The market has been a rollercoaster in the last couple of weeks. We came from some banks still predicting 40% probabilities of a recession, to an AI fueled rally rocketing the stock market to all-time highs, and then back to the sharpest sell-off in risk assets we have seen since “Liberation Day”. It currently looks like no one is sure what to believe in, with the VIX above 20 again, and people flocking to gold like never before. It’s safe to say it’s almost impossible to be right on what will happen in the short term.

Regardless, we have lately seen enormous sized bets on a variety of assets that have been placed right before groundbreaking announcements. Insider trading allegations against US representatives are nothing new. The most famous example was those against Nancy Pelosi, who emerged as one of the greatest traders of recent history, with her call buying generating envious returns. Lately it seems like it has gotten out of hand, and new Nancy’s are popping up from everywhere.

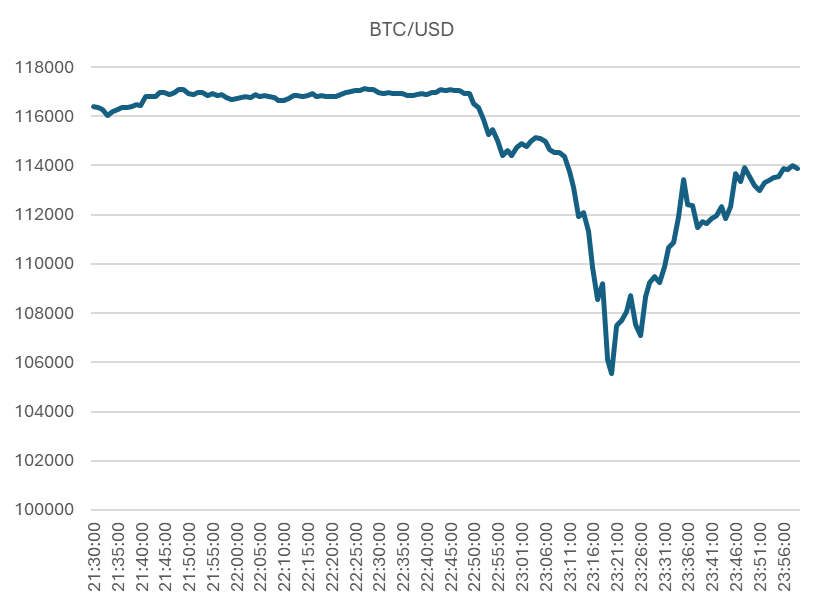

Favorite instrument of choice for the trades is of course crypto. A recent sell off across the market caused by another Trump tweet against China has caused great havoc amongst leveraged crypto players and has caught a lot of participants on the wrong side, erasing billions in the process. According to Reuters, crypto analysts said this was the largest wipeout in a 24-hour period in the market’s history, nine times larger than the February 2025 crash and 19 times bigger than the March 2020 meltdown and the FTX collapse in November 2022.

BTC/USD price 10 October 2025

Source: InterCapital, Bloomberg

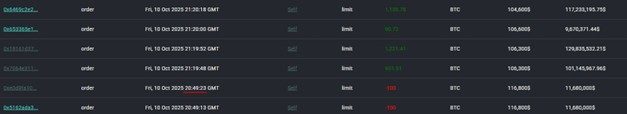

But that Friday was not grey for everyone. A newly opened Hyperliquid account conveniently placed shorts worth $1.1B in Bitcoin and Ethereum just before the Trump announcement, adding on to the position until minutes before the second tweet mentioning the 100% tariff. The positions were closed right afterwards for $192 million in profit.

Last short order from the trader coming in minutes before the Trump post

Source: InterCapital, Hyperliquid

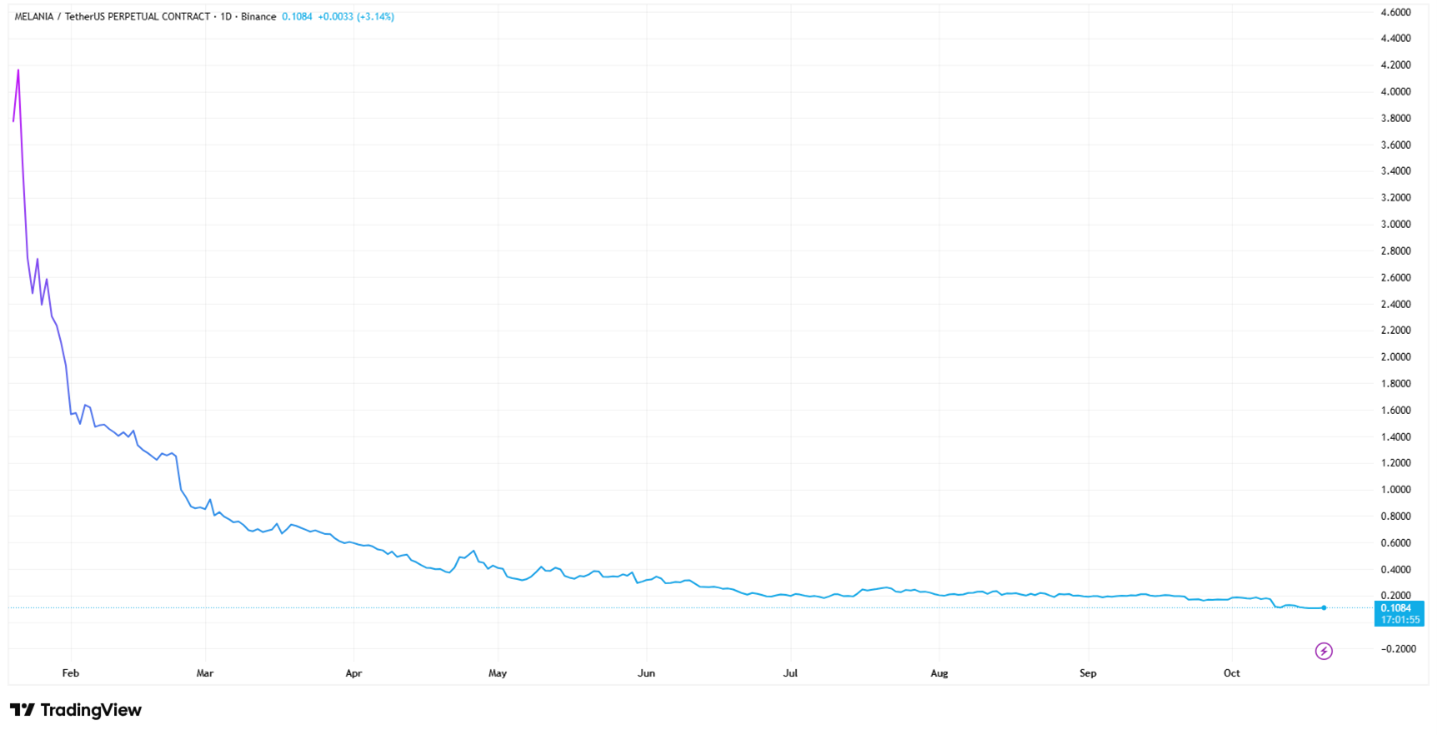

Was it skill, luck or something else? People were quick to jump on allegations of insider trading and the market being rigged. It’s not hard to believe in such a scenario after all we have seen this year. It’s enough to look at the price graph of Trump’s and Melania’s official coins.

Trump coin price (left), Melania coin price (right)

Source: InterCapital, TradingView

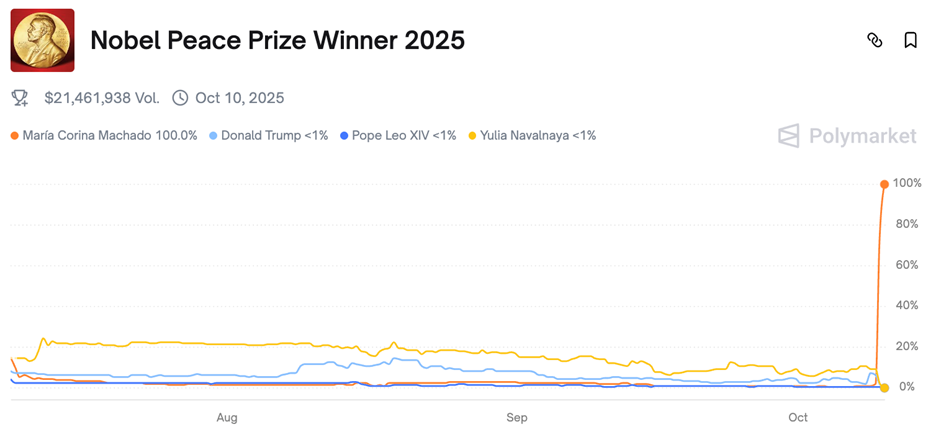

Examples in the stock market are numerous as well, but not only there, it almost seems like you can find an unusually large trade fill before any big announcement on anything these days. Event betting sites like Polymarket have been growing popularity this year, and the same patterns are emerging there as well. Before the recent Nobel peace prize winner announcement, Maria Corina Machado had negligible odds of winning right up to the announcement day, when someone started betting big on her win. This has caught the eye of Norwegian officials who oversee the Nobel peace prize and have started an investigation on the event.

Polymarket Nobel Peace Prize Winner 2025 odds

Source: InterCapital, Polymarket

Insider trading or not, it’s on the officials to investigate and determine. But for traders, this provides another opportunity. There is a new wave of market participants monitoring large orders, since it is easy to flag unusual volume coming into something and joining it. The practice is nothing new, and was present in the old pit days, where traders would watch for large institutional trades hitting the floor and jump in ahead or alongside them, trying to ride the momentum. Today, the pits are gone, but the behavior remains. People are therefore now anxiously watching every next move of the crypto whale who shorted before the crash and scanning for similar patterns in the market. It is necessary to be careful though, since no one is mentioning large sized orders on instruments where nothing happened afterwards. This is an example of selection bias, where only a small portion of trades that would actually work out is analyzed post hoc.