Financial markets started 2023 on the right foot with most of the assets being in solidly positive territory driven by decelerating inflation data across the globe. Yesterday we saw another decline in US headline CPI to 6.5% but markets were rather flat due to traders front-running the data. In the first blog of the year, we are looking at the macro releases that have driven assets skyrocketing.

On the second working day of the year, Destatis informed us that inflation in Germany was lower compared to already decreased expectations. Namely, CPI in December stood at 8.6% YoY compared to 10.0% in November (9.0% consensus on Bloomberg) while in MoM terms prices decreased by 0.8%. Most of the European countries reported a deceleration in inflation hence Eurostat on the 6th of January reported that EA inflation decreased from 10.1% in November to 9.2% in December. There were several one-off drivers for the strong drop in inflation but the biggest one was obviously the energy complex that kept dropping due to warmer weather and recession forecasts. Core inflation overjumped both expectations and November’s levels but investors shrugged off this information and bought across the markets. That is, investors started to calculate a faster fall in inflation and some of the think tanks started to forecast that Europe could miss the recession meaning that ECB could lower rates faster than previously expected. EUR yields ended 2022 at the year highs and since December 30th, bund yield went from 2.56% towards yesterday’s 2.17% i.e., it fell by 40bps in only 6 working days. This means that bund futures were up by almost 600 pips in the same time span. However, Schatz and most of the short-term papers did not change much as they are priced as OIS, meaning they are mostly connected with ECB’s rates, resulting in the yield curve being inverted significantly (2-10y more than 40bps).

However, the first ten days of the year were even more interesting in equity markets with the DAX index being up by more than 7%. The drivers are obviously warmer weather and lower energy costs, lower inflation, and China reopening which is strongly positive for German exporting companies. DAX is currently standing at 15k, the level last time seen in mid-February 2022, and only 6% below the all-time high levels seen at the beginning of 2022. If I would say to you that we have a war in Europe, inflation stood above 10% just a month ago and the ECB is priced to set rates at 3.5% in the middle of this year, would you say that the equity market in Germany will be close to its highs? I doubt. But that is the beauty of the financial markets and their predicting forces.

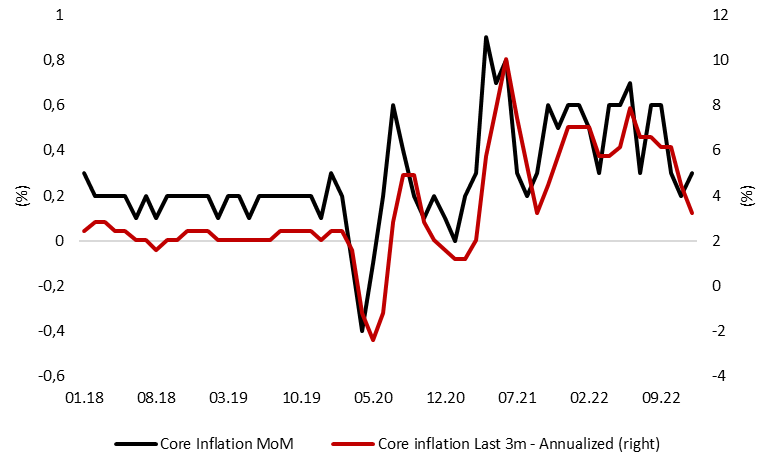

Back to CPI data, yesterday we saw that BBG consensus could sometimes be correct with all 4 data being spot on. Namely, US CPI in December stood at 6.5% versus 7.1% a month before, while core prices were 5.7% higher compared to December 2021. However, it is important to note that headline inflation stood at negative 0.1% MoM as gasoline prices slumped by 9.4% MoM. Core inflation stood at 0.3% MoM, 10bps above the level in November driven by a still strong rise of shelter growth which stood at 0.8% MoM. Many analysts are currently saying that prices of shelter have a lag of more than 12 months, meaning that prices of shelter are mostly overstated in CPI reports which are shown by several high-frequency data such as the Zillow report. In any case, the data showed that inflation is on a firm downward path and if we do not witness another energy crisis, inflation could reach 3-4% in the middle of this year. Markets did not move much, as the data met expectations although it is worth noting that both equity and bond markets already rallied before the release.

To conclude, 2023 started the year with all assets being in green, but as you may recall, that was the story in 2022 as well and then we witnessed one of the worst years for financial assets in history. We doubt that 2022 can repeat, especially for bond markets, but we witnessed markets overreact many times and I think that this could be another example of that, overreaction.

US Core CPI

Source: Bloomberg, InterCapital

Recently, Luka Koper Published its preliminary maritime throughput and revenue numbers, for the year 2022.

According to the Company’s preliminary data, in 2022, Luka Koper achieved EUR 309.4m of net sales revenue, an increase of 38% YoY. The total maritime throughout amounted to 23.2m, an increase of 12% compared to 2021. Growth was registered across all cargo segments, with the container and car segment reaching historic record volumes – more than 1m TEUs and 800k car units.

Breaking the maritime throughput even further, general cargo amounted to 1.31m tons, an increase of 16% YoY. Containers throughput amounted to 9.66m tons, at similar levels YoY. Cars throughput amounted to 1.39m tons, an increase of 27% YoY. Liquid bulk cargo throughput amounted to 4.64m, a rise of 39% YoY, while dry bulk cargo throughput amounted to 6.24m, an increase of 12% YoY.

Luka Koper maritime throughput (2022 vs. 2021, tons)

Source: Luka Koper, InterCapital Research

Luka Koper also recently published their summary of the 2023 business plan. According to the Company, they expect the 2023 maritime throughput to amount to 23.3m tons, an increase of 2% YoY, with growth expected across all commodity groups, excluding liquid cargoes. Maritime container throughput should amount to 1.08m container unit TEU, an increase of 5% YoY. Car transshipment should amount to 760k units, a 1% increase YoY.

Moving on to financials, lower revenue from storage is expected, 4% lower to be exact. EBIT should be 51% lower, while the net profit should be 50% lower. If you would like to read the entire 2023 business plan, click here.

In December 2022, the producer prices of industrial products on the domestic market increased by 19.9% YoY. On a monthly basis, however, they decreased by 2.6%.

Recently, the Croatian Bureau of Statistics (DZS) published the latest update regarding the industrial producer prices in Croatia, for the month of December 2022. According to the report, the producer prices of industrial products on the domestic market increased by 19.9% YoY in December 2022. However, the yearly data at this point does not tell us much, as the producer prices were already elevated in Q3, and especially Q4 of 2021. As such, looking at the monthly data is more prudent as it can show us if the price growth is accelerating, or decelerating.

As such, on the monthly basis, the producer prices of industrial products actually decreased, by 2.6%. Also, looking at the producer prices without Energy, which has been by far the largest contributor to the price growth makes sense. Excluding Energy, on a monthly basis, the prices actually increased by 0.8%, while on a YoY basis, they increased by 11.5%.

What does this mean? It means that Energy price decrease is one of the main deflationary drivers on the MoM basis, and this is something that could have been seen in the last quarter of 2022, as prices of oil, and especially gas stabilized to levels last seen before the Russian invasion of Ukraine. In fact, the above-average warmth in Europe during December, and as it currently stands in January, means that there is a lot less electricity and heating requirement than one would expect. Combined with the demand reduction (on the EU level, an avg. of 15%) already communicated during the summer, this led to the reduction in the aforementioned commodity prices, and by extension, electricity prices.

Producer prices of industrial products (June 2016 – December 2022, %)

Source: DZS, InterCapital Research

Moving on to changes by segments, on an MoM basis, prices of Non-durable consumer goods increased by 1.7%, Capital goods increased by 0.1%, while on the other hand, Energy decreased by 9.2%, Intermediate goods by 0.3%, while remained stable in Durable consumer goods. Meanwhile, on a YoY basis, producer prices of industrial products in Energy increased by 43.5%, in Non-durable consumer goods by 14.5%, in Durable consumer goods by 12.5%, in Intermediate goods by 9.2%, and in Capital goods by 5.9%.

Looking at the producer prices by sectors, on an MoM basis, prices in Electricity, gas, steam, and air conditioning supply decreased by 5.8%, in Manufacturing by 1.7%, and in Mining and quarrying by 0.1%. On a YoY basis, producer prices in Electricity, gas, steam and air conditioning supply increased by 62.4%, in Manufacturing by 12.5%, while they decreased in Mining and quarrying by 19.2%.

The data then is both positive and mixed for December. The slowdown in producer prices does imply that the main driver of growth, Energy, has stabilized and stopped growing. At the same time however, even excluding Energy, the YoY growth is over 10% (11.5% to be exact), meaning that the inflationary pressure has spilled to other segments of the industry. This is quite worrying, especially if we consider that the prices were already elevated at the end of the last year. This would imply that the continued pressure on prices (costs of inputs for companies) for months, and even over a year in the Energy category, drives the inflation of other segments up as well. The issue with this spillover is that it is quite hard to control, and as it took months to get to it, it will also take months for it to stabilize, and that is months without negative downturns such as one stemming from colder than-expected winter (in the coming period) or reduced oil&gas supply, for any reason.