At the end of September, total deposits in Croatia amounted to HRK 359.8bn, up by 11.5% YoY.

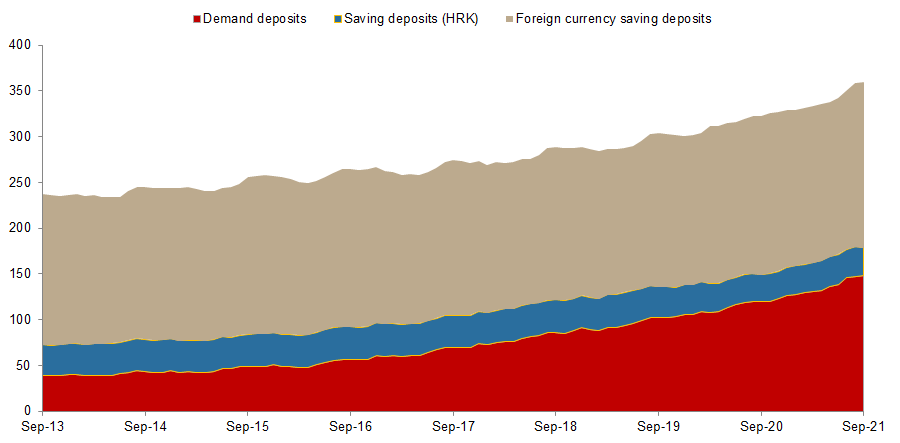

According to the consolidated statement of financial position for monetary financial institutions, which is published monthly by the Croatian National Bank (HNB), total deposits as of the end of September 2021 amounted to HRK 359.8bn, representing an increase of 11.5% YoY, and 0.2% MoM. This amount once again marks an all-time high. The high levels of deposits continued their positive trend throughout the reopening of the economy.

The increase can once again be attributed to a high increase of 23.9% YoY in demand deposits, reaching HRK 147.9bn, which accounts for 41.1% of total deposits. As of the end of September 2021, total savings deposits amounted to HRK 211.9bn, representing an increase of 4.2% YoY and 0.3% MoM. In the local currency savings deposits, one can see a decrease of 5% MoM, decreasing to HRK 30.6bn.

Foreign currency savings amounted to HRK 181.3bn, a 4.5% increase YoY. To put things into perspective, at the end of September 2021 out of total savings deposits 14.4% were in local currency while 85.6% in foreign currency.

When looking solely at households, they hold HRK 240.3bn or 66.7% of total deposits, which increased by 0.84% MoM.

Deposits breakdown (HRK bn)

Today, we decided to present you with a brief analysis of cash per share of Croatian Blue Chip companies.

In November, Croatian companies published their Q3 results, so we decided to update our cash per share analysis for 10 Blue Chip companies within CROBEX 10. The analysis is done in order to see the strength of the balance sheet and how liquid selected companies are. This figure, cash per share, as a percentage of a company’s share price, can give us more insight into the company’s strength on returning the money to shareholders (either through dividends or buybacks), paying down debt, etc.

Cash per Share of Croatian Blue Chips (HRK)

It is important to note that looking solely at cash per share of a company could lead to a misleading conclusion without also taking into consideration the company’s indebtedness, which you can find here.

A high level of cash per share indicates a solid performance of the company, reassuring the shareholders that the company is operating with “enough room” and liquidity to cover for any potential difficulties and that the company has adequate capital.

Cash per Share as a Percentage of the Current Share Price

As visible in the graph, of 10 companies within CROBEX 10, Adris Group operates with the highest cash per share as a percentage of their current share price of 48%, while their cash per share amounts to HRK 202. Končar comes next with 43% and Valamar with 35%. Arena follows with 32%. HT and Ericsson Nikola Tesla follow with 20% and 16%, respectively.

On the flip side, Podravka has the lowest cash per share as a percentage of its current share price (HRK 636) of 3.7%. Podravka’s cash per share amounts to HRK 23.