Today is Ericsson NT’s ex-date. Typically, on the ex-dividend date, the share price tends to decrease by the amount of the dividend yield, which in this case amounts to 7.6%. Consequently, we should see a share price decrease around the aforementioned amount. The payment date is set for 17 July 2024.

This regards the previously approved dividend of EUR 15 per share, consisting of a regular dividend of EUR 10 per share and an extraordinary dividend of EUR 5 per share. Given today’s market closing price, we expect the stock to decline by approximately 7.6%. The exact percentage of the decrease will help determine whether the stock has appreciated or depreciated in its intrinsic value. The payment date is set for 17 July 2024.

In the graph below, we are bringing you a historical overview of the company’s dividend per share and dividend yield. Note that the yields were calculated based on the closing price the day before the initial dividend proposal.

To put things in perspective, since the beginning of the year, Ericsson’s share price increased by 5.5%, while today’s expected 7.6% decrease can be attributed to the ex-date – as without the dividend payment incentive for investors to invest in a stock vanishes.

Ericsson NT dividends per share (2013 – 2024, EUR, left), dividend yield (2013 – 2024, %, right)

Source: ZSE, InterCapital Research

On Friday, Končar announced the signing of an agreement worth EUR 188m (Končar’s share at nearly EUR 80m) with Romanian company Elektromontaj, for the revitalization of Vidraru Hydropower Plant.

This comprehensive project, valued at over EUR 188m with KONČAR’s share at nearly EUR 80m, includes design, production, equipment delivery, installation, testing, and commissioning. The Vidraru plant, operational since 1966 and vital to Romania’s energy infrastructure, will undergo major upgrades to enhance efficiency and extend its operational life.

The project’s customer is Romania’s largest electricity producer that recently underwent the IPO process to the Romanian stock exchange (BVB), Hidroelectrica, which has a hydropower capacity of 6.3 GW. This contract marks KONČAR’s successful entry into a new market, bolstering its global competitiveness.

This latest agreement marks the penetration of Končar to the Romanian market reinforcing its global market competitiveness. This step secures Končar’s position as one of the leading Croatian exporters. Finally, Končar noted that several companies within the Končar Group will join forces in the project.

Končar Group key financials [FY 2022 vs. FY 2023]

Source: ZSE, InterCapital Research

At the share price before the announcement, this would imply a DY of 2.1%. The ex-date is set for 4 July 2024, while the payment date is set for 12 July 2024.

Yesterday, Atlantic Grupa held its GSM meeting, and the resolutions from it were published today. According to the resolutions, the proposal for the dividend has been approved, at EUR 1.2 DPS. The dividend will be paid out from 2021’s retained earnings, and the amount also represents an increase of 20% compared to the dividend last year.

At the share price before the announcement, this would imply a DY of 2.1%. The ex-date is set for 4 July 2024, while the payment date is set for 12 July 2024. Below we provide you with the historical dividend per share and dividend yields of Atlantic Grupa.

Atlantic Grupa dividend per share (EUR) and dividend yield (%) (2013 – 2024)

Source: Atlantic Grupa, InterCapital Research

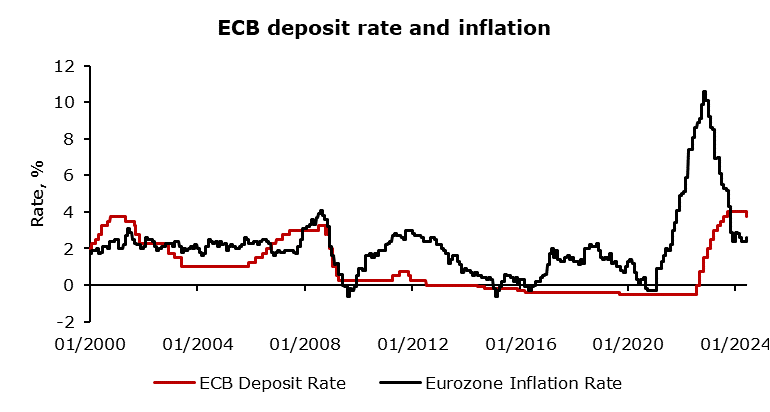

On the 6th of June, the European Central Bank decided to lower interest rates by 25 basis points which translates to a 3.75% deposit rate. According to the monetary policy statement and the speech of Christine Lagarde, they have more cuts in front of themselves to reach a neutral level regardless of the new growth and inflation outlook.

After three-quarters of the plateaued deposit rate, the ECB decided to cut the deposit rate by 25 basis points as the inflation outlook looks bright with no need to further suppress growth as much as before. The most important statement by Christine Lagarde related to the ability of cutting rates yesterday and in the future was about halving inflation in the past which was very much needed, but further halving inflation in the future would be under their two percent medium-term goal. Regardless of her dovish statements, data-dependency might change their stance especially data regarding wages which come out today. She pointed out that the main objective of the European Central Bank is taking care of price stability and the neutral rate is quite below current interest rates which translates to less restrictive monetary policy after the rate cut, not more accommodative monetary policy resulting in less headwinds for the economy, and not more tailwind. The decision to cut interest rates was made after the Governing Council gained confidence in the path ahead as they are comfortable that the inflation is under control after more than two years. Many argue that the decision and the conference should be called a „hawkish cut“, however, I would argue for calling it a „reasonable cut“ given the macroeconomic data that came since their last hike nine months ago and arguments by President Lagarde. Retaining restrictiveness, but slightly moderating is brave and something not seen before. Usually, central banks hike interest rates when inflation rises and lower them when a part of the economy is experiencing a crash, which is something that hasn’t happened yet in this tightening cycle. Also, other central banks such as the Swiss Central Bank and Riksbank have already cut interest rates with the ECB following their path.

Both the front and long end of the yield curve reacted with a fall in bond prices and rising yields. German 2-year bond yield rose by 4.5 basis points after the decision and German 10-year bond yield rose by 6 basis points. The reaction across the Atlantic was quite muted, without significant moves on the yield curve. The result is the tightening of the spread between the US Treasury 10-year yield and the German 10-year yield down to 176 basis points. In mid-April, the spread reached 220 basis points and tightened steadily since then. A year ago, in late April of 2023 the spread was at 100 basis points showing significant market expectations changes over time since then.

In conclusion, the European Central Bank’s decision on June 6th to lower the deposit rate by 25 basis points to 3.75% marks a pivotal shift in its monetary policy stance. President Christine Lagarde’s statements underscore the ECB’s confidence in having successfully curbed inflation, allowing for a transition towards a less restrictive monetary policy without fully embracing an accommodative approach. This “reasonable cut” strategy reflects a nuanced understanding of the current economic landscape, balancing the need to support growth while maintaining price stability. The market’s reaction, particularly the rise in German bond yields and the tightening of the spread between US and German 10-year yields indicates a complex interplay of global economic expectations. As the ECB navigates this delicate path, its data dependency, especially concerning wage growth, remains crucial in shaping future policy directions. The move aligns with similar actions by other central banks, suggesting a broader trend towards moderating restrictive measures amid a changing macroeconomic environment. The ECB’s approach may serve as a blueprint for other central banks, illustrating a cautious yet confident method of adjusting policy levers to sustain economic stability and growth.

Source: Bloomberg, InterCapital

To promote the strengthening of local capital markets, CFA Society Croatia published a paper that could serve as a template for the preparation of the Croatian Capital Market Strategy. We warmly support the initiative, timing, and recommendations. In this article, we are bringing you an overview of this paper, while emphasizing the need to take it to the next level and engage stakeholders with a higher level of influence.

Last year our neighbouring country Slovenia, with a comparable capital market, received its 1st Strategy for the Development of the Capital Market, which will be implemented by the Slovenian Government. To remind you, the template was based on the following pillars:

1) the introduction of funds containing shares of state-owned companies listed on LJSE (a solid example is Fondul Proprietatea in Romania)

2) additional bond offering on the market – we’ve seen solid development on this topic both in Croatia & Slovenia

3) Providing a single platform for investing in SME & financial education

4) Investments accounts – tax benefits for retail investors to support trading on LJSE

In order to promote the strengthening of local capital markets, CFA Society Croatia published a paper that could serve as a template for the preparation of the Croatian Capital Market Strategy. We warmly support the initiative, timing, and recommendations. CFA Croatia conducted a comprehensive survey of market participants’ views on our capital market. Research of this type and scope has not yet been carried out in Croatia, so this effort is highly commendable and worthwhile. At this early stage of the process, it is good that different stakeholders were involved, like the ones that supported the CFA initiative: Zagreb Stock Exchange, the Croatian financial services supervisory agency(‘HANFA’), The Central Clearing Depository (‘SKDD’), The Croatian Chamber of Economy (‘HGK’) and Croatian Ministry of Finance. We consider the main goals to be ambitious, but achievable and we are highly supportive of the initiative. We urge the Croatian Government also to get involved and take the lead in the project, so coordination between main stakeholders can be achieved with ease and in a timely manner.

In this blog, we are bringing you the summary of the template for the capital market development strategy for Croatia with the key takeaways outlined. The long-term goal for the development of the Croatian capital market lies in the achievement of the “emerging market” classification by MSCI. The quantitative criteria for achieving this goal are in line with EM criteria which implies at least three companies listed with: a) market capitalization >EUR 1.92bn, b) free-float market capitalization >EUR 1bn, c) annual turnover >15% of free-float market cap value of a share. This is not easy to achieve as the only company with a similar Market cap is Hrvatski Telekom (Market cap of EUR 2.2bn, Free-float market cap of app. EUR 850m). The third criteria for HT is not likely to be achieved as its free float liquidity is not remotely achievable and its free float is decreasing which reduces the share’s availability to traders. The qualitative criteria are focused on increasing the number of listed shares and mobilization of available savings by encouraging the involvement of small investors. The timeframe suggests tripling the turnover on ZSE (from EUR 372m to EUR 900m) by 2028, which could be supported by increasing citizens’ involvement in domestic capital markets and increasing the number of newly listed companies with a market cap above EUR 2bn. InterCapital, as the biggest broker on the ZSE, highly supports this initiative.

Specifically, the basis for the strategy consists of 4 pillars of the strategy and 25 individual initiatives. Below we present you the summary of 4 pillars of the strategy and our view of the pillars:

1) Creating a stimulating investment environment – The basis for achieving this is the mobilization of savings and initiatives that enable a greater number of investment services through simpler processes combined with a higher general level of financial literacy. Looking at this pillar, we emphasize that real opportunity lies in the simplicity of the implementation.

2) Increasing the number and activity of issuers –This is intended to be resolved by the inclusion of new issuers, which should improve the domestic capital market picture. The paper highlights the existence of many large unlisted companies that outperformed the ones currently listed in terms of both size & profitability. However, regarding this point, we think it’s highly unlikely for this kind of development to happen due to the ownership structure of our large unlisted companies, rather than just looking at size and profitability. Besides increasing the number of issuers, the paper also suggests a more optimal tax treatment of debt in relation to equity. Debt is considered tax deductible, while dividends are not. In line with the EU initiative The Debt Equity Bias Reduction Allowance (DEBRA), the paper suggests tax relief for increasing equity and limiting the tax deduction for interest payments.

3) Mobilizing market participants – This pillar lays on the fact that existing market participants are highly restricted in their activity, mainly due to a regulatory framework. The paper suggests that privatization can go in different directions, with a solid example being the Romanian fund Fondul Proprietatea, where state-owned companies are managed in the form of investment funds, by foreign expert management. This could lead to more efficient corporate management and more market participants on the stock exchange. This kind of example has already resulted in a significant breakthrough for Romanian capital markets.

4) Increasing efficiency by removing obstacles – This could be achieved by harmonizing the legal framework with EU standards combined with changes in tax system administration.

In the next part, we divide proposed initiatives by their priority and the complexity of their implementation.

High Priority & High / Medium Complexity Implementation Initiatives

wdt_ID Initiative Priority Complexity of implementation

1

Introduction of investment accounts with tax benefits

High

Medium

2

Harmonization of the implementation of corporate actions with EU standards

High

High

3

Digitization of processes

High

High

4

Determining the residency of funds for tax purposes

High

Medium

5

Raising the standard of corporate governance

High

Medium

6

Equalization of the tax treatment of debt and equity

High

High

Source: Template for Croatian Capital Market Strategy

In this category, the initiative we would like to outline is the introduction of investment accounts with tax benefits. This would imply individual investment accounts with the goal of long-term savings based on an investment in financial instruments. The key characteristic would be more optimal taxation combined with less administration to allow easier financial instrument trading. This way, savings could be directed to capital markets with a bigger retail base. Further, the main feature of this kind of investment account would be trading without incurring tax liabilities. The tax liability will occur by paying funds back to the depositor’s basic payment account in the bank. These kinds of accounts are already present in France, Hungary, Finland, Italy, the UK, and a few other countries.

Regarding the digitalization of processes, something we would like to outline is electronic voting at GSM. This would increase the practicality and participation of shareholders’ meetings. Further, it would also speed up the decision-making processes and make them more transparent. The next initiative is Determining the residency of funds for tax purposes. As domestic funds do not have“legal personality” and consequently can’t obtain the tax administration certificate, funds are liable to pay income tax on foreign markets they are not entitled to a refund. Consequently, the initiative suggests legislative framework adjustments so that the funds can have a clearly defined tax status with the aim of applying the threat of the avoidance of double taxation for mandatory and voluntary pension funds.

High Priority & Easy Fix Initiatives

| wdt_ID | Initiative | Priority | Complexity of implementation |

|---|---|---|---|

| 1 | Establishment of a community of investors at HGK | High | Low |

| 2 | Facilitating digital onboarding of clients | High | Low |

| 3 | More active involvement of small investors in public offers | High | Low |

| 4 | Changes in the legislative environment related to custody matters | High | Low |

Source: Template for Croatian Capital Market Strategy

The first category we wanted to highlight is the one with a high priority and low complexity of implementation. Regarding the 1st initiative, it is stated that the research has shown there is a need for this kind of association. Establishing a community of publishers can have a significant impact through contribution, transparency, and security. Such a community would include various issuers to protect the issuer’s interests and strengthen investor trust. We highly approve of the initiative, especially considering the ease of its implementation. The same case is with the digital onboarding of clients. This has been a common European practice for quite some time now, while not yet digitalized enough in Croatia. Regarding the activation of retail investors in public offers, some countries have implemented the practice. For example, Australia reserves c. 25% of each IPO for retail investors, while the rest is available to institutional investors. Singapore, Hong Kong, and France have a similar practice. This paper suggests the threshold is set at 15% of the issue with at least 100 private entities as shareholders.