations and the economic outlook in Europe stays gloomy. Furthermore, the much higher issuance of Treasuries this year is pushing Treasury yield further up which is not the case in Europe.

The bond market experienced a challenging summer with surging yields, but there’s been relief in the past week, and a trend reversal may occur by year-end. Yields in the US and Germany dropped from multi-year highs in early October due to falling oil prices and escalating regional tensions. The Israeli-Hamas conflict had a dual impact on bonds, offering both bullish and bearish influences. Peripheral European countries like Italy, Spain, and Croatia saw less appreciation in their bonds compared to core countries, widening spreads. The 10Y Treasury – Bund spread is widening due to favorable US economic data and a gloomy European economic outlook, coupled with increased Treasury issuance.

Source: Bloomberg, InterCapital

According to the flash estimate, Romanian GDP in real terms increased by 1% YoY in Q2 2023. Looking at expenditures and its GDP growth contribution, Gross fixed capital formation contributed 2.3 p.p., while the final consumption expenditure of the General government contributed 1.6 p.p. to total GDP growth. Taking development for both quarters this year, the Romanian GDP amounted to RON 695.8bn and grew 1.7% in real terms during H1 2023.

Yesterday, the Romanian Institute of Statistics published its quarterly GDP flash estimate for Q2 2023. According to the estimate, Romanian GDP in real terms increased by 1% YoY and amounted to RON 396bn in Q2 2023. Taking development for both quarters this year, the Romanian GDP amounted to RON 695.8bn and grew 1.7% in real terms during H1 2023.

Seasonally adjusted quarterly Romanian GDP development [2000=100, base ; 2000 – Q2 2023]

Source: Romania national Institute of Statistics, InterCapital Research

Breaking this down by expenditure items, the biggest contributor was Gross fixed capital formation, which contributed by 2.3 p.p. to total overall GDP growth. Final consumption expenditures of the General government further amplified growth by 1.6 p.p. contribution to GDP growth. However, Change in inventories partially offset the growth in expenditures, weighting down the total GDP growth by 3.9 p.p. Net export contributed positively by 1 p.p., as imports noted a more pronounced decrease compared to Exports, resulting in an overall better net export position.

GDP growth contribution by expenditures

| wdt_ID | ||

|---|---|---|

| 1 | Total final consumption | 1,60 |

| 2 | Actual individual consumption of households | 0,00 |

| 3 | Final consumption expenditure of households | 1,10 |

| 4 | Final consumption expenditure of Non-profit institutions serving households | 0,00 |

| 5 | Individual final consumption expenditure of General government | -1,10 |

| 6 | Collective final consumption expenditure of General government | 1,60 |

| 8 | Gross fixed capital formation | 2,30 |

| 9 | Change in inventories | -3,90 |

| 11 | Net export | 1,00 |

| 12 | Export of goods and services | -0,30 |

| 13 | Import of goods and services | -1,30 |

| 14 | GDP | 1,00 |

Source: Romania National Institute of Statistics, InterCapital Research

Last week we wrote about expectations published by the World Bank, where they estimated the Romanian GDP to grow by 1.8% YoY in FY 2023. The growth should come on the back of private consumption as well as EU funds’ aided investment. This outlook depends on several factors, including the extent and duration of the war in Ukraine, as well as its repercussions on the European economy, combined with the fluctuations in global prices and domestic inflation. Furthermore, Romania’s ability to efficiently absorb the EU funds will be critical for future growth in the upcoming years. So far, the current H1 growth of 1.7% is in line with the World Bank’s expectations.

World Bank current key indicators and forecast for Romania (2022 – 2025, %)

| wdt_ID | Indicator | 2022 | 2023e | 2024f | 2025f |

|---|---|---|---|---|---|

| 1 | Real GDP growth, at constant market prices | 4,70 | 1,80 | 3,70 | 3,90 |

| 2 | Private consumption | 5,50 | 3,70 | 4,50 | 4,80 |

| 3 | Government consumption | 4,30 | 2,90 | 1,40 | 1,20 |

| 4 | Gross fixed capital investment | 8,00 | 7,90 | 7,20 | 7,50 |

| 5 | Exports, goods and services | 9,60 | 0,70 | 5,80 | 6,30 |

| 6 | Imports, goods and services | 9,90 | 1,20 | 7,50 | 8,00 |

| 7 | Inflation | 13,80 | 10,10 | 5,40 | 4,20 |

Source: World Bank, InterCapital Research