If you are a bond investor, there’s only one thing left to do before taking a long summer vacation. Rolling over your existing CROATE 4.5 07/09/2025€ (matures next week) into a new instrument in order to keep you invested. But by glancing at your Bloomberg terminal, you notice that most of the IG CEE space trades higher in terms of YTM. So, where is the value of the new 10Y CROATE€? Find out in this brief research piece.

Croatian Ministry of Finance intends to place a 1bn EUR local bond with 10Y maturity (RHMF-O-357A) by the middle of this week in order to roll over the maturing CROATE 4.5 07/09/2025 (local designation RHMF-O-257A). The overall size is likely to exceed the rollover amount (800mm EUR) by about 450mm-500mm, meaning that the total size of RHMF-O-357A could likely reach 1.25bn-1.30bn EUR. CEE international bonds have been trading slightly lighter on Friday, mostly thanks to headlines coming across the Atlantic from the Oval Office that several countries may be close to signing trade deals with the US. We interpreted this news bite as the White House’s anxiety over the approaching end of the tariff moratorium (July 07th and July 09th) and hence remain sceptical over actual trade progress since neither side confirmed that any actual progress has been made. On Saturday, President Trump tweeted that countries that decline to sign the trade deal before the moratorium expires next week might be faced with unilateral tariffs from the United States, signalling that there indeed are obstacles that still need to be circumvented, and the deadline is getting closer.

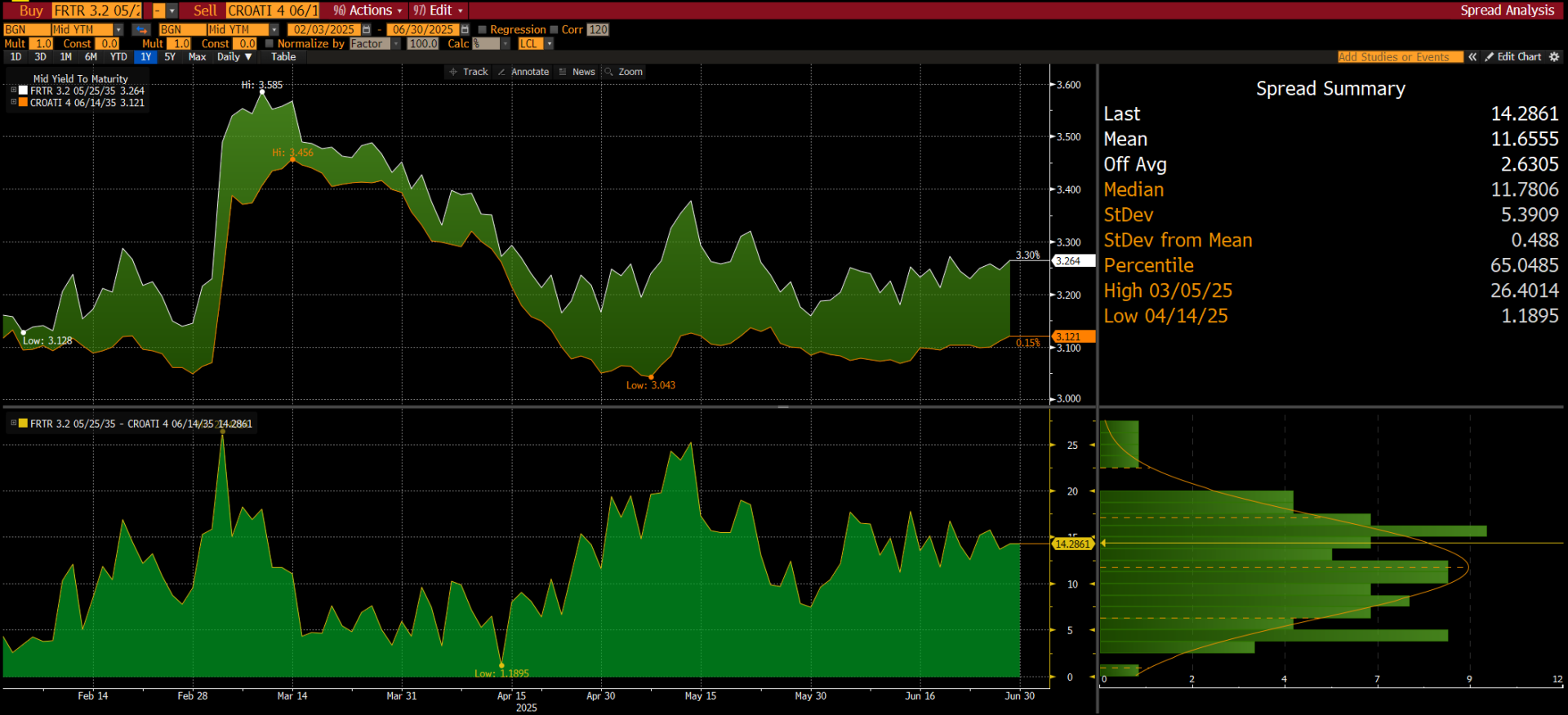

Since CROATI 4 06/14/2035€ has been trading at a 3.125% YTM level on Friday, we estimated a 3.175%-3.225% YTM band as fair value for the new Croatian local 10Y; however, we reserve the possibility of a premium to international bond getting tighter if the demand exceeds expectations. We remind our readers that LITHUN 2.125 10/22/2035€ (A stable/A stable/A2 stable) currently trades around 3.45% YTM, SLOVGB 3.75 02/23/2035€ (A+ stable/A- stable/A3 stable) trades around 3.40% YTM, while POLAND 3.625 01/16/2035€ (A- stable/A- stable/A2 stable) trades around 3.40% YTM levels as well. Bulgaria, a country you might have forgotten about altogether, is also trading a thad higher compared to expected YTM on new Croatian 10Y – namely BGARIA 3.125 03/26/2035€ is offered at 3.30% YTM, nevertheless it’s worth mentioning that the country Is rated BBB by S&P and Fitch, which might complicate decision process on some of the portfolios/funds since this is significantly below Croatian A-. In the case of Bulgaria, ratings might not matter at all since the country might get lifted shortly after joining the common currency area (January 2026).

Croatian and Bulgarian bond comparison

Source: Bloomberg, InterCapital

Who is going to buy new local 10Y if most of the comparable countries are trading 10bps-20bps higher? Croatian obligatory pension funds received a total net contribution of 528mm EUR in the first five months of 2025 (105mm EUR/month), and this is without coupon payments that also need to be reinvested. We remind our readers that 40% (211mm EUR) of these net inflows need to be reinvested into EGBs, and so far, these inflows have been targeting countries such as France. At this point in time, even French 10Y is traded some 10bps-20bps higher than Croatia (check out the chart above), and the spread might have more potential to widen as French public finances are struggling to consolidate. On the other hand, Croatia might have another terrific tourist season ahead, and it’s worth mentioning favourable supply/demand dynamics since the next Croatian local bond might not come sooner than July 2026 (that’s when RHMF-O-267E matures). The next Croatian international placement might not come before March 2027! From this point of view, RHMF-O-357A might have plenty of upside potential from UCITS funds targeting euro area exposure, but which have been UW Croatia so far. In the end, we also think that pro rata allocations on the local market bond placements offer a decent opportunity to local investors who want to obtain meaningful sizes. On the international bond placements, allocations are usually at the complete discretion of the syndicate, meaning that domestic accounts are frequent buyers of additional sizes on the so-called grey market, while on the domestic market, pro rata allocations assure that even small orders get executed to a certain degree.