10 months have passed since the global outbreak of the Covid-19 pandemic and in that period, much has changed in the equity market. Therefore, we decided to present you with an update of equity risk premiums for Croatia and Slovenia.

10 months have passed since the global outbreak of the Covid-19 pandemic and in that period, equity markets have been a roller coaster. In Q1 of 2020, the outbreak of Covid-19 has had a negative impact on the macroeconomic prospects, global capital markets and introduced additional risks to virtually every listed company. In other words, Covid-19 has undoubtedly influenced the estimates for future cashflows, growth and risk and therefore the intrinsic value of the regional companies.

However, since the early outbreak much has changed, such as the unprecedented fiscal and monetary stimulus coupled with the development of the vaccine. All of the mentioned gave additional tailwind to the markets, resulting in a partial rebound in equities in the region.

For today, we decided to present you with an update of equity risk premiums for Croatia and Slovenia. In short, the equity risk premium (ERP) can be explained as an excess return an investor would demand to invest in the average equity over the risk-free rate.

The equity risk premium can be seen as a function of:

- how risk averse the investors are (premium increasing with risk aversion)

- how much risk is perceived in the investment (premium higher for riskier investments)

According to Damodaran, to estimate the equity risk premium for a country, one should find the premium for a mature market and add an additional country risk premium, based upon the risk of the country in question. To estimate the mature market risk premium, one has to compute the implied equity risk premium for the S&P 500 index. This is done by calculating the implied expected return on stocks which is then deducted by the risk-free rate (T. Bond rate).

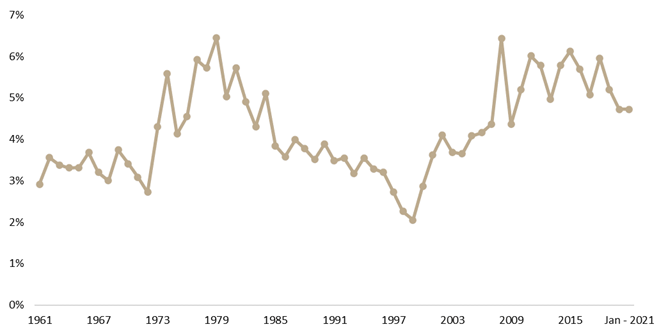

Historical ERP for Developed Markets (1961 – January 2021)

Source: Aswath Damodaran, InterCapital Research

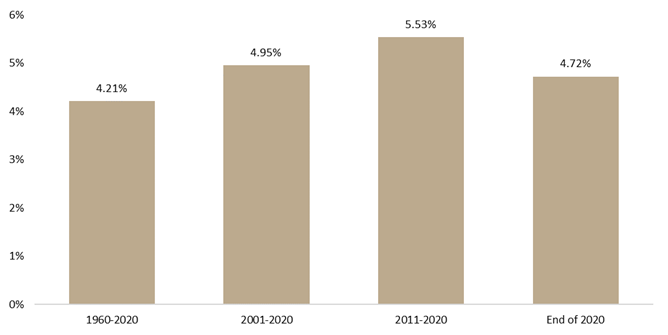

As of January 2021, the ERP for a mature equity market (such as the USA or Germany) amounts to 4.72%, representing a solid decrease of 1.4 p.p. since our update in April 2020. The current ERP is somewhat higher than the historic median of 3.94% (since 1961) and is closer to the average of 4.21%. When looking at the table below, one can also indicate that the equity risk premium for the US is very much in line with the historic data based on a few different time spans.

Historical ERP for Developed Markets

Source: Aswath Damodaran, InterCapital Research

In order to calculate the equity risk premium for Croatia or Slovenia, one would, according to Damodaran, have to add an additional country risk premium to the premium for the mature market. Damodaran calculates the country risk based upon the local currency sovereign rating for the country from Moody’s or with the CDS spread for the country (if one exists and/or has sufficient liquidity to be representable). Another way to estimate country risk would be by calculating the spread of the country’s EUR denominated 10 year bond and the Bund, since Bund is deemed as default free. We believe that this the most current metric as it reflects an up-to-date opinion of wide investor universe over the perceived default risk of Croatia and Slovenia.

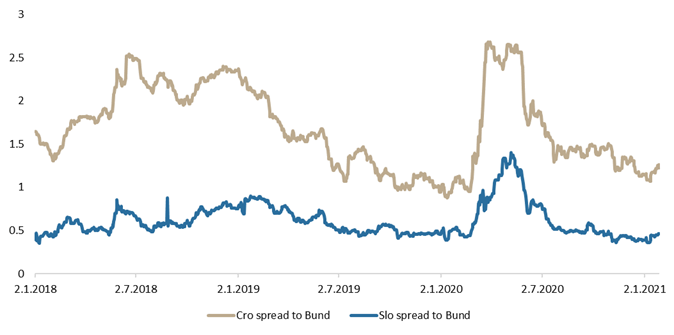

Spread Between 10Y Croatian/Slovenian Government bonds vs Bund

Source: Bloomberg, InterCapital Research

As visible from the graph above the spread between Croatian 10Y EUR denominated bond and Bund currently stands at 1.24%, while the Slovenian one is at 0.46%. This is somewhat lower than the median of 1.59% and 0.55%, respectively. Meanwhile, during the outbreak of the pandemic the spread reached as much as 2.68% and 1.4%, respectively, which was tamed by an unprecedented monetary stimulus in the EU. According to Damodaran, to compute the country risk premium it makes sense to adjust the above-mentioned default spread by the relative equity market volatility for that market. The multiplier amounts to 1.1 according to Damodaran.

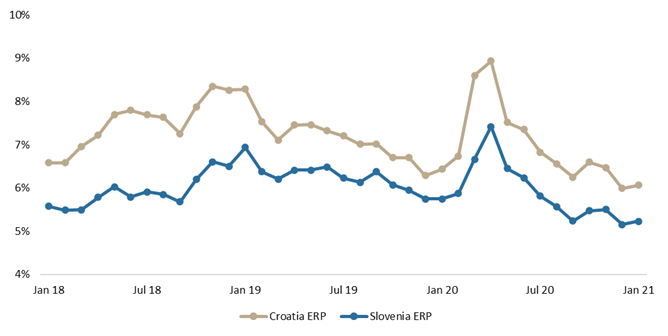

Finally, we reach the ERP for Croatia which, as of January, stands at 6.07%. Meanwhile, Slovenia’s ERP stands at 5.23%. This represents a decrease by more than 2 p.p. for both ERP’s compared to April 2020, when they reached their 2020 peak.

In the graph below you can find the ERP for Croatia and Slovenia since 2018. As visible from the graph both ERP’s are currently at one of the lowest levels in the observed period. To be specific, Croatia’s ERP is lower by 1.1 p.p. compared to the median of the period, while Slovenia’s ERP is lower by 0.7 p.p.

Croatia’s and Slovenia’s ERP (2018 – Jan 2021)

Source: InterCapital Research

We once again note that when calculating the cost of equity for Croatian or Slovenian blue chips, the same (above state) ERP should not always apply based on the country of incorporation. Many of these companies have a significant portion of their operations outside of the country of their incorporation and the risk of operating there should be reflected in the ERP. This can be done by weighting the ERP based on revenues (or another key performance indicator) it makes in each country it operates. By doing so, we believe that we estimate a more accurate ERP, without over/underestimating the risk premium with regards to operations in foreign markets. Intuitively, if a company operates in markets which are perceived to have a higher country risk premium than the one of incorporation, it’s ERP will be higher. For example, Slovenian financials operate in almost all Ex-Yugoslavian countries which all have a higher perceived country risk premium than Slovenia. Therefore, the ERP for these companies should be higher than the one above stated.

Petrol’s Five-Year management strategy announces that in 2025, the Group is planned to achieve EBITDA in the amount of EUR 336m (including announced acquisition of Crodux), with net profit amounting to EUR 180m. The net debt to EBITDA ratio is planned to be less than 1.

On Friday Petrol Group announced its strategy for the period 2021-2025 where it recognises the importance of sustainable development. In its strategy Petrol presents that in the 2021 -2025 period its goal is a transition to low-carbon energy company, via partnership with employees, social environment, industry, public sector and households. Petrol’s Five-Year management strategy announces that in 2025, the Group is planned to achieve EBITDA in the amount of EUR 336m, the figure including announced acquisition of Crodux. In 2019 Petrol’s its EBITDA was at EUR 197m, while in 2021 Petrol plans to achieve EBITDA of EUR 214m without announced acquisition of Crodux Petrol Group. EBITDA in the amount of EUR 336m for 2025 gives us a CAGR of 9.4% when we compare it to 2019. In 2025 Petrol Group plans to achieve net profit of EUR 180m, also 6-year CAGR of 9.4%. The net debt to EBITDA ratio is planned to be less than 1.The business plan is based on the assumption that Petrol Group will remain the first choice for energy transition projects in the region by offering integrated services with high added value. In 2025 Petrol estimates to achieve energy savings of 73 GWh for end-customers through energy renovation projects, while in 2020 it achieved energy savings of 51 GWh for end-customers.

Petrol Group also aims to develop and strengthen their presence in the supply and sale of natural gas and electricity, in the sale of liquefied petroleum gas and in energy efficiency projects. In renewable electricity production, Petrol Group plans to position itself to become a major supplier in SE Europe. Renewables production segment plays a particular role in the energy transition. At the end of 2025, Petrol plans to have facilities with 160 MW of production power for electricity from renewable energy sources. This is 78% more than in 2020 when they had facilities with production power of 35 MW. Facilities are located in Bosnia & Herzegovina (hydroelectric power), where electricity is produced at four small hydroelectric plants on rivers Jezernica and Kozica as well as at the small hydroelectric power plant Jeleč. Also in Croatia (wind power) Petrol produces electricity at Glunča wind power plant, while in 2020 the construction of 30 MW Ljubač wind power plant was launched.

Another important pillar of Petrol’s sustainable and innovative business is the development of new solutions in the field of electric mobility and mobility services. When it comes to mobility, Petrol Group focuses on two segments. The first segment is linked to the charging infrastructure, which means setting up, managing, and maintaining the infrastructure for the charging of electric vehicles as well as providing the charging service. The second segment is comprised of mobility services, such as operating leases, fleet electrification and fleet management services. By 2025 the Group plans to have 1,575 charging points with the charging infrastructure for electric vehicles, while at the end of 2020 Group had 171 charging points. In the period this gives average annual growth rate of 56%.

In this strategic period, Petrol Group plans to remain present in all markets, focusing on:

· Slovenia, where Petrol plans to consolidate its position of a leading energy company and partner in the energy transition;

· Croatia, where Petrol plans to use their sales network to expand its portfolio of customers in the field of energy products and energy transition services and invest in renewable electricity production; · Serbia, where Petrol plans to increase its share in the energy product sales market.

The dividend policy target for the strategic period 2021 – 2025 is 50% of the Group’s net profit, which is somewhat above previous years’ pay-out ratio. As a reminder, in 2020 Petrol paid dividend of EUR 22 per share, giving a dividend yield of 6.5% at the time of the announcement. This was at 43% of Groups net profit while pay-out ratio was around 40% in previous years. Here you can see Petrol’s historical dividends.

Investments are expected to total EUR 698m in the period 2021 – 2025, of which 35 percent will be dedicated to the energy transition. So Petrol Group expects to invest EUR 247m from 2021-2025 in energy transition and for carbon footprint reduction, while EUR 451m is aimed at expansion and upgrade of the retail network and digitalisation.