Fixed income deluge continues in the coming week as a plethora of sovereigns and corporates come to the market to lock up funding. Demand for paper is ample and nearly all placements ended up with grey market prices above reoffers, regardless of the direction Bund took. Which other placements can we expect? Find out in this brief research piece.

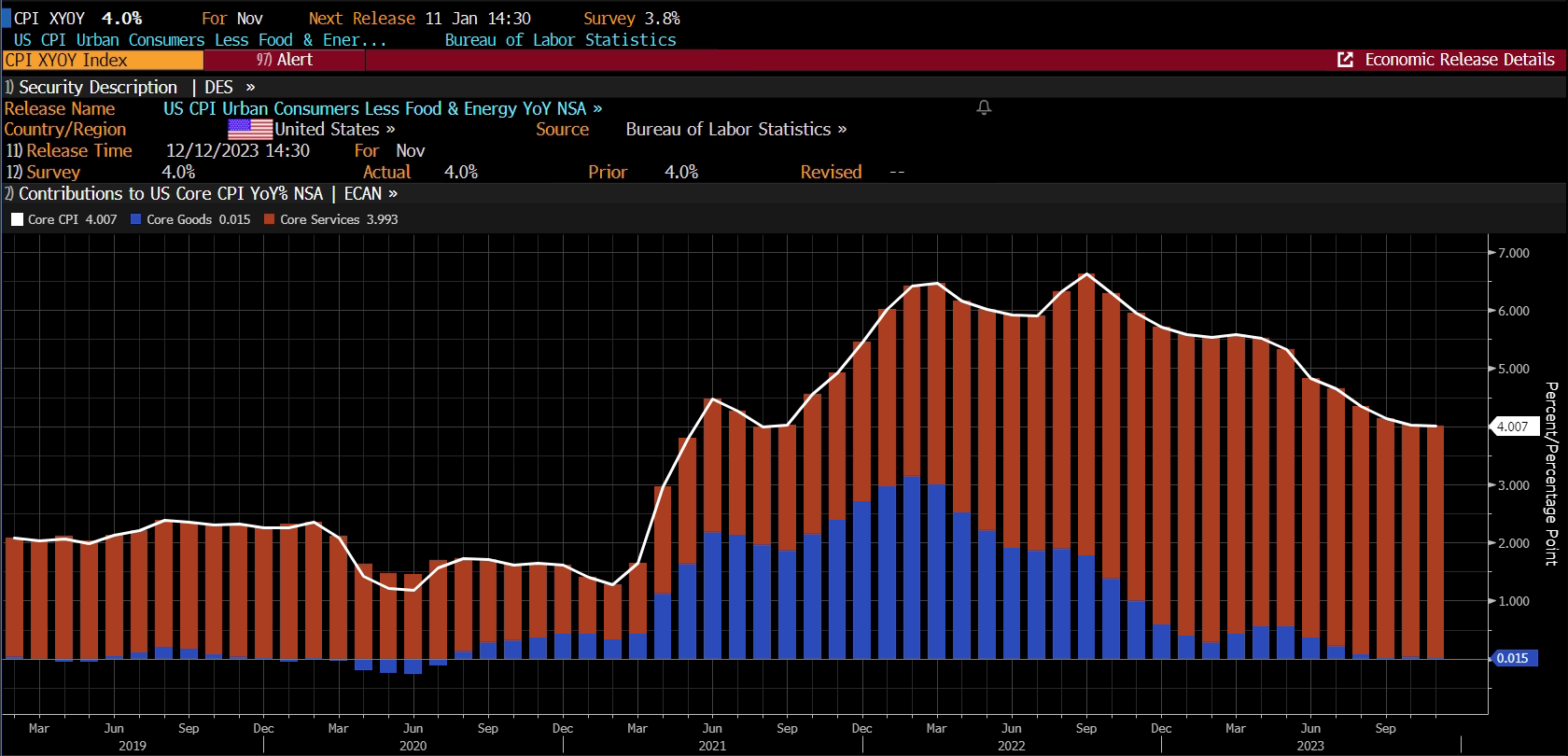

Regarding fixed income markets, the opening days of 2024 have been similar to early January weather – cold and harsh. Yields on the long-term paper reversed course in the last two days of 2023 and have continued to rise ever since. Last Friday the ISM figure managed to override the labour market data and pushed yields even higher in the process. Today we have another piece of hard data coming from the US, namely the December CPI print. We advise focusing on the core component because this is where sticky inflation continues to bite. The new print that would be delivered today at 14.30 CET has a consensus estimate of about +3.8% YoY (Bloomberg), which is some 20bps lower compared to the December read. So far the trend looks like this:

In plain man’s English, the recent drop in core CPI came almost exclusively from goods inflation (diminishing blue area) and so far the only way core can get to +3.8% YoY is if core goods disinflation turns to deflation. This is not impossible, but we deem it improbable. It’s quite likely CPI core prints +4.0% YoY, equal to the November print and bond yields might continue their march up.

The beginning of the year was also marked by immense bond placements by euro-area countries that were followed by historically high bid-to-cover ratios and book sizes. Just to get a feeling of the market, yesterday’s 10bn EUR placement of SPGB 3.25 04/30/2034€ at 3.25% YTM (existing 33s+9bps) was met with an all-time high demand of 138bn EUR versus 15bn EUR placement (bid-to-cover of 9.2x). Placed at 99.92 reoffer, it’s now traded at 100.50 (3.19% YTM), which is still some 6bps above the existing SPGB 3.55 10/31/2033. Some tightening did occur, but there might be more to go through.

Apart from Spain, Poland placed a dual tranche last week: 2.5bn EUR POLAND 3.625 01/11/2034€ at DBR 2.6 08/15/2033€+158.1bps (3.716% reoffer yield and 99.25 reoffer price) that was met with a 6.2bn EUR book (2.48x bid-to-cover) and is now traded at DBR 2.6 08/15/2033€+147bps (11bps tighter); and 1.25bn EUR POLAND 4.125 01/11/2044€ at DBR 3.25 07/04/2042€+178.1bps (4.175% reoffer yield and 99.331 reoffer price) met with 3.4bn EUR book (2.72x bid-to-cover) and is now traded at DBR 3.25 07/04/2042€+167bps. What’s even more interesting is that this spread tightening (10bps in both cases) came against the backdrop of the political crisis in Poland that has yet failed to override the sound fundamental story. Slovenia, Estonia, Hungary, Belgium and Italy also placed their paper and were met with ample demand, while Ireland is expected to place a 10Y paper today at razor-tight MS+1bps and it’s quite likely that bid-to-cover could again exceed 14.0x (42bn EUR book versus 3bn EUR placement).

So what do we expect going forward? The recent placement of T2 instruments by Belgian KBC and Greek Piraeus Bank might be bellwethers for other regional banks. Piraeus (B+ by Fitch) for instance placed a 500mm EUR 10.25NC5.25 at 7.375% and was met with a 1.5bn EUR book (3.0x bid-to-cover). Regarding sovereign paper, it’s reasonable to expect Romania to place soon, but don’t be too surprised if the SEE country goes with a greenback issue since USD paper trades at 224bps G-spread, while the EUR paper is traded at 362bps spread. The nearly 140bps difference is the reason why any minister of finance would be looking at the American market to get cheap funding, especially in times of higher interest rates. Due to the funding needs of the Romanian treasury, it’s quite likely that both EZ and US markets would be tapped this year, but it’s quite likely that first they touch US market and get a decent size cheaply, and then go to the EUR markets later in the year. As a matter of fact, something similar has already been done by Hungary last week.

Croatian Tourism has experienced significant growth in revenue compared to both 2022 but especially 2019. At the same time, the number of nights and arrivals remained roughly the same compared to 2019. December 2023 as well, despite being in the off-season, recorded solid growth in arrivals and nights, both YoY and compared to 2019.

The latest report on the performance of the Croatian tourism sector has been released by the Croatian Tourism Board (HTZ), for December 2023. Even though Croatian tourism is world-renowned for its summer season, the overall plan for the Croatian government for a very long time has been of diversity, i.e. diversifying the tourism season so it is spread more evenly through the year, but also that it encompasses other areas of Croatia which are less known. As such, looking at the performance of the sector in the off-season is also prudent.

Starting off with December 2023, in terms of tourist arrivals, they amounted to 394.1k representing an increase of 19% YoY. Furthermore, an increase was recorded in both foreign arrivals, which grew by 18% YoY and amounted to 231.8k, as well as domestic arrivals, which increased by 18% YoY and amounted to 162.3k. A similar story is present when we look at the tourist nights, which grew by 12% YoY and amounted to 937.6k. Of this, foreign tourist nights amounted to 621.2k, and grew by 8% YoY, while domestic tourist nights amounted to 316.4k, with an increase of 19% YoY.

Total tourist arrivals and tourist nights in Croatia (January 2019 – December 2023)

Source: HTZ, InterCapital Research

This would also mean that the average stay per person amounted to 2.38, which is a decrease of 6% YoY. Of course, the trend of the decrease in the average stay per person has been present for quite a while now, influenced by both higher prices on one side, and more constrained budgets due to the developments we have witnessed in the last couple of years on the other.

In terms of the types of accommodation chosen for overnight stays, 94% of the tourist nights were recorded in commercial accommodation, while 6% of tourist nights were recorded in non-commercial accommodation. Taking a closer look at commercial accommodation, 60% of nights were recorded in hotels, 25% in private accommodation, 4% in camps, and 11% in other types of accommodation. Meanwhile, the largest number of tourist nights was recorded by domestic tourists, at 32%, followed by Slovenians and Austrians at 9% each, respectively, as well as tourists from Germany and Bosnia and Herzegovina, both at 7%, respectively.

Moving on to the best-performing counties in terms of tourist nights, Grad Zagreb recorded 235.2k of them, followed by Kvarner at 168.8k, Istra at 162.7k, Splitsko-dalmatinska at 88.4k, as well as Dubrovačko-neretvanska, at 55.5k.

Meanwhile, during 2023, the total number of tourist arrivals amounted to 20.6m, an increase of 9% YoY, while the total number of tourist nights amounted to 107.8m, an increase of 3% YoY. Of this, foreign tourist arrivals grew by 10%, while domestic tourist arrivals increased by 7%. Furthermore, foreign tourist nights increased by 3%, while domestic tourist nights grew by 4%. Compared to 2019, Croatian recorded 1% lower number of arrivals, of which domestic arrivals increased by 16%, while foreign arrivals decreased by 3%. The same situation is present in terms of the tourist nights, with the total number being 1% lower, with the foreign nights remaining unchanged, while domestic nights decreased by 6%.

However, looking at just these physical indicators does not show us the entire story. In fact, according to the latest report by the Croatian National Bank, the Croatian tourism revenue amounted to EUR 12.9bn during 9M 2023, growing by 11.4% YoY, and 37.5% compared to 9M 2019. Furthermore, only in Q3 2023, tourism revenue grew by 7.7% YoY, and 38% compared to Q3 2019.

As such, despite the fact that Croatian tourism underperformed by a slither compared to 2019, the revenue numbers tell us a different story: significant double-digit growth was recorded, without any meaningful loss of arrivals/nights. At the same time, however, it has to be noted that this could turn out to be a short-term gain. Other countries around the Mediterranean have and will continue to offer competitive tourism prices and services. Combined with the constrained budgets from some of the most emissive tourism countries to Croatia, like say Germany, this will surely influence tourists’ decision-making. Given that inflation should continue falling across Europe in 2024, there are fewer and fewer “easily justifiable” ways of price increases. Will this hurt Croatian tourism’s longer-term prospects, and even the set-out development strategy (aimed at more diversity in both the types of services, but also on the expansion of the tourist season outside the main summer season), only time will tell.

Croatian tourism revenue development (9M 2015 – 9M 2023, EURm)

Source: HNB, InterCapital Research