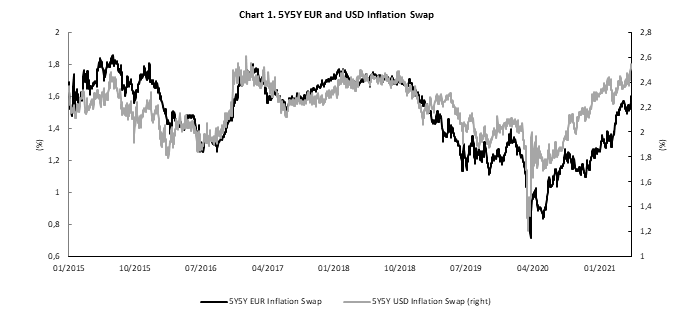

Yesterday’s US CPI surprised investors on the upside with price increase of 4.2% YoY, representing the fastest pace since 2008. Bonds were hit around the globe, but USD yield curve is still below its recent highs. In this brief article we are looking at the recent inflation data and the consequences on yield curves.

US Bureau of Labor Statistics released yesterday much awaited CPI data for April. Investors feared the number with the reason. CPI stood at 4.2% YoY, rising from March’s 2.6%. In terms of MoM performance, prices increased by 0.8%. Core CPI also surprised on the upside, rising by 3.0% YoY versus 2.3% expected and 0.9% MoM which is the largest monthly increase in the last 40 years. All the numbers look quite scary but let us look at some details. With the opening of the service sector, airline fares grew by 10.2% MoM, used cars and trucks’ price increased by 10.0% while accommodation prices were up by 7.6% MoM. On the other side, energy prices declined slightly by 0.1% MoM after rising in the last 10 months straight. Rents increased by ‘only’ 0.2% MoM while food prices were up by 0.4% MoM compared to 0.1% in March. To sum it up, pressure was most witnessed in the sectors that are seeing surge in demand due to the opening of the economy but eventually that trend should ease.

As CPI inflation at 4.2% is not already high enough, other high frequency data point to even higher number in the coming months due to several factors. Service sector in the United States has still a lot to recover while commodity prices are at their multi-year highs with some of the, like lumber, rising so much, they became internet meme. Companies could decrease their margins to stay competitive, but question is for how long. On the other hand, last week NFP shocked markets with only 266k increase versus 1 million expected, and March data was also reviewed lower. Unemployment rate actually increased from 6.0% in March to 6.1% in April vs. 5.8% expected. Market first reaction to the NFP was to buy bonds – US 10y yield breached 1.50% with short sellers covering their positions. However, on the second glance, NFP data revealed something more important, resulting in longer-term bonds ending the day in red. Namely, average hourly earnings increased by 0.3% YoY while they were expected to fall by 0.4% due to the specifically low base in 2020. On top of that, this week we saw number of job openings reaching record high of 8.1m in March compared to 7.5m expected. To sum up, surprisingly low NFP, combined with high JOLTS data and rise of hourly earnings point to the conclusion that labor market could become a drag on the economy and could push prices way higher. Mr. Biden had its say on the matter. POTUS stated that federal unemployment benefits do not discourage workers to come back to work, but employers should pay more decent wages. With most of the fiscal packages now delivered and federal unemployment benefits to last until September, we expect employment to increase in the coming months, but we could still see some shortages on the labor market which could be last nail for the ‘transitory’ rhetoric.

What did markets had to say on these scary numbers? Well, inflation expectations were rising for the last few weeks and once again overjumped 2.50% level. Yesterday of course, bonds were sold and US 10Y jumped by some 5bps reaching 1.70% mark. However, US treasuries are still not testing lows that we saw a month ago when US 10Y yield was above 1.75%. Back then some parts of the puzzle were priced to perfection. Fed is currently more focused on the labor market than on prices. Although it will probably downplay 4.2% price growth as being transitory, it sure will become harder for them to defend their stance in the following meetings.

Source: Bloomberg, InterCapital

At the current share price dividend yield is 7.2%. Ex-date is 30 July 2021.

Telekom Slovenije published the convocation to the GSM in which the Management Board proposed a e payment of dividends in the amount of EUR 26,021,912.00 or EUR 4.00 gross per share. Such a dividend per share is EUR 0.5 per share higher compared to the one paid in 2020.

At the current share price, dividend yield is 7.2%.

We note that ex-date is 30 July, while the dividend shall be paid on the 3 August 2021. The dividend payment is subject to approval at the GSM which will take place on 18 June 2021.

In the graph below, we are bringing you historical overview of the company’s dividends.

Telekom Slovenije Dividend per Share (EUR) & Dividend Yield (%) (2010 – 2021)

The share price closed at EUR 58.8 per share, representing an increase of 6.91% and marking its best day so far in 2021.

NLB has published their Q1 results on Tuesday after market close, showing higher than expected Q1 result. As a reminder in Q1 of 2021, the Group generated EUR 64.6m of profit after tax (+252.8%). Of that, KB contributed EUR 6.0m to the result. Note that a full company note is available for our research subscribers.

The market reacted very positively to the Q1 results, with share price closing at EUR 58.8 per share. This represents an increase of 6.91%, which notes the highest daily increase so far in 2021. Meanwhile, on a YTD basis the share is up by 28.4%.

NLB was yesterday the second most traded share on the Ljubljana Stock Exchange with a turnover of EUR 502.2k.

YTD Share Price Performance of NLBR

At the current share price dividend yield is 7.8%.

NLB published an announcement on the LJSE stating that they have received a counterproposal from VZMD (Pan-Slovenian Shareholders’ Association) regarding the profit distribution. To be specific, VZMD proposes EUR 92.2m to be appropriated for dividends, which translates into a dividend of EUR 4.61 per share.

At the current share price dividend yield is 7.8%.

As a reminder, Management Board proposed EUR 24.8m (EUR 1.24 DPS) of the distributable profit to be paid to the shareholders dividends in two instalments.

The first instalment in the total amount of EUR 12.0m immediately after the GSM (EUR 0.6 DPS), and the second instalment in the total amount of EUR 12.8m after 30 September 2021, if the payment or assumption of the obligation to pay the second instalment were not contrary to the regulations, which currently apply on domestic level from Bank of Slovenia (EUR 0.64 DPS). The proposed amount represents the maximum amount currently allowed by ECB, while the Bank’s ambition to distribute in total EUR 92.2m (EUR 4.61 DPS) out of 2020 Group profit remains in place.

In Q1 the company reported an increase in sales of 5%, increase in EBITDA of 10% and a net profit EUR 7.4m (+8%).

In Q1 2021, sales of Cinkarna Celje reached EUR 50.3m, which is an increase of 5% YoY and is 16 % above the plan for the period. Higher than planned sales in the Q1 are due to higher value of sales of titanium dioxide, copper fungicides, powder coatings and polymer services.

Total sales to foreign markets increased by 6% YoY. The increase in sales to foreign markets is undoubtedly due to higher quantities of pigment sold. In absolute terms, the most obvious increase is in sales to EU markets, which account for 74.6% of the total sales.

When looking at the sales program, sales of the titanium dioxide pigment program reached EUR 40.3m (80.2% of total sales). The company notes that changes in consumer habits during the epidemic towards the end of the year resulted in a significantly increased demand for pigment.

Sales of varnishes, masts and printing inks (9.2% of total sales) noted a sharp increase of 17% which is mainly related to the increase in the volume of sales of masterbatches and powder varnishes.

Turning our attention to operating expenses, cost of goods, materials and services reached EUR 27.4m (-1%). In relative terms, the most important is the increase in packaging costs, which are due to each customer requirements higher by 18%. The total direct cost of materials, energy and packaging is EUR 84k higher YoY, with a 1% reduction in production at constant prices. Labour costs noted an increase of 3% to EUR 7.3m.

As a result of all of the above EBITDA reached EUR 12.6m, representing an increase of 10%. Such a result puts EBITDA margin at 25%.

Going further down the P&L, Q1 of 2021, Cinkarna reported an operating profit of EUR 9.2m, representing an increase of 9% YoY (exceeded the business plan by 67%). In Q1 the company reported a net profit of EUR 7.43m, representing an increase of 8% YoY. Such a result is also 66% higher than the company’s plan.

Cinkarna Celje Key Financials (EUR)