It’s not just football that’s unpredictable until the very last minute: yesterday the orderbook on new Croatian 7Y exceeded 18.5bn HRK just before the close of the book. What can you expect from the new paper on secondary market? Find out in this research piece.

Croatian Ministry of Finance placed yesterday a 9bn HRK local bond with 7Y maturity (CROATE 0.5 07/05/2028 ticker on Bloomberg). Initial price target (IPT) was 0.563%-0.583% in YTM terms, nevertheless from the start this target seemed a bit too generous to be true, at least if we take excess liquidity in the financial system in the equation. The orderbook was building up gradually and a couple of minutes before noon the size of the book reached 9.5bn HRK. At this point in time the size of the placement was already expected to be 9bn HRK since 6bn HRK was basically a rollover of the existing CROATE 2.75 07/08/2021, while the remaining 3bn HRK were earmarked for deficit spending. This means that couple of minutes before noon things didn’t really look so bright because the size of the orderbook barely exceeded the expected size of the placement. It seems that big ticket clients were waiting for the last call in order to determine allocations more precisely. By the time the orderbook went subject, the full size reached 18.5bn HRK and the YTM was set below the lower target at 0.533% (0.50% coupon and 99.774 clean price).

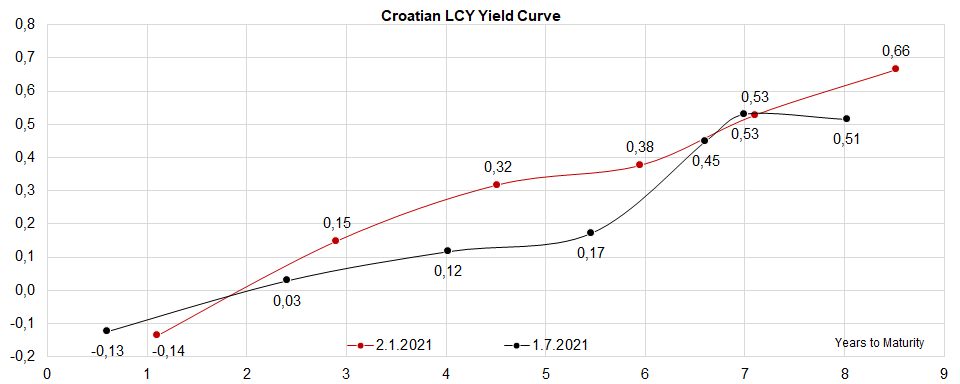

Anecdotal evidence not officially confirmed by the bookrunners reveals that most participants received pro rata allocations of 46.6% of submitted orders, meaning that the final book was probably set at 19.3bn HRK. From what we hear, no preferential treatment was given to holders of CROATE 2.75 07/08/2021. We expect that a significant part of allocations (at least half) went to commercial banks which were hungry for HRK assets giving at least some yield. We also think that at least some would go to banks’ trading books, meaning that the paper would be available at the secondary/grey market. The question is at what price since the chart below demonstrates at least some of the concessions being given to the bond buyers.

As a matter of fact, the anticipation of 7Y paper being placed slowed down trading on this part of the curve for quite some time, which explains why CROATE 0.875 02/07/2028 is still quoted at roughly the same YTM as six months ago while the rest of the curve moved 10bps-20bps down. It’s quite plausible to expect that with rising excess liquidity fostered by possible FX interventions, the yield might continue to move down, albeit this path is not in itself so straightforward: don’t forget that bank ALM departments usually buy bonds with up to 5Y duration, which are in turn supplied/sold by “yield curve riding” UCITS funds. Following the 2020 March local bond sell off some of the UCITS funds completely dumped their local bond holdings, so this time the supply of shorter paper might be a bit more constrained than usual. On the other hand, a curious thing is happening with pension funds’ allocation in local Croatian bonds. The allocations are gradually decreasing, the move being more visible in relative terms: back in January 2020 about 67% of obligatory pension funds’ assets was in government bonds (75.9bn HRK), while in May this year the allocation was down to 59.4% (74.4bn HRK). With rock bottom yields, pension funds are quietly shifting away from bonds and literally in all other asset classes: equity, UCITS funds and AIFs being the most notable. With this in mind, it’s not unreasonable to expect that some of them might be looking to quietly reduce their exposure to new 7Y paper, especially if it starts trading significantly below the yield curve. We don’t think pension funds would be the only sellers at this point in time.

The paper was placed at 0.53% YTM (99.774 clean price), however the shape of the yield curve suggest at least 5bps of new issuance premium because at 0.48% YTM the bond would right on the curve. We also remind that larger chunks of CROATE 2.875 02/07/2028 (in bond trading jargon “the old 28s”) were traded end May at 0.38% YTM, so the 0.48% fair yield looks quite realistic to us. The new bond didn’t start trading yet, but it’s quite possible offers might start popping up around 100.10 (0.48% YTM) because if there are any fast money accounts out there, at this level (32.6 cents above reoffer) they would be looking to get out. This is of course, just an educated guess base on the behaviour we have observed on the last bond placements.

Adris’ shareholders approve HRK 12.5 DPS, DY 2.8% for preferred shares and DY 2.6% for regular shares, ex-date Jul 13th.

Adris held their GSM yesterday during which the company’s shareholders approved a dividend of HRK 12.5 per share. According to yesterday’s closing price this translates to a dividend yield of 2.8% for preferred shares and dividend yield 2.6% for regular shares. The dividend will be paid out on 30 July 2021, while the ex-dividend date is set on 13 July 2021.

As a reminder, Adris did not pay out a dividend in 2020. However, we note that besides dividends, Adris frequently uses share buyback to return cash back to their shareholders.

In the graph below, we are bringing you the historical overview of the company’s dividend per share and dividend yield. Note that the yields were calculated based on the closing price the day before the initial dividend proposal.

Dividend Per Share (2013 – 2021) (HRK)

Dividend Yield (2013 – 2021) (%)

AD Plastik released a statement yesterday in which they announced the signing of new deals worth EUR 53.2m.

According to a statement released on the ZSE yesterday, AD Plastik announced the signing of new deals worth EUR 53.2m. The deals were signed with the Stellantis Group and are related to the EU market.

In their statement AD Plastik did not specify which models were covered by the deal, but instead just said that there are several of them. Meanwhile the estimated project duration will be seven and eight years, depending on the model.

We find the conclusion of this deal encouraging as it doubles the value of newly signed deals in 2021. As a reminder, prior to this deal, AD Plastik signed a total of EUR 41m worth of new deals in 2021. Out of this amount, EUR 16.6m was for the Russian market, while EUR 24.4m was related to new deals for the EU market.

Size wise, this deal is among the largest deals signed by AD Plastik in the last couple of years with the highest deals signed amounting to EUR 80m (Ford Puma, EU market) and EUR 71m (New Logan & Sandero, Russian market).

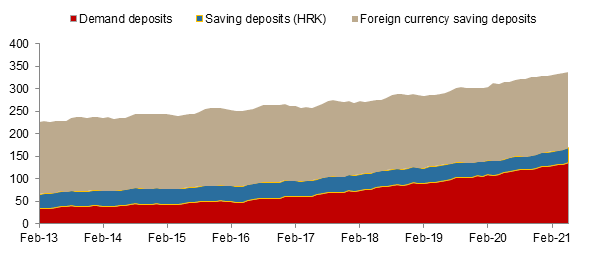

At the end of May 2021 total deposits in Croatia amounted to HRK 338bn, up by 7.3% YoY.

According to the consolidated statement of financial position for monetary financial institutions which is monthly published by the Croatian National Bank (HNB), total deposits as of end May 2021 amounted to HRK 338bn, representing an increase of 7.3% YoY, while increasing 0.9% MoM. This amount represents once again an all-time high. The high level of savings points to a continued trend of suppressed spending fuelled by pandemic crises that started in April last year. Majority of funds is channelled towards demand deposits, while savings deposits are decreasing due to the fact that they are yielding almost no interest.

The majority of increase is channeled to demand deposits, reaching HRK 136.7bn, which now amount for 40% of total deposits. We can assume that Croatian citizens do not believe that times of prosperity are ahead of us, as higher savings are a sign of uncertainty.

As of end May 2021 total savings deposits amounted to HRK 201.3bn, representing a decrease of 0.4% YoY and 0.8% MoM. Same as last month, there has been an increase in local currency savings deposits. The 5.5% increase YoY to HRK 32.3bn indicates growing belief in the local currency. Foreign currency savings amounted to HRK 169.0bn, a 1.5% drop YoY, reflecting the overall trend of decrease in savings deposits. Total saving deposits at the end of May 2021 were 16% in the local currency and 84% in foreign currency, showing that showing that Croatian institutions and citizens still do not prefer holding their savings/assets in the Croatian Kuna.

When observing solely households, they hold HRK 230.6bn or 68% of total deposits. Household deposits were up 6% YoY in May, and up 0.6% MoM. 31% of Household deposits are demand deposits while 69% are savings deposits. Out of households savings deposits 60% are in foreign currency.