Last week, NLB held a 2-day event, including the Investor Day, during which it unveiled its new business strategy until 2030. The goals in the 2030 Strategy include reaching over EUR 50bn in assets by 2030, having recurring revenues of over EUR 2bn, profit of over EUR 1bn, a dividend payout ratio moving towards 50-60%, as well as a P/B ratio of over 1x. While these goals might seem ambitious, the track record of the Bank’s management in the last couple of years has proven that they can achieve their set goals. In this overview, we’ll detail the whole strategy and look at its feasibility from the current perspective.

While the 2030 Strategy might seem ambitious, it is set out across many initiatives in 3 segments: Retail, Corporate & Investment Banking, and Payments.

Retail

Starting with Retail, NLB currently holds the position of the largest bank in the SEE region, and its goal is to not only maintain but also expand the position. Thus far, this was achieved by growing the customer base to over 2.7m clients in the region, with just the Slovenian segment having over 700k clients. Also, NLB was able to grow at an 8% revenue CAGR thus far, with strong diversification (e.g. 30% fee contribution). Furthermore, the Group has diversified its services structure, offering investments, banc-assurance, leasing, payments, etc. to its clients.

The Group plans on expanding this further, reaching >3m clients by 2030 across all regions, growing the revenue per customer to over EUR 400 (2023: EUR 270), and achieving a revenue of EUR 1.3bn, implying a 9% CAGR until 2030. Furthermore, through digitalization efforts, they plan on reaching 80%+ digital penetration (currently: 39-60%).

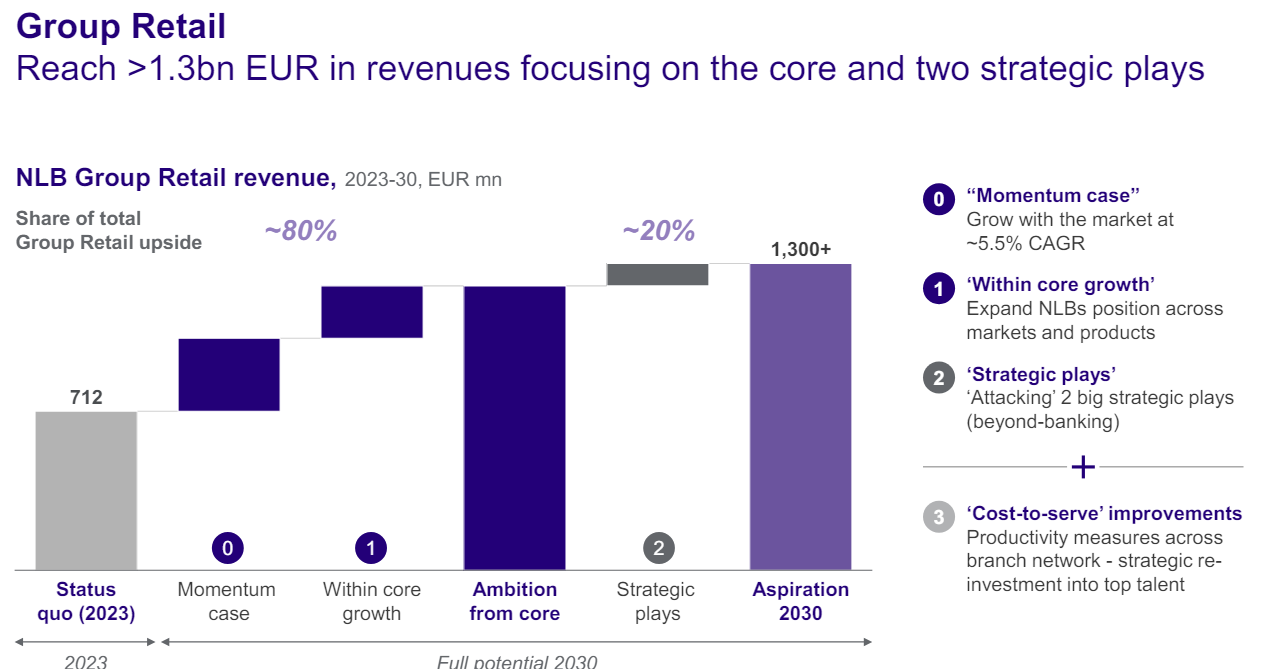

NLB Group retail revenue development until 2030 (2023 – 2030, EURm)

Source: NLB Group

Besides organic growth, the Group plans on 2 strategic plays (previous outlooks: 1 strategic play of up to 4bn RWAs).

NLB Group Retail segment initiatives

Source: NLB Group

As we can see in the two previous graphs, the Group has set out goals which at the current rate of development do not seem that outlandish, and they are aimed at expanding the current business, especially in the less-developed regional markets.

Corporate & Investment Banking

Meanwhile, in the Corporate & Investment banking (CIB) segment, NLB started by noting that the SEE region in general is growing faster than the EU in terms of real GDP, while at the same time, the regional companies are less indebted than the EU average. Suppose we combine the various EU funds’ contributions and the desire of SEE region countries to converge with the EU average (especially after the possible entry of more regional countries into the Union). In that case, it will mean that a lot of investments will have to be made in the coming years. These investments would of course have to be financed by debt, and NLB sees a strong opportunity for synergy in this regard.

Thus far, this has been supported by the fact that NLB has positioned itself as a strong CIB franchise in the region, with a clear market leadership position in Slovenia with app. 26% of loan market share. Furthermore, despite the challenging macroeconomic environment in the last couple of years, NLB was able to manage the risk well, resulting in both profitable book building as well as low NPL ratios. NLB plans on expanding its CIB playbook, which includes trade finance, corp. finance, as well as custody. If all goes as planned, they will be able to achieve EUR 3.2bn of new transition finance volume in 2030, EUR 500m in revenues, implying an 8% CAGR, <45% cost-to-income ratio, as well as a full (100%) digital onboarding for SMEs.

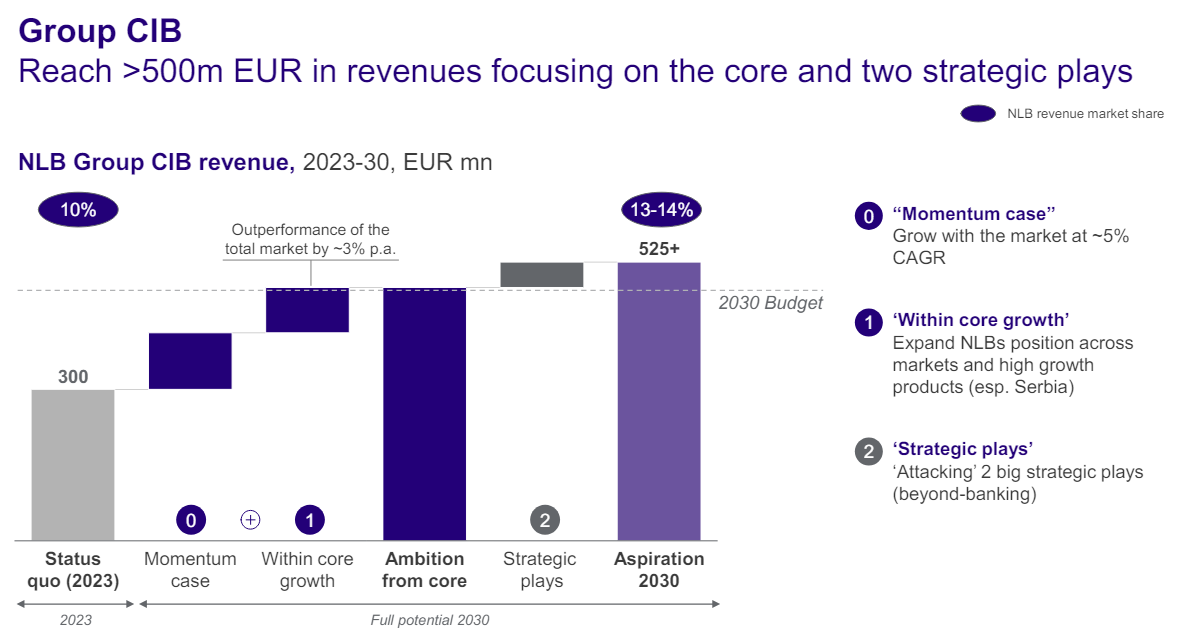

NLB Group CIB revenue development until 2030 (2023 – 2030, EURm)

Source: NLB Group

While no details were provided, the organic growth could once again be supported by 2 strategic plays. The full overview of the CIB strategic initiatives is available below.

NLB Group CIB segment initiatives

Source: NLB Group

If successful, NLB will be able to achieve revenue per active client of EUR 20k in 2030 (2023: EUR 12.5k), increase its fee income to over 37% of the total (2023: 27%), grow its total CIB stock loan volume from EUR 6bn in 2023 to over EUR 12bn in 2030, and achieve over EUR 1.3bn in Green financing stock (currently: EUR 0.3bn).

Payments

The last segment, i.e. Payments, was focused primarily on the transition from cash usage in the region towards a more cash-less society, and how NLB could position itself to take advantage of this. In general, regional markets still use cash far more than the EU average. Thus far until 2023, NLB has established payments as a core part of the Group, with EUR 220m+ of fee income, related to accounts, packages, cards, and payments. NLB also continues to be a regional front-runner for services such as instant pay, Apple Pay, Google Pay, merchant acquiring, and other digital payment innovations.

By 2030, they plan on rolling out more of these, with a focus on digital payments and merchant solutions. If this is achieved, by 2030 the Group will have >EUR 100m in incremental revenue, with >80% of mobile active by 2030.

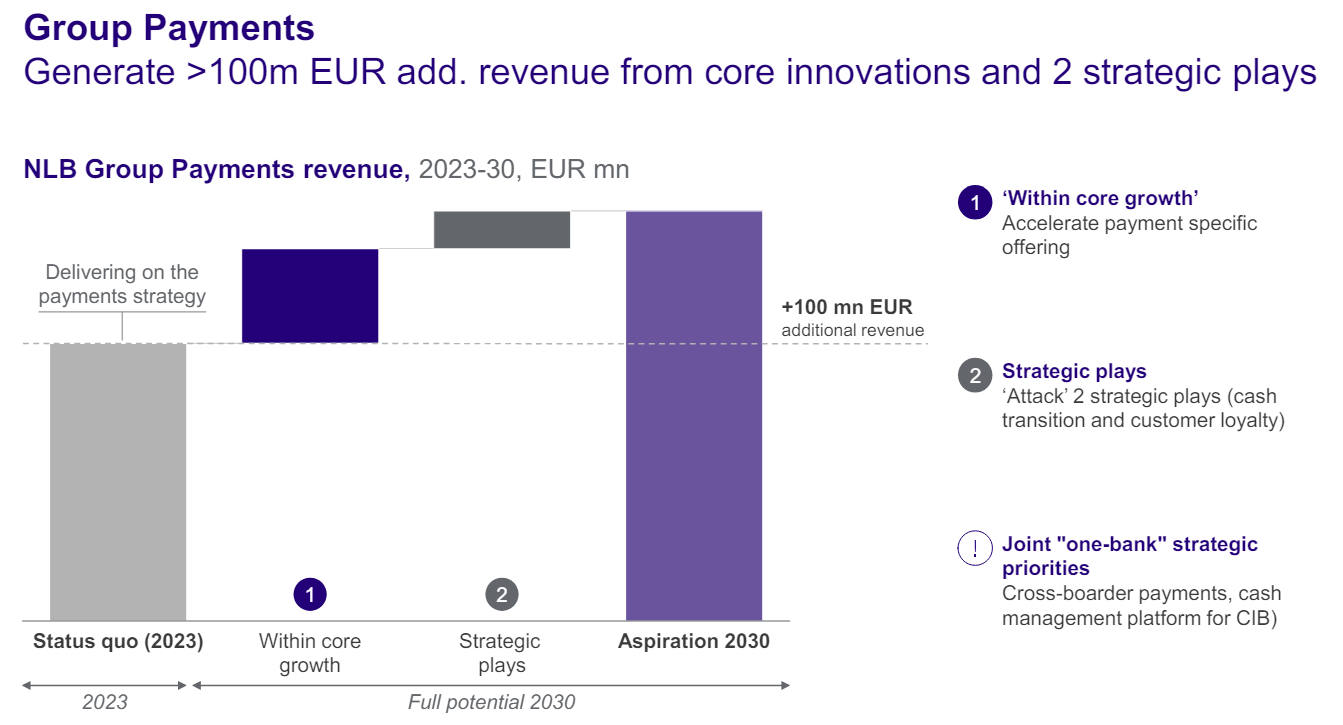

NLB Group Payments revenue development until 2030 (2023 – 2030, EURm)

Source: NLB Group

To achieve these developments, NLB provides six strategic initiatives, which we detail below:

NLB Group Payments segment initiatives

Source: NLB Group

If all of this is achieved, this segment’s revenue contribution will grow to over EUR 320m in 2030 from EUR 220m today. Retail clients’ digital penetration will reach over 80% (2023: 25-60%), with increased penetration of mobile value, increased number of digitalized card transactions, and a lower number of Retail cash transactions in the Group’s branches.

When all of the aforementioned initiatives and developments across the different Group segments are combined, NLB has set a goal for itself of achieving over EUR 50bn of assets, doubling from the current level, having recurring revenues of >EUR 2bn (2023: EUR 1.1bn), ROE of >15% (2023: 21%), a payout ratio that goes towards 50-60% (currently: app. 40%), and a P/B of >1x (currently: 0.8x).

While all of these goals seem extremely ambitious, they would be achieved over 5 and a half years, leaving a lot of room. One thing that is important to note is that a lot of the growth in the banking sector in general, but for NLB too in the last couple of years came from the elevated interest rates. While it isn’t exactly yet known how low the rates will be cut once the rate cut cycle ends, it is unlikely that they will land in the negative territory or at 0% as they were before. This could leave NLB room for growth toward its goals, but until we know where the rate cuts end, it is hard to say if will it be achievable. At the same time, the Group still has a lot of room for growth in its regional markets outside of Slovenia, and with a larger focus on digital services and reduction of costs from branches as a result, there are still headwinds behind the Group.

The wildcard is of course, in the strategic plays, i.e. M&As. Previous M&As by the Group were always done at P/B levels of <1x, and if such opportunities present themselves, this could give another strong push toward these goals. Furthermore, the resolution of the legacy issues in Croatia could also open opportunities for growth in the region, and NLB’s management hasn’t hidden the fact that they desire to unite the whole region under the Group. However, no clear targets have been communicated.

Still, if the goals set out in the strategy are achieved, strategic plays would account for “only” 20% of revenue production, meaning that they would be a boost on top and not the main driver. While a lot of people were surprised at the announcements made during the Investor Day, especially regarding the high ambitions of the goals, one must remember that the current Management has achieved all of the goals that they’ve set out in the last couple of years, and this also includes several upgrades to outlooks. As such, it might be too early to count them out. After all, like NLB’s CEO said: “It’s not rocket science”.

On Friday, Moody’s Investors Service (Moody’s) completed a periodic review of the ratings of Croatia. Croatia’s previous Baa2 Rating & Positive Outlook both remain unchanged.

On Friday, Moody’s Investors Service (Moody’s) completed a periodic review of the ratings of Croatia. Croatia’s Baa2 Rating & Positive Outlook, from the previous revision, both remain unchanged. However, Moody’s provided us with a rating consideration and rationale, which you can find below.

As the rating agency emphasized, Croatia’s Baa2 ratings are supported by a level of institutions and governance strength and fiscal strength that are higher than that of rating peers. Further, it was noted that high institutional effectiveness underpinned Croatia’s adoption of the euro in 2023, while the government debt burden remains on a declining trend.

Anyhow, despite our relatively high per capita income level, Croatia’s demographics remain its biggest challenge. The banking sector and geopolitical risks also remain constraints on the rating.

Moody’s expects Croatia to grow at one of the highest growth rates in the euro area, amounting to 3.3% in 2024. Headline government deficit is expected to expand to 2.5% of GDP in 2024 due to rising costs for public sector wages and pensions as well as loan-funded EU investment. However, Moody’s still expects the debt burden to decline to 59.2% of GDP at the end of 2024 from 63.5% at the end of 2023, while debt affordability metrics will also remain stronger than most rating peers. Moody’s also expects the new government formed following parliamentary elections on 17 April 2024 will provide broad policy continuity as the governing coalition will continue to be led by the Croatian Democratic Union (HDZ) which has governed Croatia since 2016.

Regarding Croatia’s outlook, the positive outlook reflects the increasing likelihood that Croatia’s debt burden will fall more significantly than previously expected, leading to further improvements in fiscal strength combined with improvement in institutional effectiveness through the effective implementation of the very significant package of investments and reforms under Croatia’s Recovery and Resilience Plan (RRP).

Finally, Moody’s noted that it would upgrade Croatia’s ratings if the government debt burden continues to fall more significantly than expected, while debt affordability is maintained. Effective implementation of Croatia’s RRP would also support Moody’s assessment of Croatia’s economic as well as institutions and governance strength, thus also supporting the case for an upgrade.

On the flip side, Moody’s would consider changing the outlook back to stable, and in an adverse scenario, to negative if there was to be a reversal in the trend of debt reduction, accompanied by a significant loosening of government fiscal policy. A significant weakening of the growth outlook relative to Moody’s expectations, as well as a weakening of Croatia’s ability to effectively implement our national RRP, would also support the case for a stabilization of the outlook. An increase in geopolitical risks negatively impacting the Croatian economy and public finances would also be credit-negative.

At the share price before the announcement, this would imply a DY of 3.1%. The ex-date and the payment date are yet to be announced.

On Friday, Equinox’s Board of Directors meeting was held, during which a proposal for the distribution of 2023 retained earnings was made. According to the proposal, EUR 3m will be distributed in the form of dividends, while EUR 10.3m will be carried forward. This would imply a payout ratio of 22.5%. On a per-share basis, this would imply a gross dividend of EUR 1.69. At the share price before the announcement, the dividend yield would amount to 3.1%.

This dividend represents an increase of 18.6% compared to the dividend distributed last year. Neither the ex-date nor the payment date has yet been announced. The dividend proposal is subject to approval by the GSM, which will be held on 12 June 2024. Below we provide you with the historical dividend per share and dividend yield of the Company.

Equinox dividend per share (EUR) and dividend yield (%) (2023 – 2024)

Source: Equinox, InterCapital Research