Stablecoin regulation is rushing through across global policymaking bodies, including the US, Europe, Hong Kong, and Singapore, while other countries are contemplating whether or when to join the current. Meanwhile, corporations are weighing the costs and benefits of issuing their own stablecoins. The 2nd biggest stablecoin Issuer, Circle Internet Group, went public in an oversubscribed IPO, underpinning a strong demand trend for public companies engaged in cryptocurrency activities, more specifically in stablecoin issuance.

On May 19th, the US Senate voted to further advance a key stablecoin-regulating bill after Democratic senators blocked an earlier attempt to move the bill forward over concerns about President Donald Trump’s sprawling crypto empire. Cloture vote on the Guiding and Establishing National Innovation for US Stablecoins Act, or GENIUS Act, passed in a 66-32 vote, with 16 Democrats dissenting to pass its first-ever crypto regulatory overhaul. GENIUS Act sets requirements for Issuers such as full backing of stablecoins with non-risky reserves1, periodic security audits2, and federal or state regulators’ approval. Only licensed entities3 can issue payment stablecoins and market them4, while algorithmic stablecoins are restricted. The bill currently faces 130 submitted amendments in the Senate for discussion before moving to a final vote.

Two days later, on May 21st, Hong Kong’s Legislative Council passed their own version of a Stablecoins Bill, paving the way for a new regulatory regime for all activities, including fiat-pegged stablecoins (in HK Dollar and Renminbi). The bill is set to take effect by year-end, also banning algorithmic stablecoins. On May 29th, the SEC issued a statement that claims that many proof-of-stake activities do not involve the offer or sale of securities. This statement is a regulatory pivot providing clarity for node operators, validators, custodians, and other network participants, implying that such activities mostly fall outside the SEC’s jurisdiction. This guidance refers to “Protocol Staking”, which involves crypto assets used to secure and operate public, permissionless proof-of-stake networks. The justification is that these crypto assets are “intrinsically linked” to blockchain network consensus mechanisms and earned as rewards for validation services, not tokens with embedded profit or equity rights. Under all three staking models that were acknowledged by the statement, stakers retain ownership and control over staked assets, and staking rewards are categorized as compensation for ministerial or administrative work, not profits derived from the entrepreneurial or managerial efforts of others. The SEC concludes that these activities do not satisfy the “efforts of others” condition of the Howey test used to determine whether an investment contract exists. Other types of staking are excluded.

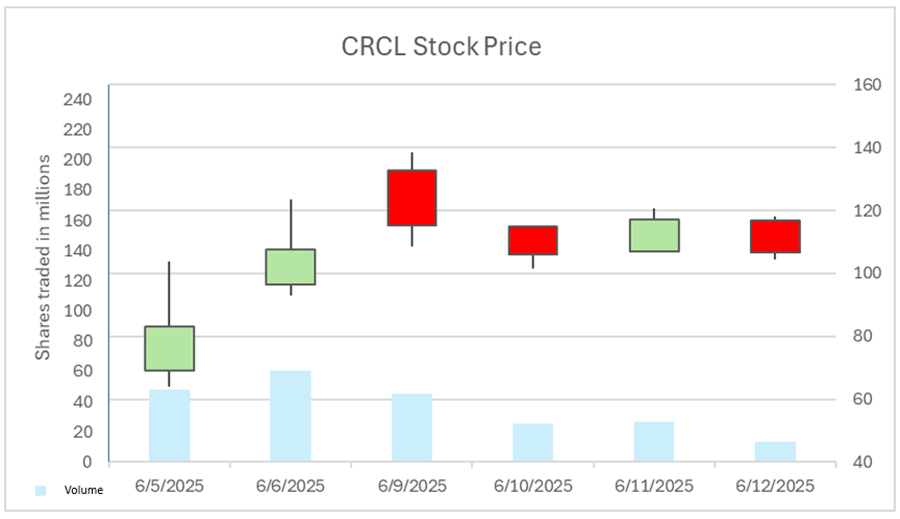

On 4th June, Circle Internet Group (CRCL) went public, selling 39 million shares, raising USD 1.145 billion. IPO was 25-30 times oversubscribed, as strong demand resulted in Circle shareholders leaving money on the table. Circle5 is the Issuer of USDC, the 2nd largest stablecoin by market capitalization, accounting for about 24% of the total stablecoin supply, trailing Tether’s USDT, which commands more than 60% market share. CRCL started trading at $69 at an implied valuation of $18 billion on a fully diluted basis, compared to the $31 IPO price.

Source: NASDAQ, InterCapital

1 Short-term USTs and US Dollars or similarly liquid assets, as determined by the primary regulator.

2 Monthly public disclosure of reserve composition. Large Issuers, defined as over $50 billion of market capitalization, are required to do annual audited financial statements.

3 A “permitted payment stablecoin issuer” (PPSI) is defined by the GENIUS Act, while the relevant regulator depends on the specific Issuer’s structure. Generally, PPSIs are regulated by federal banking regulators like the OCC, FDIC, or the Federal Reserve, depending on whether they are subsidiaries of insured depository institutions (IDIs). If a PPSI is a subsidiary of an IDI, the federal regulator of the parent IDI would oversee it. The OCC regulates non-bank PPSIs, while a relevant state banking agency would regulate a state-licensed issuer.

4 Any marketing that implies US Government backing of payment stablecoins in terms of credit and FDIC insurance coverage is strictly prohibited, making it unlawful to mislead consumers about government guarantees.

5 Almost all (98%) of Circle’s 2024 revenue came from interest on USDC reserves. Circle generated $1.7 billion in reserve income in 2024 and $558 million in reserve income for the three months ended March 31 of this year. Circle attempted to go public in 2022 through a $9 billion blank-check deal that broke down.