Kevin Hassett emerged as the front runner to become next FED Chairman, as early as spring 2026. Financial markets didn’t really welcome his new role. What happens next? Find out in this brief research piece.

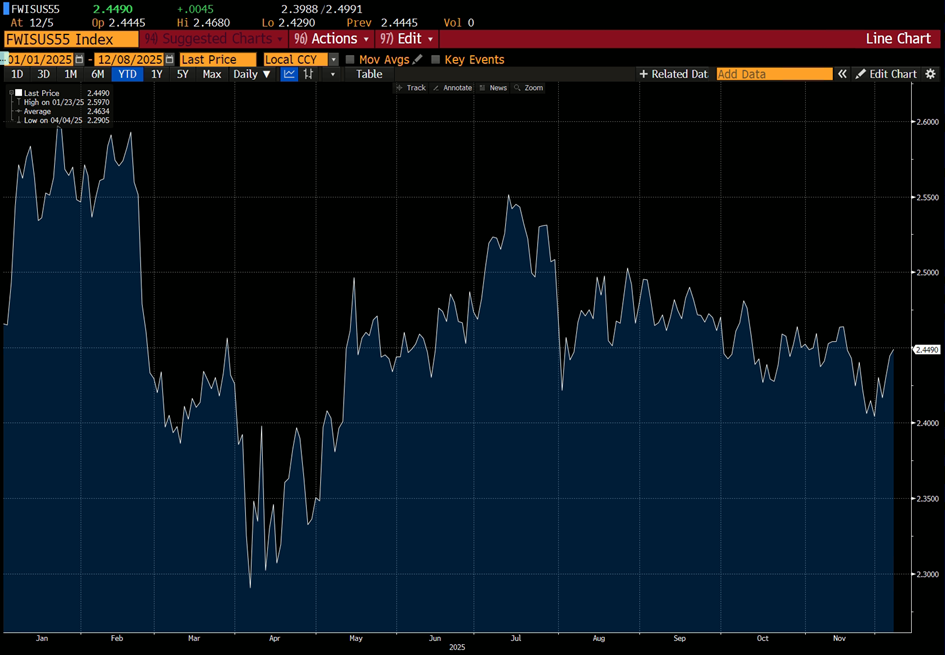

Regarding last week’s fixed income markets, top news affecting bond yields has likely been Kevin Hassett emerging as the Spitzenkandidat for role of FOMC chairman starting from June 2026. The reaction was mixed – US 2Y yields went slightly down, but retraced in the following sessions, while 10Y yields went up by +13.3bps. Only about 5bps of the +13.3bps could be explained by rising inflation expectations in the US (as per 5Y5Y inflation swap):

Before we continue on the explanations of the residual rise in yields, let’s remind our readers that Donald Trump emphasized the decision on Powell’s successor to be made early next year – meaning that all of this might have been trial balloon after all. Both Trump and Secretary of Treasury Scott Bessent highlighted that 10Y point on the curve is very important to them and it’s quite likely that singling out Hassett as frontrunner of the FOMC Chairman race might have been to check the reaction of the last (or second to last) lever of political power in the United States that Trump still doesn’t control – and that is the bond market. So far vote of the bond market has been against Hassett, probably because cutting rates before inflation has reached it’s target would mean higher inflation in the near future and hence higher medium rates. Also, don’t forget that the real job of FOMC Chairman is to build consensus within the committee. Why is that? Because monetary policy decisions work with a lag and what we’re experiencing now could have been affected by decision made 18 or 12 months before. Without consensus backing it up, markets would resort to FOMC members’ individual press statements that would further enhance bond market volatility. Our final thought on FOMC – the role of SCOTUS emerges as one of prominent importance because if Hassett is appointed as FOMC Chairman and underdelivers (i. e. 10Y yields skyrocket, growth exhibits hard landing and FOMC activates QE), what happens next? Can Trump fire him at will and replace someone else? We stick to the belief that SCOTUS would once again ride in the defense of institutional independence of the central bank, so whoever is elected in January 2026 will obviously stick around in years to come.

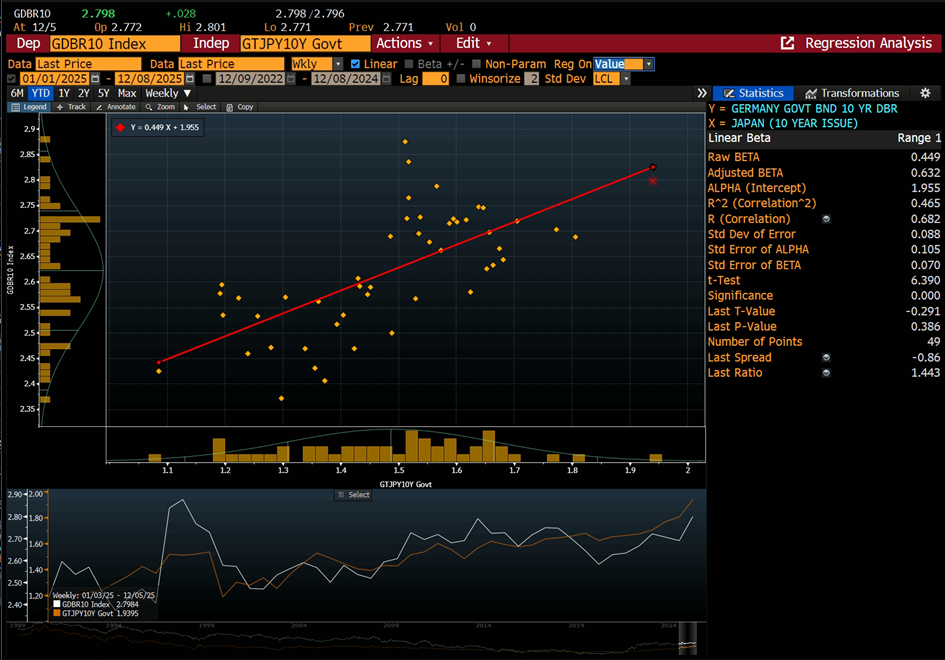

Our main point about recent bond sell off is that it emerged from Japan and spread across the globe as wild fire. First of all, notice the high correlation between Japanese and German 10Y yields (YTD R2 > 45% on weekly basis), as well as that JGB 1.7 09/20/2035 YTM (10Y benchmark) moved up by +14.5bps (from 1.805% on Monday December 01st to 1.95% on Friday December 05th). A similar move we have basically observed on German 10Y, orchestrated on a bps for bps move. A correlation that high cannot be a coincidence.

So what happened in Japan? Last Monday BOJ Governor Kazuo Ueda said that BOJ is ready to act if USDJPY continues to go up (i. e. if yen depreciates) – this modestly hawkish statement was a tailwind for yen, but a headwind for JGBs. The statement itself was interpreted as is BOJ stands ready to hike interest rates on December 19th (yes, that’s Friday; yes, some US NFP data gets released on the same day). Ueda’s statement took the edge off JPY bears, but so far it looks as if bears are lurking under the surface looking whether BOJ will actually deliver.

So what happens next? Japanese ultra long bonds have already started to tighten versus the 10Y point, but this might be due to the lack of supply into year end. As short dates Japanese yields gradually grind higher, long-term yields are likely to move lower in lockstep. However, we might be looking at the wrong market since what was driving yields in the last five days might get sidestepped by events taking place in the most important theater of them all. Namely, FOMC is set to deliver its last 2025 interest rate decision on December 10th, which is going to be accompanied by brand new DOTS. Yields might retrace some of the move exhibited last week on the back of FOMC decision, new data releases and naturally – BOJ decision is still up in the air (notice that JPY appreciated, and FOMC just needs to be neutral instead of hawkish to deliver an early Christmas gift to Mr. Ueda).

What happens with Croatian bond yields? Well you probably imagined that with BTP-Bund spread contracting even further, CROATI 4 06/14/2035€ managed to report a contraction of the spread to Germany to 24bps. But more importantly, the focus of the investors is on the pending T bill auction, the last important event into year end. The Ministry of Finance has penciled in an auction of 1.6bn EUR of 3 month paper at 2.50% YTM (10bps blow the 2.60% yield that the retail investors got so much accustomed to). Remember, on the last 3M Ts institutional investors had to place orders at 1.98% to get 1.99% return. It’s quite likely that institutional investors get yield at around 1.90%. Does it make sense to buy at that levels (below ESTR)? At this point in time it might be prudent to explore belly of the curve maturities, such as CROATE 2.375 07/09/2029€ offered at 2.32% YTM.