Last week’s developments underline how political instability in France, centered around the looming confidence vote, has reignited volatility in bond yields and spreads. The outlook for French fixed income remains highly uncertain, dependent on the vote outcome and subsequent fiscal policy clarity.

The week behind us showed that markets have come under intense pressure following Prime Minister François Bayrou’s announcement of a confidence vote scheduled for September 8. The vote, aimed at securing support for sweeping budget cuts, is widely expected to fail as opposition parties have already opposed it, raising fears of government collapse and snap elections.

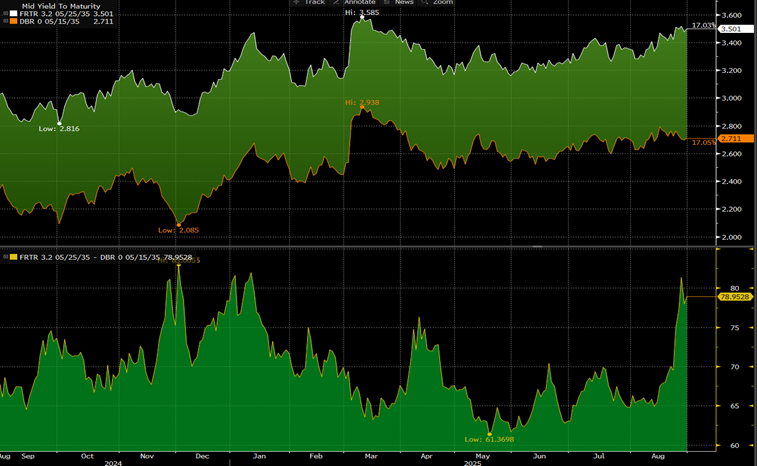

The reaction was swift: the 10-year OAT yield moved from 3.50% in mid-week to a near-March high of 3.53% but quickly settled back near 3.50%. The spread between French and German 10-year bonds widened markedly, jumping from approximately 65 bps to 78 bps – levels reminiscent of past political shocks. The political strain spilled into equities, with the CAC 40 index falling ~1.5%, while major banks like BNP Paribas and Société Générale tumbled over 6%. Furthermore, if Prime Minister Bayrou loses the vote, even broader fallout is possible, including wider bond spreads, credit rating downgrades, and a further drop in investor confidence. Citi notably cautioned that French equities have not fully priced in the bond market risks and forecasted that OAT – Bund spreads could widen from ~80 bps to 125 bps, potentially dragging equities down another 10% – especially in sectors like finance, real estate, and autos.

German and French 10-year bond yield spread

Source: Bloomberg, InterCapital

Despite the mounting volatility, Finance Minister Éric Lombard sought to reassure markets, dismissing fears of a full-blown financial crisis. Speaking to the MEDEF business lobby, he emphasized France’s underlying economic strength and reiterated the government’s goal to reduce the public deficit to 5.4% of GDP by year-end, insisting no IMF assistance will be needed.

However, pressure remains acute: France’s public deficit and debt levels are among the highest in the euro area (behind only Greece and Italy), raising doubts about fiscal sustainability amid fragile political conditions. If Bayrou survives, markets may stabilize. But a collapse could trigger a deeper sell-off, credit concerns, and elevated inflation and budget fears. Should political risk escalate further, the ECB may face increasing pressure to intervene to prevent spillovers across euro-area bond markets – but that remains contingent on fiscal compliance and broader euro stability strategies.

Over to US, where, despite significant political upheaval, particularly President Trump’s attempt to remove Federal Reserve Governor Lisa Cook, the U.S. bond market has exhibited a surprising calm. The 10-year Treasury yield has remained stable since the 2024 election, signalling either investor confidence in the Fed’s enduring independence or complacency about the political drama. That said, two-year Treasury yields have dropped to near four-month lows (~3.65%), broadening the yield curve. This reflects growing expectations for imminent rate cuts and persistent inflation. Analysts warn that political interference could elevate term premiums and spur steeper yield curves, as long-term yields rise amid inflation fears and declining confidence in the Fed’s autonomy.