On its latest monetary policy meeting, Board of Czech central bank decided to leave rates unchanged as widely expected. However, their statements says that interest rates should be stable initially, “.. followed by a gradual rise in rates from roughly the middle of this year onwards. “ This means that in case Czech economy accelerates pace of recovery, CNB could be the first central bank in EU to start tightening its policy already this year. In this article we are looking at the drivers for such a decision by CNB and monetary policies across the globe.

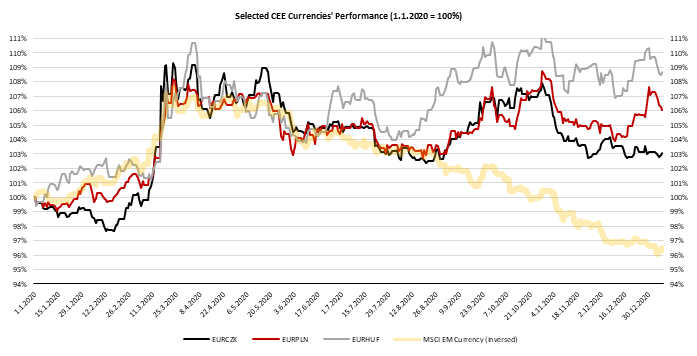

As you may already know, CNB was regarded as one of the most hawkish banks in the world even before the corona crisis. It managed to hike its rates several times in period of 2018-2020 to 2.25% (2-week repo rate) as economy was roaring. Back then, inflation kept rising and stood above CNB’s target of 2.0% while Czech koruna witnessed strong appreciation trend due to EM inflows but also due to solid carry trade. It is worth noting that CNB lifted its interest rates once in February 2020 as inflation reached multi-year high of 3.7%. Nevertheless, corona crisis kicked in in March and central bank had to reverse some of its decisions. That did not seem to be the problem for CNB’s governor Jiri Rusnok and his officials. Namely, CNB cut its interest rates down first on March 17th by 50bps, then by 75bps 10 days later and then finally by another 75bps in May, to reach 0.25%. As it was the case with the rest of the EM, CZK depreciated strongly and almost reached 28.0 versus euro while inflation rates dropped significantly.

Since the second quarter of 2020 which was one of the worst quarters in respect of economic collapses, a lot of things have changed. Vaccines process is accelerating while businesses and consumers became adapted on „new normal„ meaning that after Q2 economies started to recover. Last year Czech economy decreased by 5.6%, reflecting the biggest decrease of GDP on the record, although looking at the Q2 when economy was lower by 10.7% YoY, it could have been worse. Meanwhile, restrictions in Czech Republic and the rest of Europe are still in place and could be lifted only gradually which concerns retail and service sector. On the other hand, export and industry-oriented services fared quite well in the last few months and were hit only to a small extent. Considering above said, CNB expects economy to grow by more than 2.0% this year and to fasten next year, reflecting return to the pre-corona levels.

Talking about pre-corona levels, CNB does not expect inflation to reach levels from the beginning of 2020 but only to fall further close to 2.0% and to fluctuate around the target in the following period. Recovery of the economy and stable inflation around the target leads us to the latest monetary policy meeting by CNB a week ago. Although Mr Jiri Rusnok stated that CNB could hike one, two, three or maybe zero times in 2021 even before the meeting, some analysts interpreted his statement as slightly hawkish as he mentioned even three hikes this year. In the statement CNB says that they could start hiking rates in H2 and on the presentation it could be seen that they expect rates to reach 1.0% in the end of 2021. One should bear in mind that all the central banks in the region are still talking about loosening monetary policies rather than tightening while ECB seems to be miles away from even mentioning tightening. Although we think CNB’s projections are a bit too optimistic, we expect economies to recover above consensus and that vaccine rollout will accelerate further in the following months. That scenario could support CNB’s expectations and Czech central bank could be the first European central bank that started to tighten its policy. CNB’s projections have driven CZK appreciation in the last few weeks and it reached 25.70 versus EUR, being only 3.0% above pre-corona levels. In case, optimistic scenario becomes reality and CNB manages to hike several times this year, we do not exclude EURCZK trading at 25.0 at the end of this year.

Source: Bloomberg, InterCapital

Komercijalna banka is currently traded at a P/B of 0.66, which is lower than the transaction multiple of P/B 0.77 concluded in early February 2020.

Today NLB has published a Takover Intention Notification in daily newspaper Politika (newspaper that is regularly distributed on entire territory of Serbia). The Takeover Intention Notification regards the acquisition of:

- all remaining regular shares of Komercijalna banka at the point of publishing not in NLB‘s ownership (2,820,270 shares or 16.77% of this class of shares) and

- all priority shares of Komercijalna banka (373,510 or 100% of this class of shares)

NLB’s takeover intention states that it intends to submit Takeover Approval Request to Serbian Securities Exchange Commission (“SEC”) within a period of 15 business days and publish Takeover Bid immediately (latest the next following day) after obtaining the corresponding approval from SEC.

Such news do not surprise us, given that NLB has a 100% stake in virtually all of its subsidiaries, so a squeeze out seemed to be a natural course of action. We note that Komercijalna banka is currently traded at a P/B of 0.66, which is slightly lower than the pricing of the acquisition announced in February 2020.

As a reminder, in late February 2020, NLB announced that they have acquired the entered into a share purchase agreement with the Republic of Serbia for the acquisition of an 83.23% ordinary shareholding in Komercijalna Banka.

NLB acquired the 83.23% shareholding for the amount of EUR387m, which will be payable in cash on completion. Such a price puts the transaction multiple at P/B 0.77 and P/E 6, while it implies a valuation of EUR 465m for the 100% stake in Komercijalna Banka. We also note that in accordance with Serbian bank privatisation regulations, NLB was not required to launch a mandatory tender offer for minorities’ shareholdings in Komercijalna Banka.

As of end December, total financial institution’s loans amounted to HRK 275.65bn, which represents a 5.9% increase YoY.

Croatian National Bank (HNB) published their monthly statistical report on loans placement of other monetary financial institutions. According to the monthly statistical report as of end December, total financial institution’s loans amounted to HRK 275.65bn, which represents a 5.9% increase YoY and an increase of 1.4% MoM. Such figures do indicate that Credit activity, especially certain segments, showed very solid resilience during the pandemic.

Its biggest categories household loans and corporate loans evidenced growth of 2.3% YoY and 5.3% YoY, respectively. In March corporate loans observed a monthly increase of 4.3% which arguably came on the back of higher demand for working capital loans and revolving loans. However, since then corporate loans have been observing a negative trend, recording MoM decreases. This trend was reversed in December, when they observed a 2.48% MoM increase. Corporate loans ended 2020 at HRK 86.28bn.

It is also worth adding that loans to central government witnessed sharp increase of 16.2% YoY to HRK 43bn, which was mostly evidenced with the beginning of the pandemic. To be specific, this relates to a HRK 6bn loan to the state (for Covid-19 support) which occurred in parallel to HNB reducing the required reserves for banks freed additional funds. Meanwhile, loans to local government amounted to HRK 6.5bn, representing an increase of 31%.

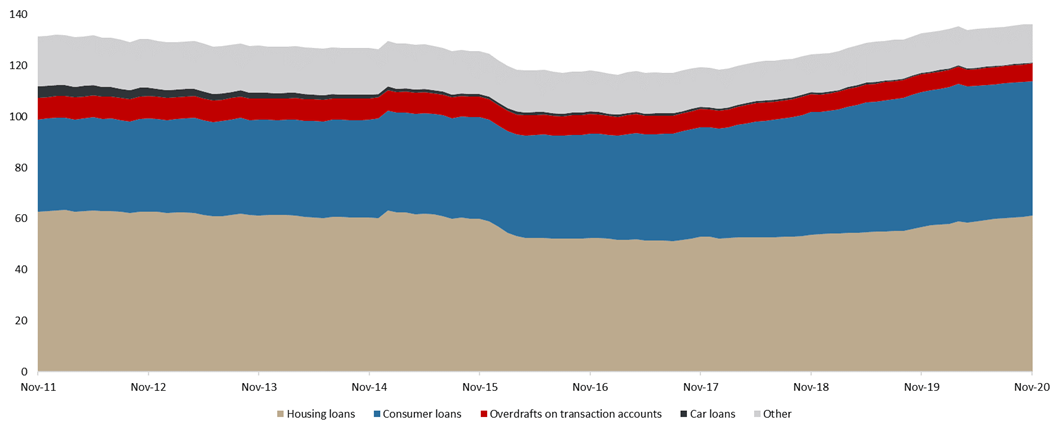

Total loans issued to households amounted to HRK 136.2bn, representing an increase of 2.3% YoY (or HRK 3.08bn). Such an increase was almost entirely driven by a rise in housing loans (+8.2% YoY or HRK 4.74bn). The second largest item within Household Loans, consumer loans, did eventually see a slight YoY decrease of 1.3%, or the highest absolute YoY decrease of HRK 689m. We note that these two items account for 84% of the total Loans to Households.

The largest relative YoY drop was witnessed in car loans (-24.2% or HRK 129.5m). This does not come as a surprise, given the low car sale trend which has been observed throughout this year.

Loans to Households (HRK bn)

Source: Croatian National Bank, InterCapital Research

If we were to compare total loans issued to households since the beginning of the pandemic, one can notice a slight increase of 0.6% or HRK 823.8m. Such an increase could mostly be attributed to a still solid performance of housing loans by 5.7% or HRK 3.34bn, which was partially offset by a 3.2% decrease in consumer loans (or HRK 1.73bn). We note that this loan segment has once again seen a MoM decrease (which has been the trend throughout most of the pandemic). On the flip side, housing loans continue recording MoM increases, with the exception of April (lockdown period), when housing loans observed a 0.6% decrease.

Structure of Loans to Households (December 2020)