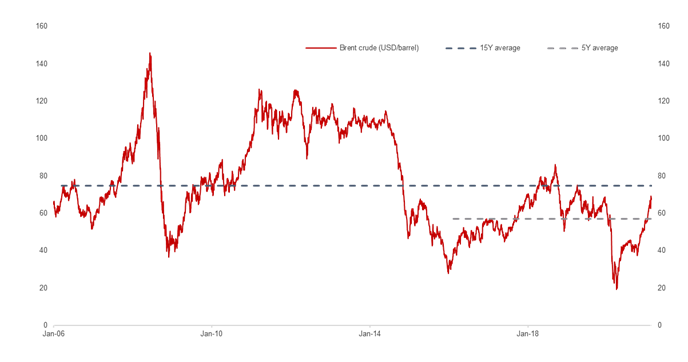

As of 9 March, Brent crude is traded as USD 67.52 per barrel. At the current price, Brent crude is traded quite above its 5Y average of USD 57.16.

Brent crude showed a very strong performance since the begining of 2021, with expectations of a recovery in the global economy amid the approval of a USD 1.9 trillion stimulus by the US Senate. The markets seem to expect that the mentioned will lead to a reduction in crude oil inventory in the US.

The beginning of this week was particularly interesting as, on Monday, as Saudi Arabia’s oil facilities were targeted by missiles and drones on Sunday. A Houthi (Yemen) military spokesman claimed responsibility for the attacks. As a result, on Monday, Brent crude futures noted a sharp increase above USD 70 for the first time in more than a year, however those gains were turned around, settling the session in the red. According to media, it seems that the assault on the Saudi terminal has not had an impact on shipments.

Oil prices were also supported in March by OPEC and its oil-producing allies announced the group would keep production largely steady through April. Saudi Arabia also stated that it would extend its 1m barrels per day voluntary production cut into April. The group approved the continuation of current production levels for April, except that Russia and Kazakhstan will be allowed to increase production by 130,000 and 20,000 barrels per day, respectively.

As of 9 March, Brent crude is traded as USD 67.52 per barrel noting a very sharp increase of as much as 32.2% YTD. At the current price, Brent crude is traded quite above its 5 Year average of USD 57.16.

Source: Bloomberg, InterCapital Research

Saponia and TNG were excluded from CROBEX & CROBEXtr, while Viktor Lenac was included.

The Index Committee announced the revision of CROBEX and CROBEXtr. Saponia and TNG were excluded from the mentioned indices, while Viktor Lenac was included.

Meanwhile there were no changes in CROBEXprime, ADRIAprime, CROBEX10 and CROBEX10tr. Indices will have a new structure after 19th of March 2021 with 1st day of trading on 22nd of March 2021.

You can find the new composition of CROBEX in the table below.

| wdt_ID | Ticker | Free float factor | Number of shares | Representation Factor | Weight in index |

|---|---|---|---|---|---|

| 1 | ADPL | 70,00 | 4.199.584,00 | 1,00 | 5,50 |

| 2 | ADRS2 | 95,00 | 6.784.100,00 | 0,37 | 10,00 |

| 3 | ARNT | 50,00 | 5.128.721,00 | 1,00 | 8,50 |

| 4 | ATGR | 45,00 | 3.334.300,00 | 0,48 | 10,20 |

| 5 | ATPL | 80,00 | 1.395.520,00 | 1,00 | 2,10 |

| 6 | DDJH | 50,00 | 10.153.230,00 | 1,00 | 0,20 |

| 7 | DLKV | 40,00 | 24.719.305,00 | 1,00 | 0,70 |

| 8 | ERNT | 55,00 | 1.331.650,00 | 0,88 | 10,10 |

| 9 | HT | 45,00 | 80.766.229,00 | 0,15 | 10,10 |

| 10 | IGH | 50,00 | 613.709,00 | 1,00 | 0,40 |

| 11 | INGR | 95,00 | 13.545.200,00 | 1,00 | 1,50 |

| 12 | KOEI | 100,00 | 2.572.119,00 | 0,58 | 10,30 |

| 13 | KRAS | 12,00 | 1.498.621,00 | 1,00 | 1,30 |

| 14 | OPTE | 40,00 | 69.443.264,00 | 1,00 | 1,80 |

| 15 | PODR | 85,00 | 7.120.003,00 | 0,32 | 10,20 |

| 16 | RIVP | 55,00 | 126.027.542,00 | 0,46 | 9,80 |

| 17 | VLEN | 14,00 | 16.813.247,00 | 1,00 | 0,30 |

| 18 | ZABA | 4,00 | 320.241.955,00 | 1,00 | 7,10 |

By looking at the latest announcement from the Tax Administration of the Republic of Croatia, being tracked for Covid-19 pandemic purposes, in the period from 1 Mar till 7 Mar 2021 the value of taxable invoices decreased by 1.27% YoY.

A higher frequency data is compiled by Croatian Tax Administration, a department of the Ministry of Finance, who stated that the value of taxable invoices dropped by 1.27% YoY (or HRK -40.9m) in the period from 1 March till 7 March compared to same week last year. Meanwhile total taxable invoices in the mentioned period amounted to HRK 3.18bn.

Increase in taxable invoices in wholesale and retail trade in the same period was at 5.29% (or HRK +117m) to HRK 2.33bn while drop in accommodation and food services reached 40.4% (or HRK – 97m).

The value of taxable invoices increased by 4.69% in the first week of March compared to last week of February. Mostly, it was driven by increase in accommodation and food services of 58.67% while wholesale and retail trade increased by 2.86%. The increase was expected due to relaxation of restrictions in Croatia on March 1st 2021. Furthermore, we might expect continuations of relaxation of restrictions in Croatia thanks to lower numbers of hospitalizations.