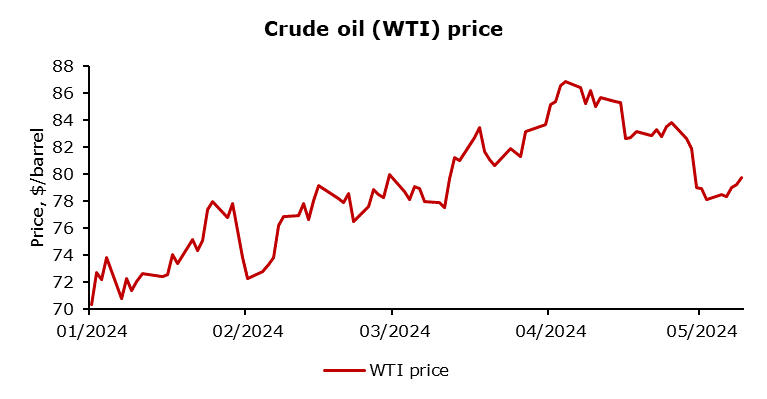

Crude oil has been weak over the past few weeks. West Texas Intermediate crude futures contract price fell 10$ as the geopolitical premium vanished and inventories surprised to the upside.

WTI reached a high of 88$ per barrel on the 5th of April and has been trending down since. A few different economic data that were released in April came under expectations resulting in an economic slowdown. GDP data in the US came significantly below expectations as well as NFP data for May. That might have pushed oil prices down as the economy cools down. China imports are still at very high levels even though the Chinese economy is not in the best shape and consumer spending is still subdued. However, various theories explain huge imports of crude oil to China as evasion of buying Treasuries to fuel further de-dollarization, they rather store crude in tanks as it is not currently needed. Further push to the lower prices might be the fear of China needing less crude oil in the future leading to subdued prices. The conflict between Iran and Israel is contained and no further escalation is in sight. Consequently, geopolitical premium swiftly vanished and pushed prices from high 80$ to high 70$. Saudi Arabia even tried to prop up prices by raising crude prices to China, however, the market did not find it bullish enough to break to the north.

Production growth at these prices should remain strong with rig count staying stable over the past quarter. An actual number of rigs fell on a YoY basis, however most of the closed ones are natural gas rigs. Also, the downside for oil prices is a further slowdown of the manufacturing sector which is particularly strong in Germany and Czechia. The economic outlook for manufacturing is gloomy with no positive catalysts in the near future. At least until China which is one of the biggest German trading partners does not make a turnaround. Furthermore, gas-to-oil switching is no longer needed as natural gas prices are very low. All the arguments point to lower prices of crude oil in the near future with further downside in case of negative upcoming economic data alongside weakening futures spreads and negative CoT signal. Inventory data surprised to the upside five times out of the last seven readings and pushed the WTI price down to 78$ per barrel. However, as it is shown on the chart, WTI is still in a strong uptrend and the last move down might be a brief correction.

In conclusion, recent weeks have seen a notable weakening in crude oil prices, primarily driven by the evaporation of the geopolitical premium and unexpected inventory increases. Economic data, including disappointing GDP and NFP figures in the US, hint at a cooling economy, further pressuring oil prices downward. Despite robust crude imports by China, uncertainties persist regarding future demand, particularly amidst global economic slowdowns and geopolitical tensions. While production remains stable, the bleak outlook for the manufacturing sector and low natural gas prices pose additional challenges. Overall, the current trend suggests potential for further declines in crude oil prices, pending negative economic indicators and inventory surprises.

Source: Bloomberg, InterCapital

Taking into account the latest available data from the Croatian Bureau of Statistics, in Croatia the total registered unemployment rate in March 2024 stood at 6.2%. Further, looking at the latest wage data from February, average net earnings increased by 0.5% in real terms compared to January 2024, and 8.4% if we were to compare it to the same month of the previous year.

Recently, the Croatian Bureau of Statistics published data regarding employment and unemployment in Croatia for March 2024. Looking at the data, one can see that the number of persons in employment amounted to 1.65m, which represents an increase of 0.7% MoM and an even more pronounced growth of 1.7% if we were to compare it to the same month of the previous year. In the period from January to March 2024, as compared to the same period of the previous year, the total number of persons in employment increased by 1.4% YoY. Taking the total number of persons in employment and the unemployed number of persons, the total registered unemployment rate in March 2024 stood at 6.2%.

Total persons in employment & Unemployed persons [2015 – 2023]

Source: DZS, InterCapital Research

Moving on to the latest available data for February 2024, regarding the average monthly wages in Croatia, average net earnings increased by 0.5% in real terms compared to January 2024 and 8.4% if we were to compare it to the same month of the previous year.

Median net wage – Croatia [2016 – Feb 2024]

Source: DZS, InterCapital Research

Average annual median wage growth rate [%]

Source: DZS, InterCapital Research

Below we decided to present you with the nominal growth of an average median wage throughout the year. The most recent pronounced growth should not come as a surprise due to the double-digit inflation for the period. However, we emphasize that as part of pre-election packages in Croatia, the government presented us with a historic salary increase in state and public services. As expressed, the main goals of this reform are to increase the salary of all employees and to achieve “equal pay for equal work”. This salary increase will affect c. 244k of employees. Consequently, we should expect further elevated growth rates in wages.