With the NFP numbers now behind us, all eyes turn to the Federal Reserve and its upcoming FOMC meeting on September 17th, where a 25bps rate cut is widely anticipated. Market expectations for additional rate cuts later this year have also shifted notably, with more than one further cut now seen as increasingly likely toward year-end.

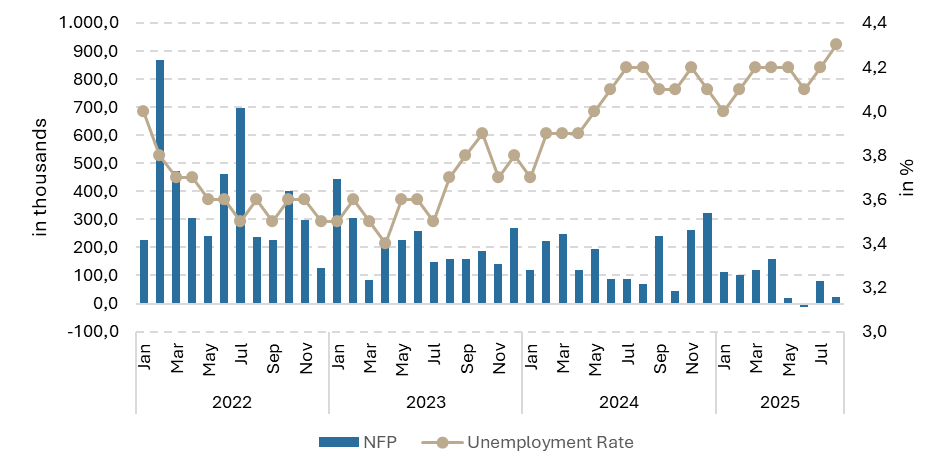

Following the abrupt dismissal of the Bureau of Labor Statistics commissioner in July over alleged data manipulation, President Trump refrained from commenting on the latest NFP figures during his Friday remarks. Instead, he once again urged Fed Chair Jerome Powell to lower the Fed Funds rate. In addition, Trump continues to consolidate influence over the Fed Board, with more than two governors now reportedly aligned with his administration and positioned to vote accordingly. This growing influence has raised concerns over the Fed’s independence, heightening the risk of more sudden and aggressive rate cuts in the first half of 2026 and fuelling market unease. As the first week of September concluded, the closely watched NFP report significantly underwhelmed, with only 22K jobs added versus a consensus expectation of 75K. This disappointing print signals an ongoing and severe deterioration in the labour market, at a pace not observed since the pandemic years. Unemployment ticked slightly higher to 4.3%, matching consensus expectations but up from 4.2% in the previous month. The impact of tariffs on the broader economy remains unclear, while persistent inflation concerns and ongoing uncertainty continue to discourage companies from hiring. Although a rate cut at the upcoming Fed meeting appears virtually guaranteed, markets remain divided on whether a single cut will be sufficient to support the weakening economy.

Nonfarm employment (seasonally adjusted, in thousands, left), unemployment rate (%, right) (2022 – 2025 YTD)

Source: US Bureau of Labor Statistics, FRED

In response to these developments, equities saw modest pullbacks. The S&P 500 closed down 0.32%, the NASDAQ slipped 0.03%, and the Euro Stoxx 50 ended the day 0.47% lower. The bond market also reacted, with U.S. Treasury yields falling across the curve: the 2-year, 10-year, and 30-year yields all declined around 7bps, respectively. The U.S. dollar weakened further, with EUR/USD extending gains above the 1.1700 level and closing at 1.1719, up 0.59% on the day. German Bund also gained momentum, ending the session 51bps higher, though it quickly retreated thereafter as European markets brace for what appears to be another politically volatile year for the French government.

This week the ECB is scheduled to meet on Thursday, with the deposit facility rate expected to remain unchanged. However, markets will be paying close attention to the tone of the meeting and any signals regarding future policy direction, especially considering persistent inflation concerns and political instability in parts of the eurozone. In the U.S., the focus will shift to a series of key economic data releases, with PPI figures due on Wednesday, followed by CPI and initial jobless claims on Thursday. These indicators will help shape the market’s expectations for further Fed action beyond the September meeting. As monetary policy remains front and centre and economic signals grow increasingly mixed, both investors and policymakers face a challenging environment heading into the final quarter of the year.