If Frank Sinatra was alive and well today, it would have been his 104. birthday. The author of countless evergreens that are still extremely popular in retirement homes across the globe is recognised as the author of existential anthem “My Way“, in which he states: “Regrets, I’ve had a few/ But then again, too few to mention. / I did what I had to do / And saw it through without exemption“. The last two verses could easily be applied to FOMC this year – they did what they had to do (three cuts) and saw it through without exemption. What could they do in the following two years? Find out in this brief article.

The last FOMC meeting this year went by quite unremarkably – the rates are unchanged (FED funds @ 1.50%-1.75%), the US GDP growth expectations are kept unchanged (2.2% 2019, 2.0% in 2020, 1.9% in 2021, all in real terms) and the only major tweak came in core PCE inflation where FOMC now expects 1.6% increase in 2019 versus 1.8% expected in September. Median dot in 2020 is close to the current level, implying no rate cuts next year, with next rate hike possibly in 2021.

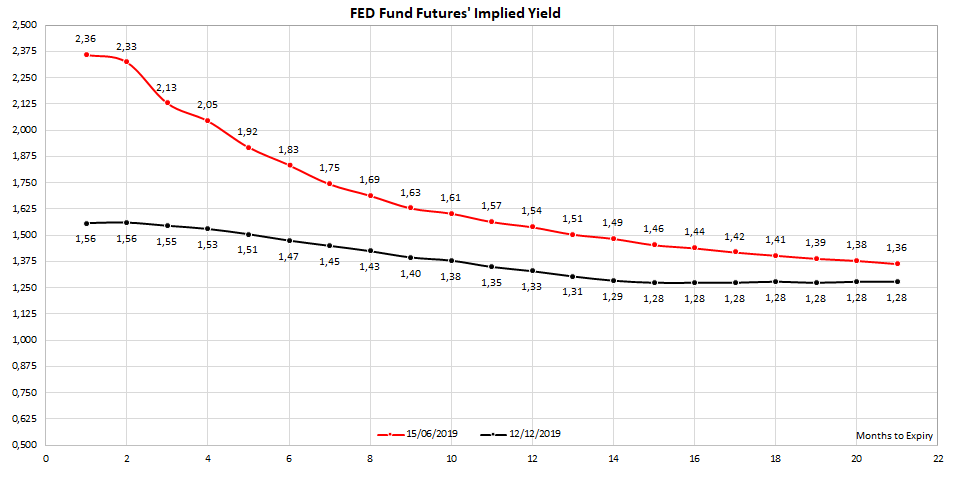

Looking at 2020, only four out of seventeen FOMC members expect a rate cut next year. Since ten out of the seventeen are eligible to vote next year, even if all four of the hawks are voting members, still there wouldn’t be enough hands for a rate hike in 2020. This means that there’s a wide consensus to keep the rates unchanged in the election year. The decision came in the aftermath of the best NFP print since January (266k jobs in November versus 312k in January). Looking at the FED fund future chart submitted below, it’s easy to spot that FED and the markets are on the same page in 2020, but diverge in 2021 since markets imply one interest rate cut in 2021 in the midst of a slowing economy.

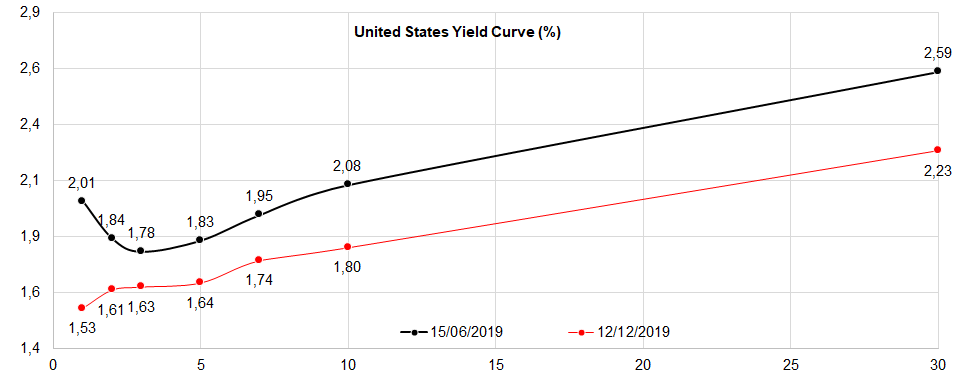

After being inverted for a couple of months, US curve is back into positive shape, with US 2Y10Y spread at 19bps (1.80% – 1.61%). The notorious recession predictor dipped into negative in the second half of August, but returned back to zero at the beginning of September and went as high as 27bps in mid-November. It’s worth noting that Federal Reserve Bank of San Francisco published a brief report stating that spread between 3 month and 10 year yield is by far the best traditional recession predictor twelve months into the future. This recession gauge inverted for a very brief period in time in March and it’s worth mentioning that it was deeply in negative between end-May and beginning October. If the indicator is right this time, recession might start sometime between March and October 2020 – with tight labor market in US and pending trade wars without a clear indication of when the tariffs might be rolled back, it could happen that the FED has to cut rates at least one more time, possibly ahead of the presidential election.

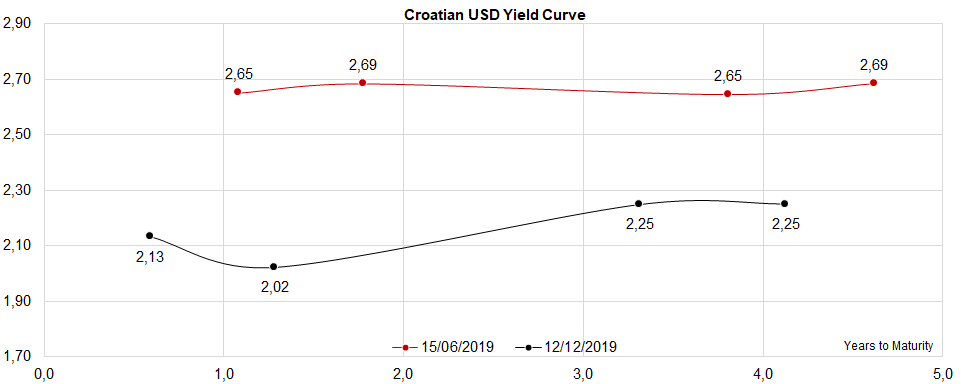

Speaking about Croatian USD yield curve, the shape has slightly changed compared to where it was six months ago. Back in June the curve was flat as a pancake, but now at least some of the term premium has emerged. Back in August, Croatian banks had a total amount of 5bio HRK (754mio USD) in greenback bonds, roughly half of it in Croatian Eurobonds (2.52bio HRK or 373mio USD). The total position in USD paper corresponds to the amount of USD deposits held by households and corporations in Croatian banks (6bio HRK, according to D8a table from the central bank). More importantly, back in August about 797mio HRK were in CROATIA 2019 USD, the Eurobond that matured in early November. It’s difficult to foretell where these proceeds in size of roughly 118mio USD went since the supply of Croatian dollar bonds is rather tight. The supply is only going to get tighter since mid-July next year CROATIA 2020 USD is going to mature as well, removing 678mio HRK (100mio USD) off the market. Banks will remain a net buyer of dollar assets because of the FX structure of deposits they carry on the liability side of their B/S – the only question is, which assets?

Telekom Slovenije published an announcement stating that the Supervisory Board of Telekom Slovenije discussed and approved the strategic business plan for 2020 – 2023.

As a reminder key objectives for FY 2019 were:

- Operating revenues: EUR 711.9m ( -3% YoY) currently at 71.3% of target

- EBITDA: EUR 216.0m (+16% YoY) currently at 76.9% of target

- Net operating profit: EUR 30.3m (-9% YoY) currently at 118.4% of target

- Investments: EUR 211.9m (+58% YoY) currently at 55% of the target

Meanwhile key strategic policies of the Group for the period 2019 to 2023 were:

- Maintaining the market position on the mobile services market and increasing thier market share on the fixed services market

- New revenue sources

- Maintaining a superior network

- Consolidation on individual markets

The new strategic business plan includes all of the above mentioned policies, with the exception of the first one while it also includes:

- Retaining revenue levels from core activity in Slovenia

Telekom Slovenije aims to retain their number of fixed and mobile users in Slovenia through a portfolio of comprehensive services for smart living, and through the development of a unique, user-tailored experience, which will be based on a straightforward user experience and superior network, inspiring services, breakthrough solutions and a caring approach to users.

- Simplification of processes, products and platforms

The Group will continue to optimise business processes, and restructure thier products, portfolio and information systems with the aim of enhancing their ability to adapt dynamically to the demands of users through understandable and easy-to-use solutions.

- Optimal staffing structure

Achieving the objectives set out in the Strategic Business Plan are only possible by ensuring the optimal number of employees, taking into account the needs of the work processes of individual Group companies, and by ensuring the development of employees’ competences.

- Financial stability

- Quality and social responsibility

Key objectives of the Telekom Slovenije Group for 2020

- Operating revenues: EUR 676.0m

- EBITDA: EUR 210.6m

- Net operating profit: EUR 27.5m

- Investments: EUR 209.7m

For the FY 2019, the company expects a 3% YoY increase in sales, a decrease in EBITDA of 27.6% and a decrease in net profit of 37.9%.

Cinkarna Celje published a document on the Ljubljana Stock Exchange announcing their FY 2019 target and 2020 plan.

2019 Target

For the FY 2019, Cinkarna Celje expects to record a 3% increase in sales, amounting to EUR 168.8m. The mentioned increase is expected to come from sales on the foreign market, which is expected to increase by 5% YoY, amounting to EUR 19.06m. Meanwhile, the sales on domestic market, which make up for roughly 11% of the sales, are expected to record a decrease in sales of 12%.

Change in the value of inventories of products and work in progress is expected to decrease by EUR 9.4m, amounting to EUR 2.37m.

Operating expenses are expected to observe an increase of 6.8%, amounting to EUR 155.7m. Such an increase could mostly be attributed to higher material costs of EUR 9m.

As a result of the above-mentioned, EBITDA is expected to decrease by 26.7% YoY, amounting to EUR 35.75m. Meanwhile, operating profit is expected to record a decrease fo 36.9%, amounting to EUR 22.96m.

In the FY 2019, net profit is expected to amount to EUR 18.98m, which would represent a decrease of 37.9% YoY.

Outlook for 2020

In 2020, Cinkarna Celje expects to reach EUR 174.2m in sales revenue, which the company deems achievable. Such a result represents an increase of 3% compared to the 2019 target. Sales in foreign markets is expected to reach EUR 155.7m in 2020, which is a 4% increase.

Change in the value of inventories of products and work in progress is expected to further decrease by EUR 7.3m, amounting to EUR -4.9m.

Compared to the 2019 target, in 2020, operating expenses are expected to observe a slight decrease of 0.5%, which would mostly come on the back of lower labor costs by EUR 2.4m.

As a result, EBITDA is expected to amount to EUR 29.52m, which would represent a decrease of 17%. Meanwhile, operating profit is expected to further decrease by 24%, amounting to EUR 17.4m.

The projected net profit for 2020 amounts to EUR 14.1m, which would note a decrease of 26%. The company states that such a poor performance throughout the P&L is a direct consequence of the decline sales prices of titanium dioxide pigment.

Turning our attention to CAPEX, the investments in 2020 will be made primarily in the context of enabling sales growth, sourcing new and maximizing the availability of existing titanium production facilities of dioxide. It is mainly a continuation of the planned investments for 2019.