For today we decided to present you with a brief overview of share price performance across sectors for regional companies.

For this we decided to look at the average share price performance of companies in our wider coverage which includes companies from Croatia, Slovenia, Romania, Serbia and Bulgaria. When looking at the graph below one can notice that there are not any surprises when it comes to top or bottom performers. All observed sectors recorded a decrease, of which Pharma recorded the lowest of – 8.7% YTD and is the only sector which observed a single digit decrease. The Pharma companies in our sample are currently traded at an average P/E of 10.2 and EV/EBITDA of 6.2. Food and Insurance sector follow, with a decrease of 11% and 12.2%, respectively.

On the flip side, the highest share price decreases are mostly in line with the sectors which seem to be affected the most by the ongoing Covid-19 situation. Therefore, Construction witnessed a decrease of 26.7%. Tourism comes next, with a decrease of 23.4%. The companies in the Tourism sector in our sample are currently traded at a median P/E of 11 and EV/EBITDA of 7.6.

YTD Performance of Regional Companies by Sector*

*Average share price performance of regional companies in our wider coverage

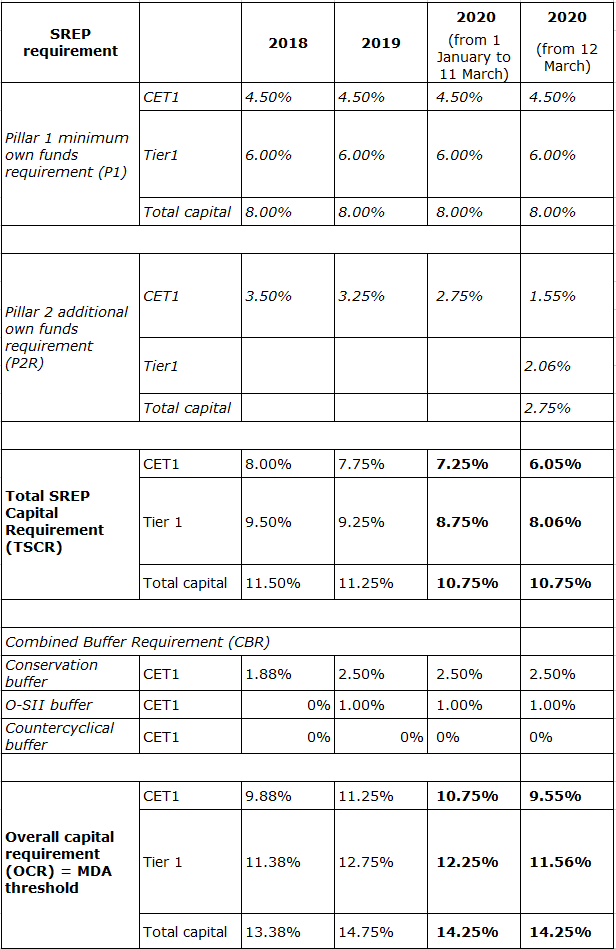

NLB has received new decision amending the composition of the Pillar 2 additional own funds requirement of the currently applicable decision establishing prudential requirements.

NLB published an announcement on the Ljubljana Stock Exchange stating that the ECB has formally notified the bank of its decision to amend the applicable decision establishing prudential requirement (Original Decision) in relation to P2R composition:

the Pillar 2 additional own funds requirement to be held in the form of Common Equity Tier 1 (CET1) capital, shall, instead, be held in the form of 56.25% of CET1 capital and 75% of Tier 1 capital, as a minimum. Decision shall apply retroactively from 12 March 2020.

Source: NLB Group

NLB also announced that they received the decision of the Bank of Slovenia relating to MREL requirement (minimum requirement for own funds and eligible liabilities), which amounts to 15.56% of Total Liabilities and Own Funds (TLOF) on sub-consolidated level of the NLB Resolution Group (consisting of NLB d.d. and non-core part of the NLB Group). MREL requirement shall be reached by 31 December 2021 and from that date shall be met at all times. This new BS decision supersedes previous BS decision on MREL requirement dated 15 May 2019.

The benchmark interest rate was cut by 25bps to help lessen the disruption caused by the Coronavirus outbreak.

Yesteday, the National Bank of Serbia’s (NBS) Executive Board voted to cut the key policy rate by 25bps, further to 1.5%, in order to alleviate the negative effects of the Covid-19 on economic activity, while at the same time ensuring that inflation remains within the bounds of the target in the medium term. As a reminder, NBS already cut their benchmark rate in March by 50bps to 1.75%, so this decision does come as a surprise to the markets.

The Executive Board’s decision on further monetary policy accommodation is based primarily on the fact that indicators from the international environment signal that the negative effects of the virus on global economic growth are stronger than expected, which has also reflected on developments in the international commodity and financial markets and the decisions of central banks and governments of countries worldwide.

The Executive Board highlights that Serbia faced this crisis in a much more favourable position, with a growth rate of over 4%, low and stable inflation for seven years in a row, eliminated fiscal imbalance and a much reduced external imbalance, and foreign exchange reserves at their highest level on record, which created space for further monetary and fiscal policy easing during the crisis period, without threatening macroeconomic stability.