There is a verse from a popular Croatian song that quite well describes the current situation in France: “Stvari se polako vraćaju na mjesto, ovako nešto se ne događa često.” French banks have started erasing June 14th losses, but the OAT-Bund spread remains wide. Is this spread the second shoe to drop? We beg to differ. Also, what happens with the new Croatian 3Y retail bond and what happened to the idea of placing a 10Y side-by-side with the retail bond, but strictly for the institutional base? Find out in this brief research piece.

The most frequent question we received this morning is: since Le Pen’s Rassemblement National (RN) didn’t achieve an absolute majority in the first round of French elections, why haven’t EGB spreads tightened more and why aren’t Bund futures even lower (rf. 130.80 for the September contract versus 131.52 on Friday close)? Well, let’s take it step by step…

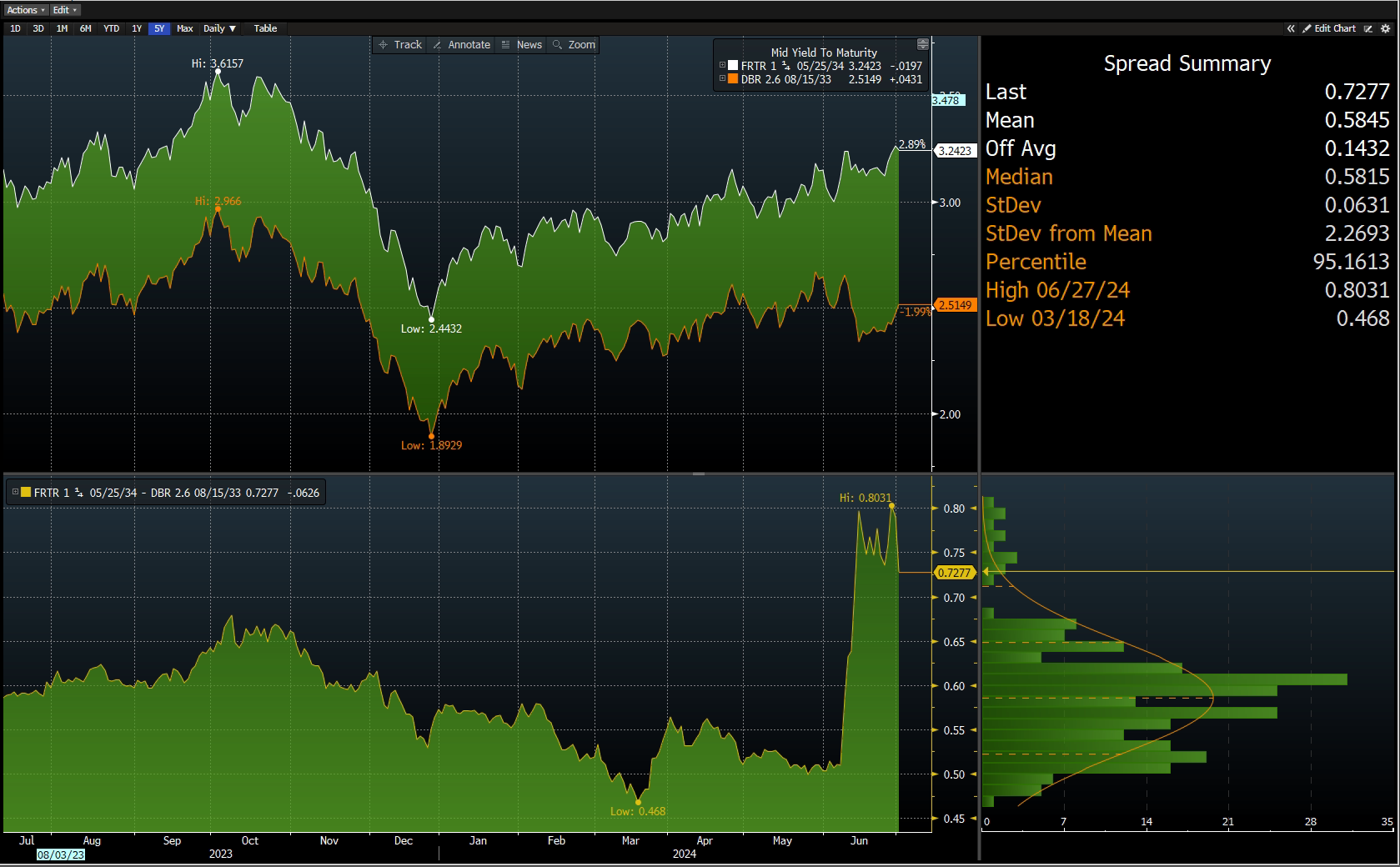

There are still no official results regarding French snap vote, but the exit polls conducted by IFOP, Ipsos and OpinionWay tell us that so far RN won 34% of the ballots cast, the socialists concentrated behind Nouveau Front Populaire (NFP) got about 29%, while incumbent Macron’s front won some 20.5%. The second round of French parliamentary elections are scheduled for July 07th and so far Jean-Luc Mélenchon, the unofficial leader of NFP, quietly endorsed Macron in the second round for the constituencies that are divided between Macron and NFP. This decision makes it harder for RN to get to the absolute majority, meaning that we might have a hung parliament after all. This is rather good for the French fiscal blueprint since the political composition makes it really hard to push forward deficit spending that’s non compliant with the EU’s Excessive Deficit Procedure (EDP). Also, the remainder of RN’s agenda such as raising taxes and slashing immigration spending is also brought into question. And that’s precisely why EURUSD is up, while Bund futures slipped half a point with consequent spread tightening to this morning’s 72.8bps.

For more clarity on French elections, we will be looking at the official candidate selection disclosed by Tuesday evening to be sure that Macron and NFP will not go against each other in the second round. After that, the focus would shift to UK parliamentary elections (July 04th, the same day as US Independence Day) which are expected to end with Tories handing over the power to Labour with not much spillover on the financial markets. Finally, we beg to differ that the most important event this week would be Friday’s labour data – we wouldn’t be surprised if they yield more price volatility than this morning’s French election results.

So what happens next? As said before, the coming week is going to be packed with political and economic news. Tomorrow RN, NFP and Macron will publish candidate lists for the final round of parliamentary elections. On July 04th we will be looking at UK elections that are not expected to yield much volatility since the incumbent parliamentary party (Tories) is expected to hand out political power to another parliamentary party (Labour). This contrasts with the situation in France in a way that Le Pen’s RN was never in history given the right to govern. Finally, on Friday we are looking at the final show-off between financial markets and FED’s data dependence in the way of labor data.

How does this translate into Croatian bonds? Well, the focus of the local markets would be on the pending 3Y retail placement expected to collect about 750mm EUR into government pockets. The book building will take place between today (July 01st) and next Monday (July 08th, 11.00 CET). Now what about a 10Y local tranche that was mentioned a few weeks earlier? Well, since there is about 1.4bn EUR local bond maturity on July 10th and since the 3Y tranche probably would not collect more than 1.4bn EUR in proceeds, it’s quite likely that the Ministry of Finance will offer institutional investors to invest in new 10Y local bond yielding 3.40%-3.60%. We wouldn’t bet the farm on yield ending up at this target because remember that you still have NFP data on Friday, but there’s a decent chance that the new 10Y yield might end up in this range. Why has the Croatian Ministry of Finance been so quiet so far about the 10Y placement following the 3Y retail tranche? Possibly not to confuse the domestic investor base. Either way, stay tuned.

On Friday, Končar announced the signing of an agreement worth EUR 188m (Končar’s share at nearly EUR 80m) with Romanian company Elektromontaj, for the revitalization of Vidraru Hydropower Plant.

This comprehensive project, valued at over EUR 188m with KONČAR’s share at nearly EUR 80m, includes design, production, equipment delivery, installation, testing, and commissioning. The Vidraru plant, operational since 1966 and vital to Romania’s energy infrastructure, will undergo major upgrades to enhance efficiency and extend its operational life.

The project’s customer is Romania’s largest electricity producer that recently underwent the IPO process to the Romanian stock exchange (BVB), Hidroelectrica, which has a hydropower capacity of 6.3 GW. This contract marks KONČAR’s successful entry into a new market, bolstering its global competitiveness.

This latest agreement marks the penetration of Končar to the Romanian market reinforcing its global market competitiveness. This step secures Končar’s position as one of the leading Croatian exporters. Finally, Končar noted that several companies within the Končar Group will join forces in the project.

Končar Group key financials [FY 2022 vs. FY 2023]

Source: ZSE, InterCapital Research