Yesterday Petrokemija announced that it is closing its production facilities of Urea and Ammonia after successfully repairing its technical failure due to business optimization to gas market conditions. Natural gas and CO2 prices in Europe stand at their multiyear highs which is influencing the profitability of their production.

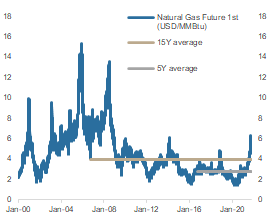

The price of natural gas front month futures became very volatile in the last weeks, but growth subsided when Vladimir Putin, the Russian president, hinted that his country could supply additional gas to Europe. Moving away from classical energy sources has resulted in Europe being very vulnerable to the supply of natural gas, so the lack of supply had sent spot prices last week up by over 60%. Most of entities were trying to get supplies of natural gas ahead of the winter months, which has resulted in strong pressure on natural gas futures which currently stands at USD 5.784 per million Btus, which is 2x higher than its 5-year average (USD 2.82/MM Btu). The price of natural gas futures is currently at 45% of its 15-year average (USD 3.98/MM Btu). In the period from 2000, the price of natural gas future hit the maximum in December 2005, when it was at USD 15.38 /MM Btu.

CO2 prices have also been at their historical high, while rising carbon price in the European Union’s emissions trading scheme has made it hard to switch to other dirty forms of energy. If you want to read more about emission trading, please see visit our blog at this link.

In the first 9 months of 2021, GWPs grew by 11% YoY. GWPs in non-life insurances grew 11.9% YoY and life insurance also grew by 8.5% YoY.

Croatian Insurance Bureau published the GWP development in September 2021. Since the beginning of the year, GWP’s rose by 10.95% compared to the same period last year. The total amount of GWPs collected reached HRK 9.1bn (includes insurers located in Croatia and insurers operating in Croatia but based in another EU country).

The amount of GWPs in non-life insurances, which traditionally account for the biggest portion, grew 11.9% YoY, amounting to HRK 6.9bn. In this segment, Triglav osiguranje observed solid increase of 24.3% YoY to HRK 486.4m. Croatia osiguranje, accounted for 28.5% of the market in this segment and noted a 6.1% YoY increase.

Life segment observed an increase of 8.5% YoY (or HRK 172.8m). We note that Croatia’s largest insurer, Croatia osiguranje observed a slight increase in this segment compared to the same period last year of 1.4%.

When observing GWPs by structure since the beginning of the year, insurance against civil liability in respect of the use of motor vehicles (which accounts for 24.8% of GWPs) recorded a high increase of 15.1% YoY (or HRK 293.5m). The second-biggest category in non-life insurance is vehicle insurance (casco policy) which accounts for 11.7% of total GWPs recorded a solid increase of 7.6%. Health insurance also observed a solid performance of +10.35%.

The impact from two destructive earthquakes which struck central Croatia is still seen on two insurance categories which both observed an increase: fire and elemental insurance with +10.4% and other property insurance +14.4%. Meanwhile, credit insurance noted a pickup compared to 2020 and observed a sharp increase of 42.4% (or HRK 82.5m).

The value of last week’s taxable invoices in Croatia (4th Oct – 10th Oct 2021) increased by 19.6% YoY, reaching HRK 3.96bn.

According to the latest announcement published by the Tax Administration of the Republic of Croatia, the value of the last week’s taxable invoices (4th Oct – 10th Oct 2021) was up by 19.6% YoY or HRK 648.9m. Compared to the same period in 2019, the value of taxable invoices was up by 9%.

The value of taxable invoices in wholesale and trade in the same period increased by 13.3% YoY, while compared to the same period in 2019, it was up by 11.9%.

Meanwhile, the value of taxable invoices from accommodation and food services recorded solid growth of +50%, amounting to HRK 381.2.62m. This segment is down by 9% compared to the same period in 2019.